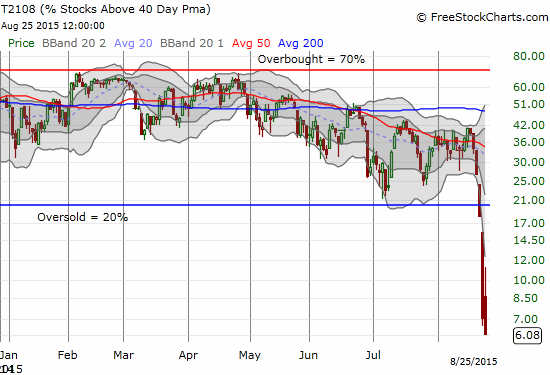

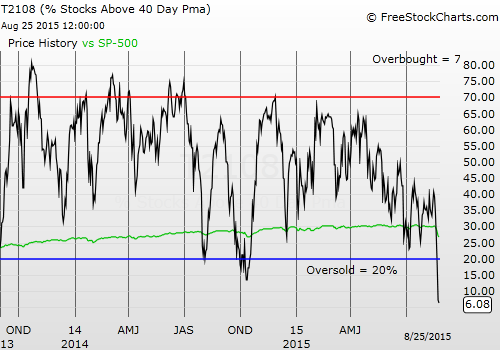

T2108 Status: 6.1%

T2107 Status: 15.5%

VIX Status: 36.0%

General (Short-term) Trading Call: Bullish

Active T2108 periods: Day #3 below 20% (oversold), Day #4 under 30%, Day #27 under 40%, Day #67 under 50%, Day #84 under 60%, Day #283 under 70%

The sellers kept up the pressure yesterday. Futures were notably weak before the open. Yet, buyers showed up in time to gap the market up in a move that COULD have confirmed an oversold bottom. Instead, the sellers immediately moved to retake control, and the ball rolled all downhill from there. T2108 closed at a fresh low of 6.1%!

How low will T2108 go?

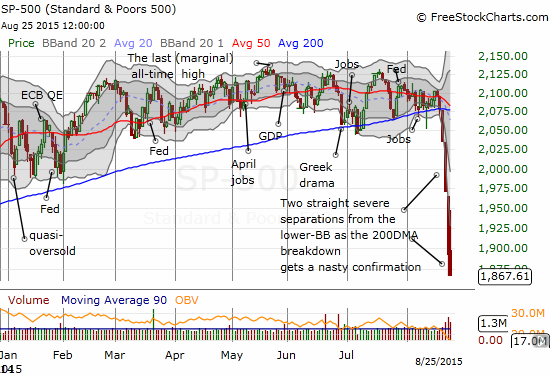

The S&P 500 closed for a loss for the 6th straight day, and below the lower-Bollinger Band® for an amazing 4th straight day.

The sellers remained strong, as they were able to press the S&P 500 for a fourth straight day below its lower-Bollinger Band (BB). The index lost 11.2% over six straight days of selling. Whenever the buyers return to bring some balance, the resultant rally is likely to be very impressive.

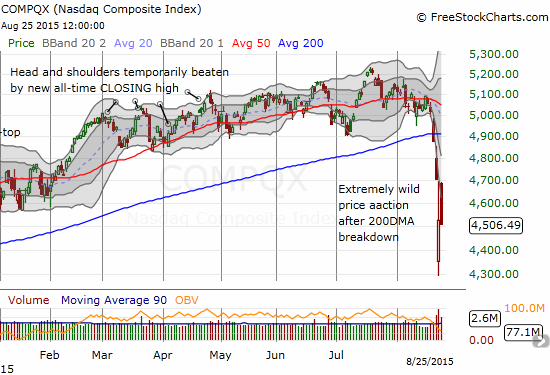

Here is a chart of the NASDAQ (NASDAQ:QQQ) for additional context. The tech-heavy index closed with a fractional loss only because Monday’s low (and open) were so incredibly (and unbelievably) deep. The NASDAQ has lost 11.5% in six days of selling.

Little consolation as the NASDAQ’s selling did not create a new low.

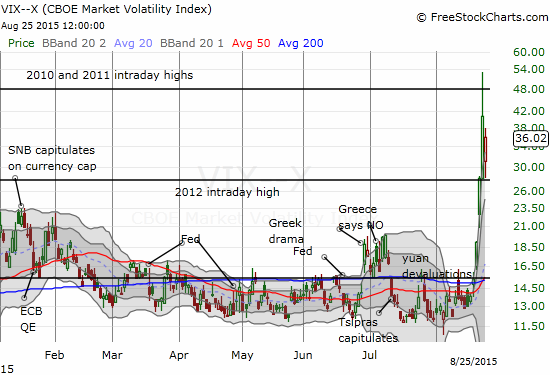

According to the rules I laid out previously, there were no trades to make no matter your risk preference. The VIX managed to trade perfectly between the previous high and low. As a reminder, a break to a new high gets aggressive traders buying. Less aggressive buyers wait until the VIX CLOSES below a previous low.

The volatility index swung through a wide range but stayed “in bounds.”

This action translated into large moves in the volatility products. ProShares Short VIX Short-Term Futures (NYSE:SVXY) plunged into the close, while ProShares Ultra VIX Short-Term Futures (NYSE:UVXY) put on a rare display of resilience.

ProShares Short VIX Short-Term Futures (SVXY) was crushed again as an initial rally quickly faded.

ProShares Ultra VIX Short-Term Futures (UVXY) reached again for its 200DMA downtrend.

Although the trading rules did not trigger, I did execute three key trades.

With T2108 oversold, I set at least one limit order for call options on ProShares Ultra S&P500 (NYSE:SSO) at a low ball price to catch a plunge while I am not monitoring the stock market. Surprisingly, my low ball offer of the day triggered near the close. I guess it makes sense given the rush of selling. Again, I strongly preferred at this stage of the oversold period to buy additional positions when the VIX was surging to new heights.

The second trade was on shares of ProShares Short VIX Short-Term Futures (SVXY). The plunge into the close looked so much like panic that I could not resist buying back into SVXY for the next short-term swing. This is even more speculative than usual given the VIX did not print a new high.

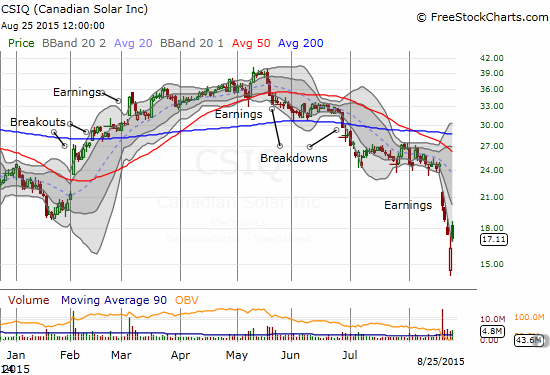

Finally, the third trade was a two-for-one on solar stocks Canadian Solar (NASDAQ:CSIQ) and First Solar (NASDAQ:FSLR). I included CSIQ in my shopping list of stocks on the first oversold day because I concluded the stock was “ridiculously” oversold. I took a risk and bought as CSIQ faded to close the opening gap up (I wish I had CSIQ on the list for Monday’s plunge!). I set a tight limit order to sell at $18 since I am already holding call options. Fortunately, the stock proceeded to rally straight up and took out my price target in short order. After CSIQ, I took a look at FSLR and decided to jump back into my favorite solar stock with call options.

Unfortunately, both CSIQ and FSLR hit walls later in the day along with the market, and ended up closing at their lows. FSLR was turned back from resistance at its 50DMA. CSIQ has a chart commonly seen in the market right now: a gap down and a rally on Monday; a gap up and a fade on Tuesday – almost a “sloppy” abandoned baby bottom except the upside showed too little conviction. The battle between bears and bulls, sellers and buyers is just getting warm.

Canadian Solar (CSIQ) struggled, like so many stocks, to pick itself up and out of deeply oversold conditions in what ALMOST looked like an abandoned baby bottom.

Here is what a proper abandoned baby bottom looks like (from Steve Nison’s Candlecharts.com):

Nison: “A very rare Japanese candlestick top or bottom reversal signal. It is comprised of a doji star that gaps away (including shadows) from the prior and following sessions’ candlesticks. This is the same as a Western island top or bottom in which the island session is also a doji.”

Me: An abandoned baby bottom "traps" bears and sellers on the second day. These sellers assumed the big gap down confirmed the bearishness of the selling on the first day.

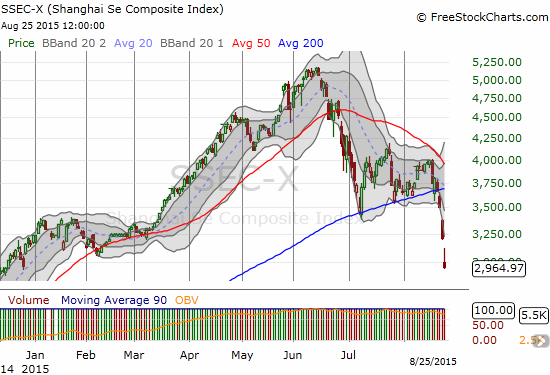

Finally, finally…a nod to China’s increasing woes with this short news video from a Canadian network followed by chart showing the on-going collapse of the Shanghai Composite Index (SSEC).

The Chinese government lost control of the Shanghai Composite Index as it continued to collapse from its 200DMA breakdown. This reversed a gain that was as high as 59% for 2015.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

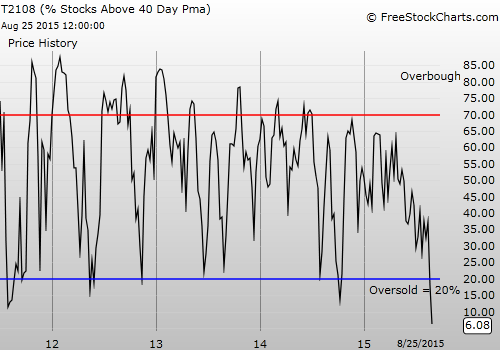

Weekly T2108

Be careful out there!

Full disclosure: long SVXY shares, long SSO shares and call options, long FSLR and CSIQ call options