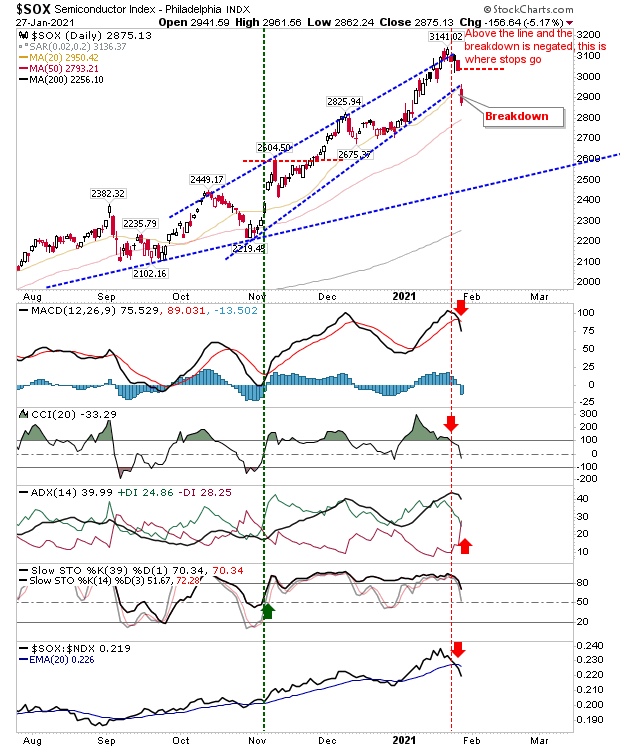

Semiconductors suffered heavy selling yesterday, which broke support of the rising wedge in a 5% loss. This had obvious knock-on effects to other indices such as the NASDAQ and S&P. It's too early to say if this is the start of a major swing high or just a heavier than expected selling day.

The key thing from the Semiconductor Index is the gap down from the sell off, breaching support and the 20-day MA undercut. If this is a significant breakdown, then the gap can't be closed (and really, shouldn't be challenged). It's going to take a few weeks for this to recover, even if it does recover. Semiconductors have come a long way in the last five years, but now looks like a time for a period of sideways action.

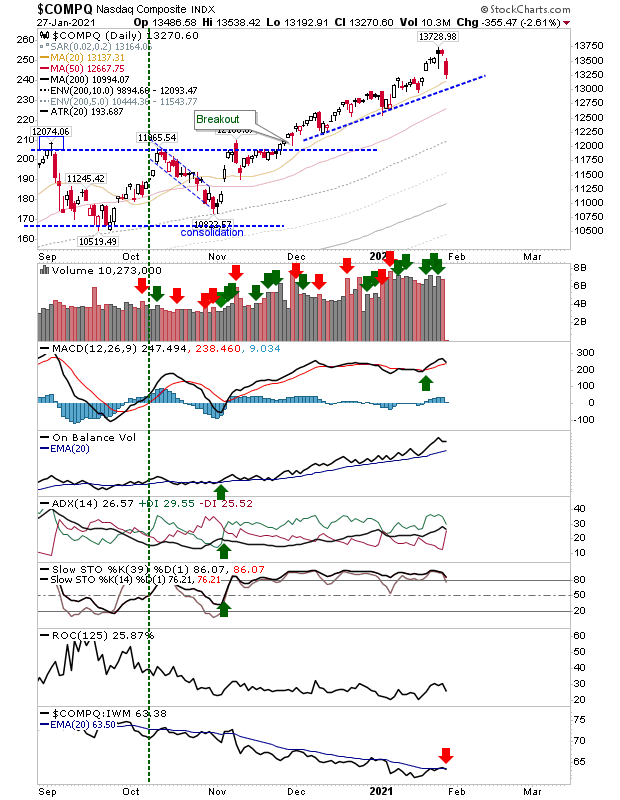

As a result, the NASDAQ has moved back to its 20-day MA, but hasn't yet challenged its own rising support. However, this has stalled the improving relative performance against Small Caps. Damage from the Semiconductor index will continue to seep through to the NASDAQ. The question will be how long lasting will it be.

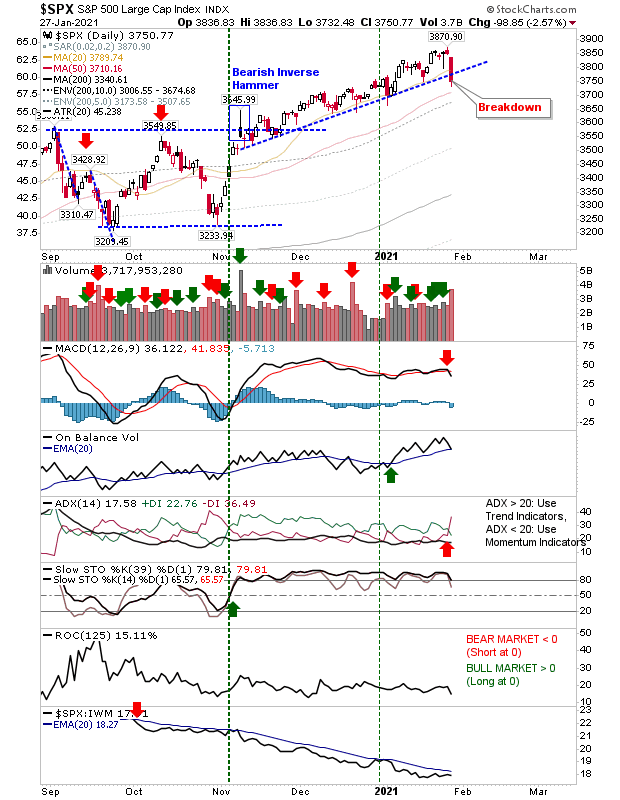

The S&P has heavy Tech exposure, so no surprise to see it undercut rising support. Wednesday's sell off brought with it a 'sell' in the MACD and +DI/-DI. The index is still underperforming relative to the Russell 2000, so yesterday won't be helping it make up lost ground.

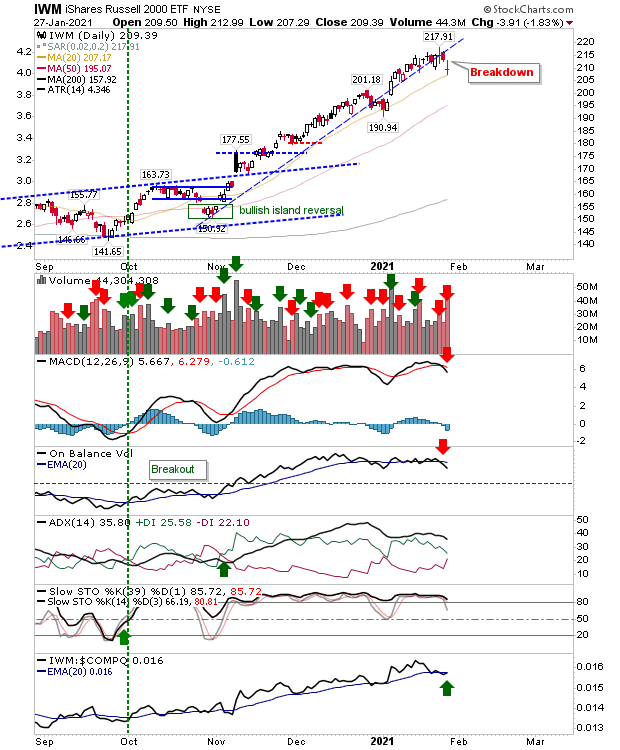

The Russell 2000 (via IWM) lost rising support despite the lightest absolute loss of the lead indices. It did test its 20-day MA over the course of the day, finishing with a neutral doji—so it could go either way today. Yesterday's selling was enough to see 'sell' triggers in the MACD and On-Balance-Volume.

Today will be about seeing how much damage yesterday really caused. The news cycle attributed the sell-off to Fed comments, but we have indices which have been running well in excess of historic performance since December. It's time for things to cool.