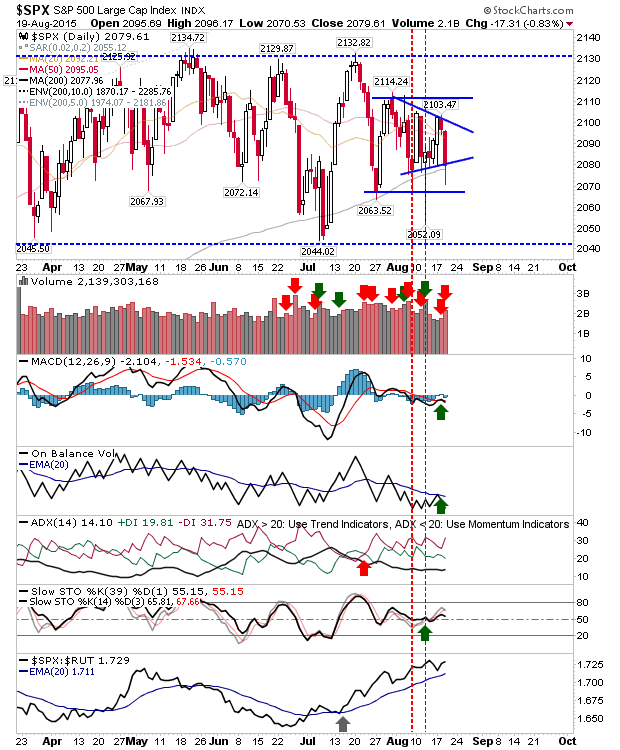

Tough day at the office yesterday, with sellers having all of the fun until the Fed meeting minutes jacked up prices, only for sellers to return into the close.

For the S&P, each test of the 200-day MA weakens it, and we are probably getting close to the point we get a decent push down, and a move outside of the longstanding trading range which has plagued this market throughout 2015. Even a modest 10% correction off highs would set it to drop below psychological 2000. Should such a move occur it should be welcomed like refreshing rain on a muggy day. The market needs direction.

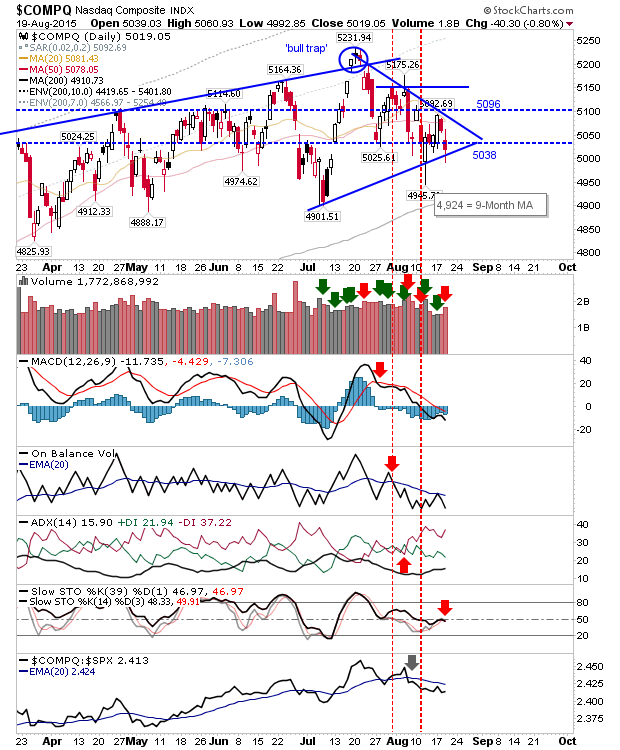

The NASDAQ dropped below 5,038, but 4,950 is key support - which is also close to where the 200-day MA is. Still plenty of places for buyers to step in, and this is not looking as vulnerable as the S&P.

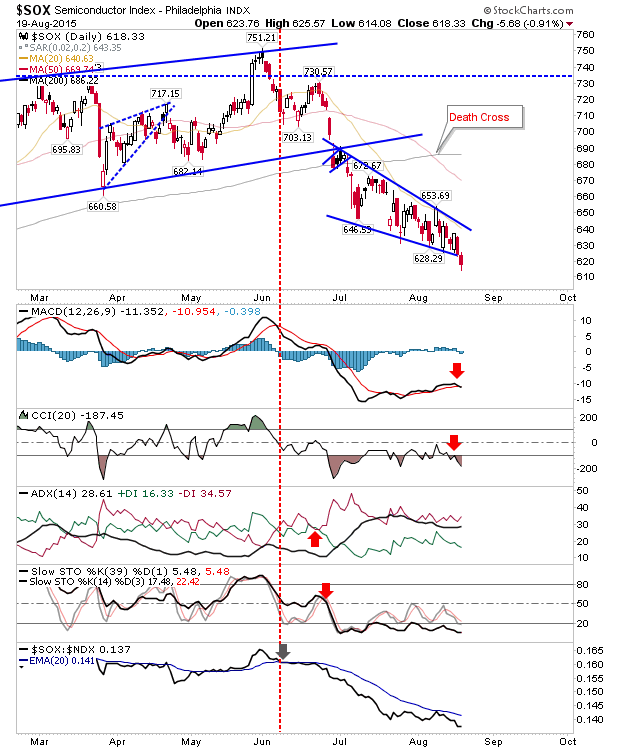

The key disappointment for Tech was the loss of support from what had looked to have been a bullish wedge in the Semiconductor Index. Technicals are again all net negative.

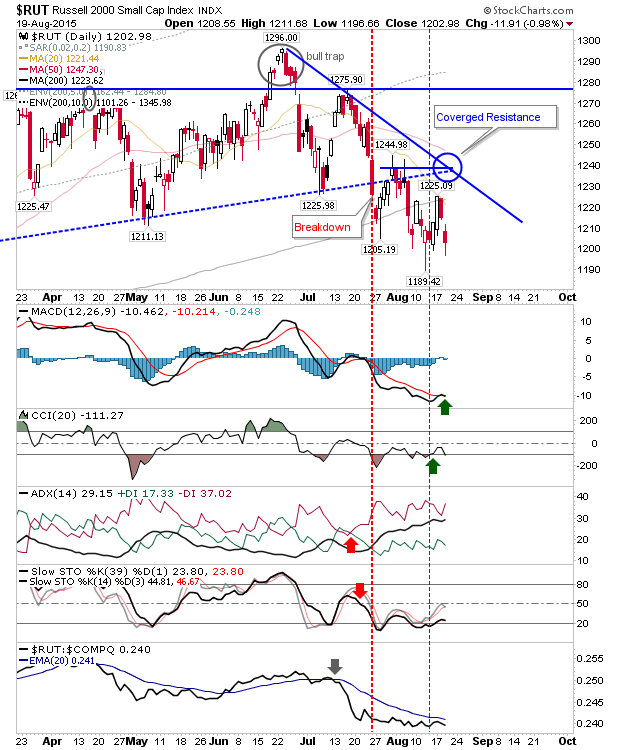

The Russell 2000 had flagged its intent Tuesday when it experienced a 0.80% loss and reversal off its 200-day MA. Yesterday wasn't much better, but it did at least hold 1,200.

The action in markets, Large Caps in particular, is not attractive for those looking to build long term positions. Without those buyers it's hard to see markets having the momentum to push markets out of these ranges.

A solid 10-15% drop from highs would probably bring these buyers in. Keep an eye on the relationship of the indices to its 200-day MA, this is tracked in the tables at the bottom of charts: Note: this is another point when value buyers could emerge.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.