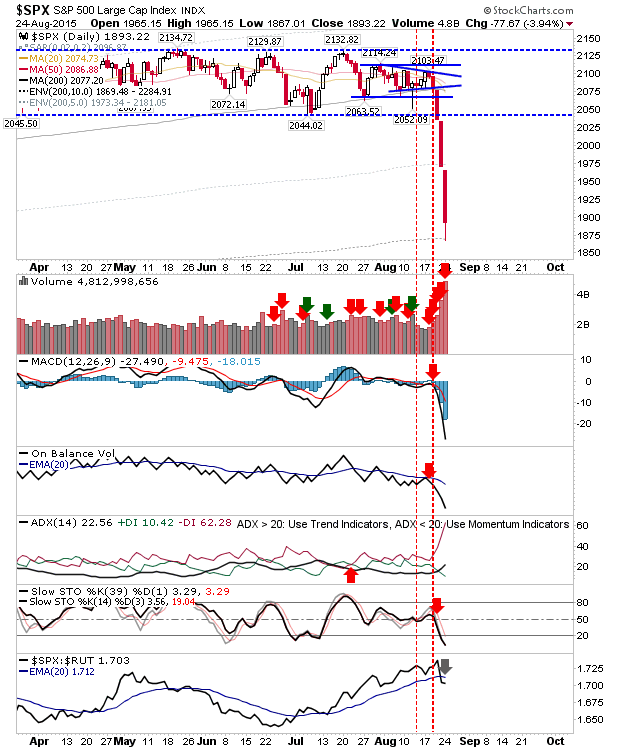

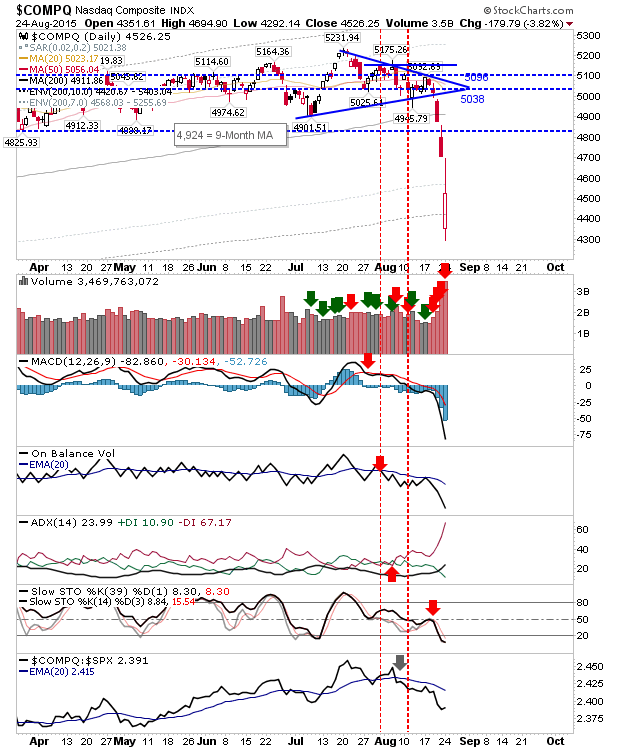

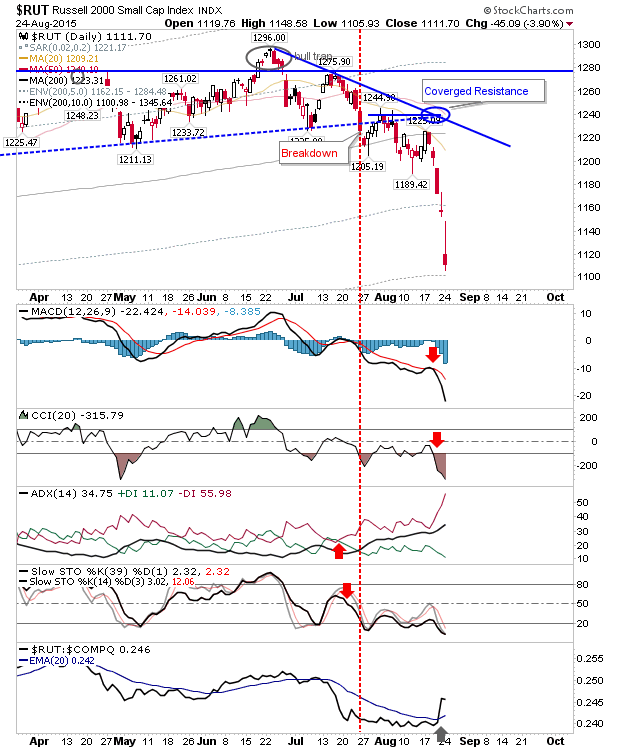

The third day of selling pushed markets deeper into oversold territory and potential long term 'buy' territory. In my 'bottom' tracker, the S&P 500 is priced in the 90% zone (i.e. only 10% of historic prices relative to the 200-day MA have been worse), while the NASDAQ Composite and Russell 2000 is in the 85% zone. It has been 4 years since markets have been this oversold.

The S&P made a picture perfect tag of the 10%, 200-day Envelope. Although with trading restrictions in place at market open it would have been difficult to get a fill at this price. But now is a time to be shopping for value in individual stocks

The Nasdaq closed the breakdown gap in intraday trading, but the weaker finish left this in neutral territory.

The Russell 2000 came close to a tag of the 10% 200-day MA envelope. It too looks to be offering value for those willing to take the risk.

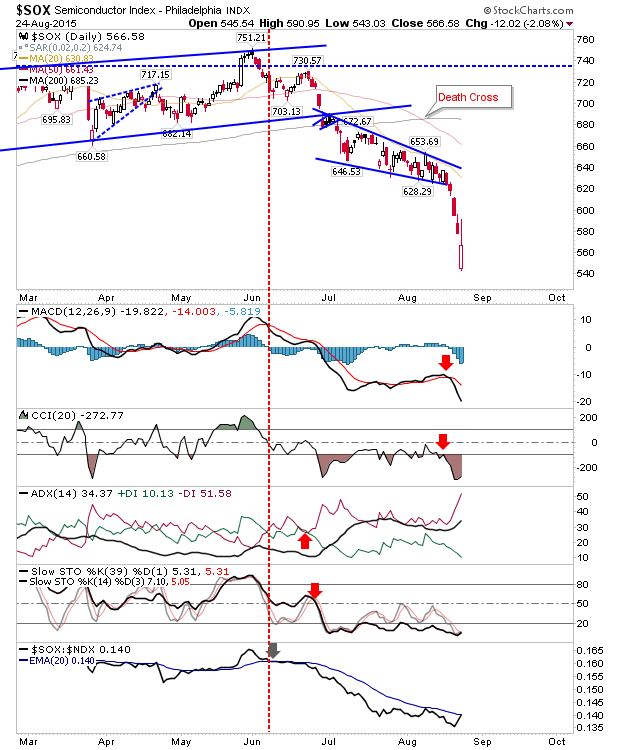

The carnage continued elsewhere. The Philadelphia Semiconductor Index experienced a wide range day, but didn't lose as much ground as lead indices. Has a trade worthy bottom arrived?

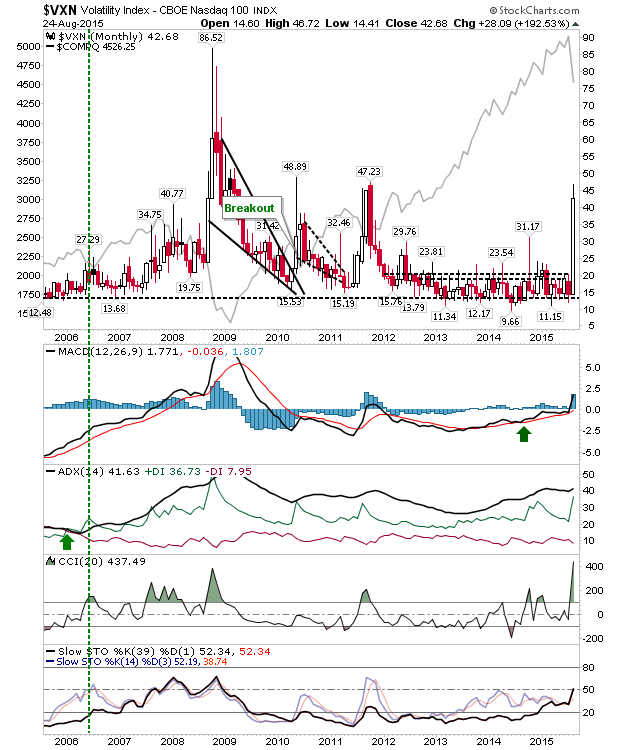

Or will the CBOE NASDAQ 100 Volatility push another weak month for September.

Short term traders will likely continue to have it rough, but long term buyers may find some valuables amongst the rubble.