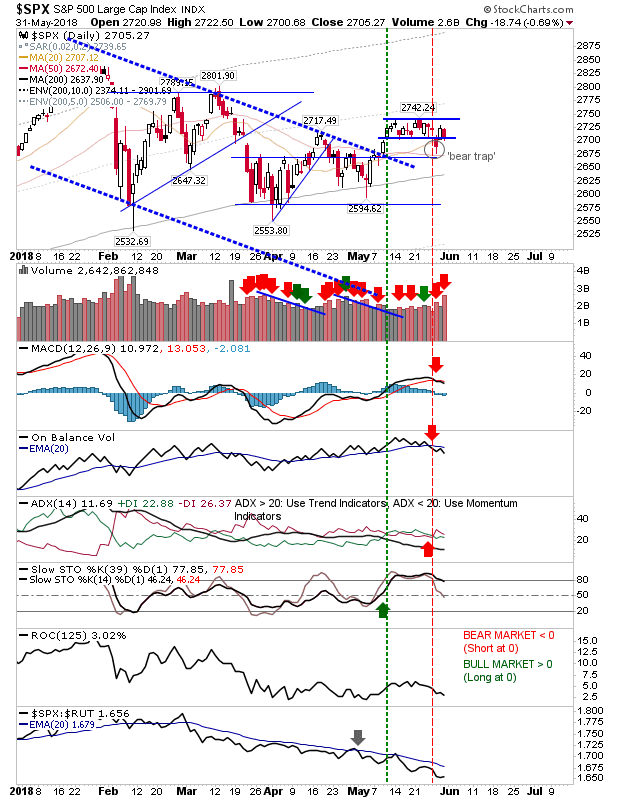

US President Donald Trump's tariffs sent markets on a bit of a spin, but total selling, while ranked as distribution, didn't go above 1%. More importantly, the bullish setups from Wednesday remain valid.

Losses in the S&P 500 took the index back to challenging the 'bear trap'. An open around 2,700 could offer a discounted long opportunity.

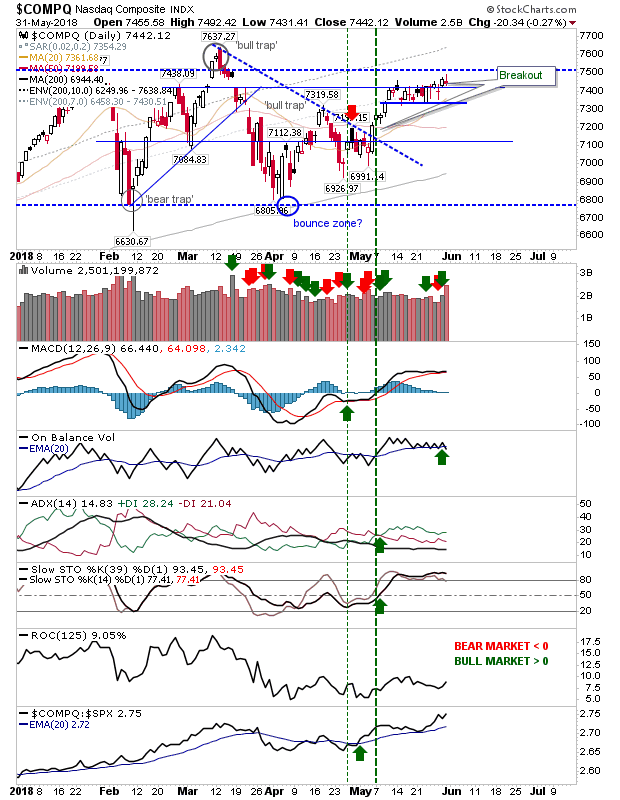

The NASDAQ finished with a small 'inverse hammer' just above the breakout level.

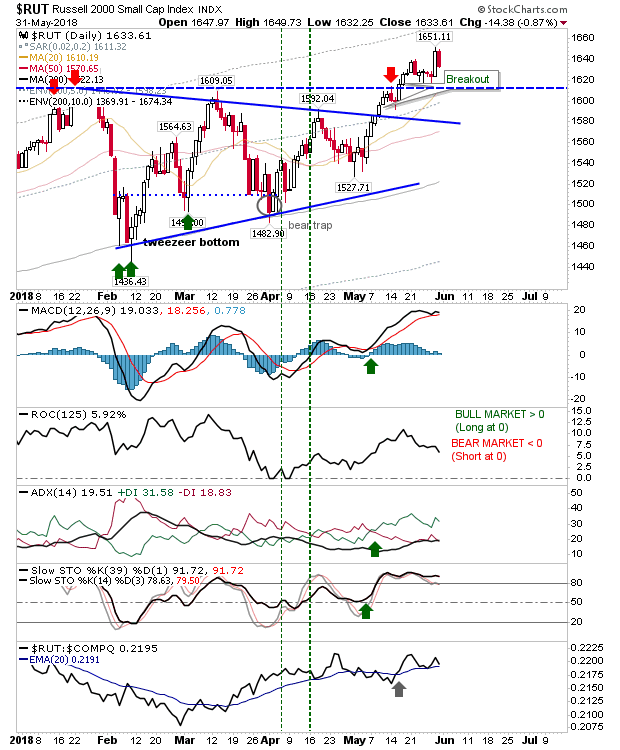

Small Caps gave up a large chunk of Wednesday's follow-through move but not enough to negate it. Technicals remain net bullish.

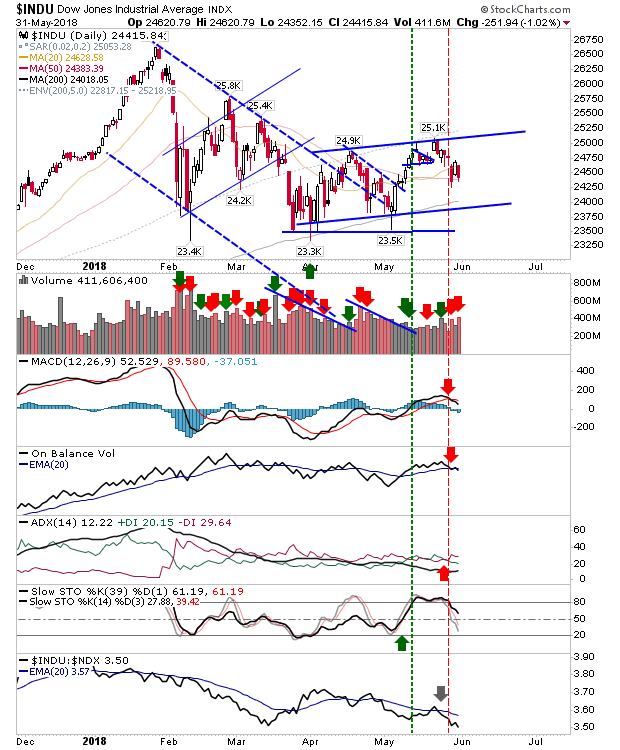

The only index where further losses might be favoured is the Dow Jones Industrial Average. Thursday's losses may have pushed a little too hard for a recovery on Friday; a move to rising channel support looks like a better play.

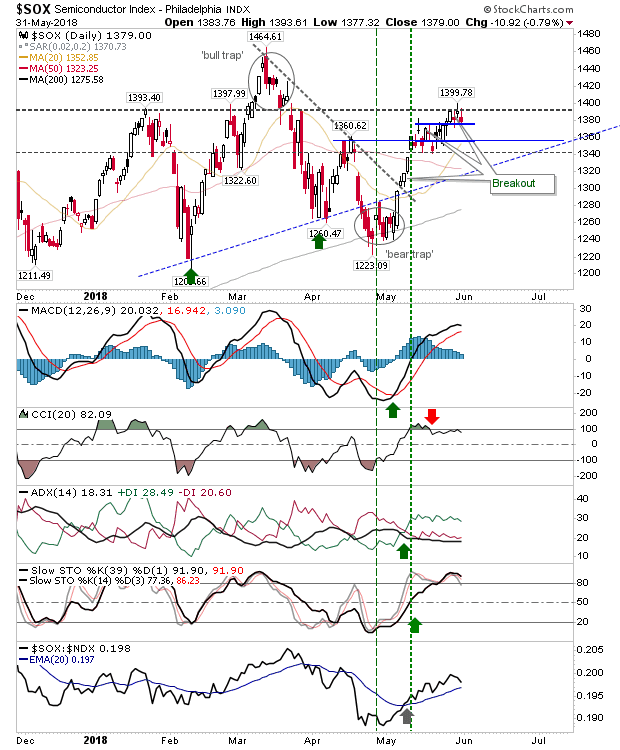

Finally, the Semiconductor Index – despite not having a great day on Thursday – still maintains its breakout.

For Friday, those favouring continued weakness can focus on the Dow Jones. Longs could go aggressive on the SPX or look for the Russell 2000 to recover its lost ground from Thursday.