Investing.com’s stocks of the week

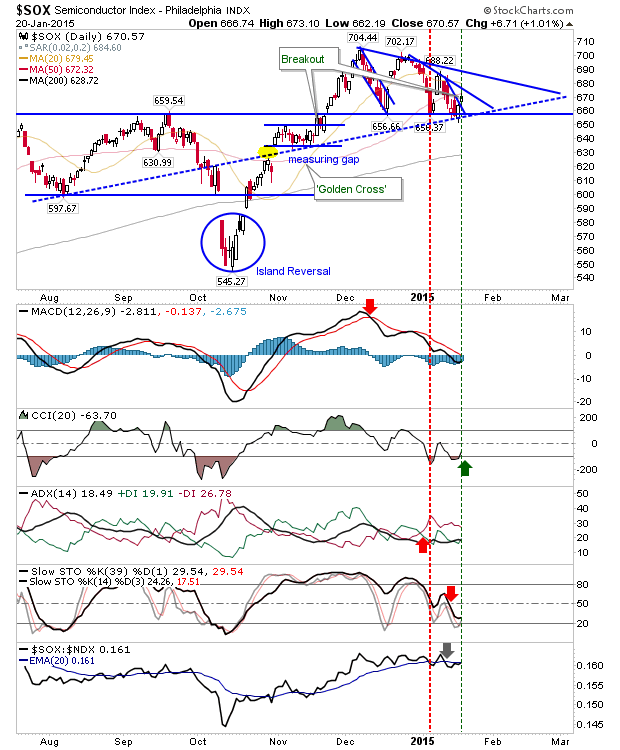

There wasn't much on offer by the close of business yesterday as early losses were returned by the close. The Semiconductor Index may have had the best of the action, although the relative gain was small. The index crept over declining resistance, but has another resistance level to challenge soon. Support at 659 remains in play, but if it breaks it becomes a shorting opportunity.

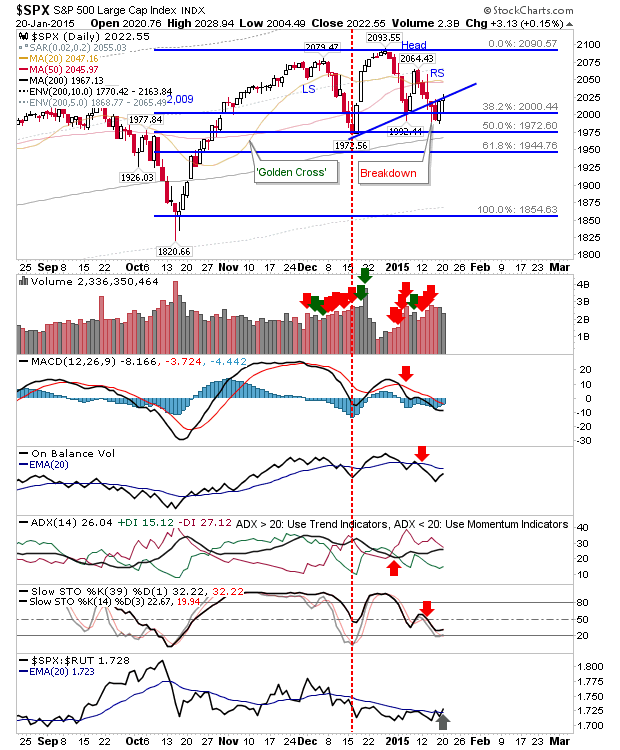

The S&P ended the day at neckline resistance of the head-and-shoulder reversal. Volume was lighter in the recovery. Today is set up for a short with a tight stop above 2,028. A more flexible stop would use the 20-day MA as a marker.

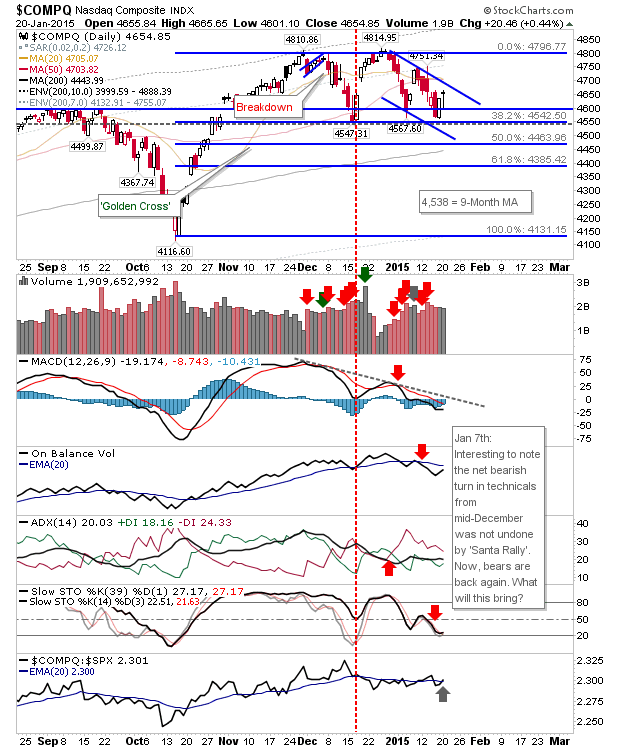

The NASDAQ remains inside its channel. Yesterday's action was relatively neutral, but a push against resistance would key up a breakout such as the one in the Semiconductor Index.

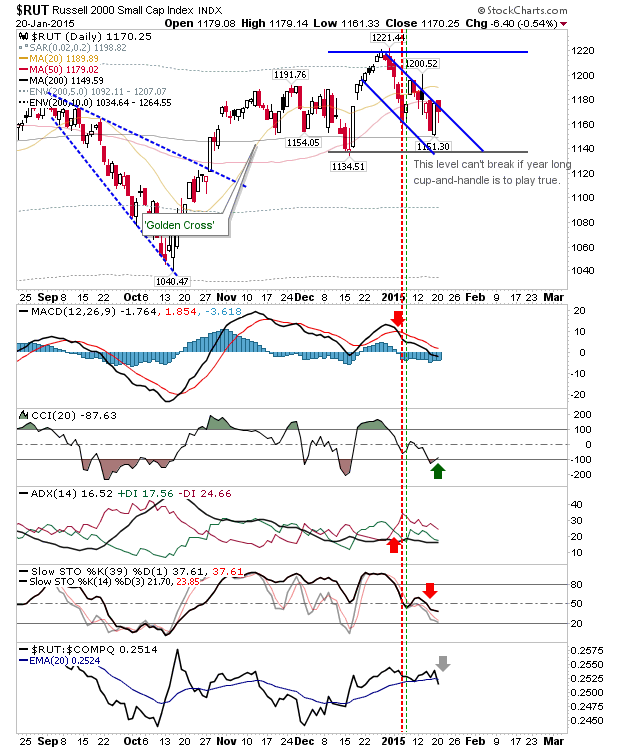

Unfortunately, the Russell 2000 was unable to clear channel resistance. However, this just delays the chance for a handle breakout.

For today, the Russell 2000 needs to push on to maintain the momentum in the Semiconductor Index, and to create an opportunity to negate the head-and-shoulder reversal.