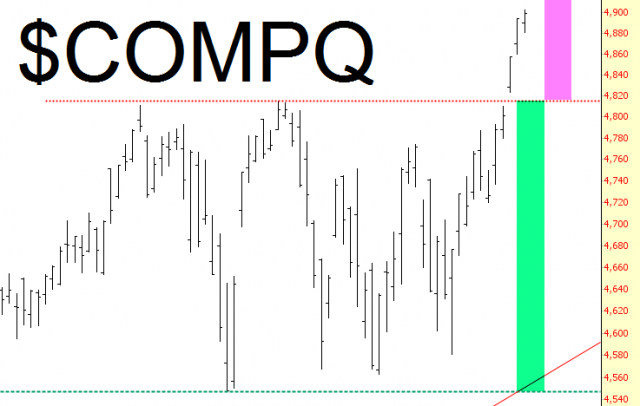

February has been a wretched month for the bears (dare I use the plural anymore?). Let’s review where things stand as of Tuesday’s close. We’ve got a NASDAQ Composite which has broken out of a cleanly-defined range:

A Dow which is a fraction of a percent away from another lifetime high:

An S&P 100 which pushed to a lifetime high and has likewise escaped its own range:

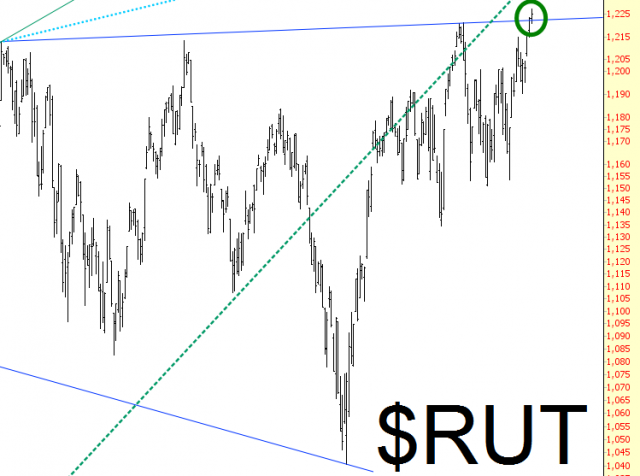

A Russell 2000 which has, as so many other indexes, painted another lifetime high as well as emerged above a fairly clean “bottoming” (ha!) pattern:

And an S&P 500 which just so happened to close at 2100 today, aided by a sudden crush of buy orders at the day’s end to create that very headline-friendly round number.

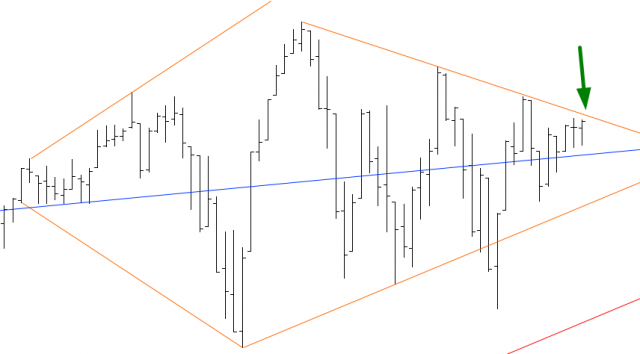

Pretty much the last index that hasn’t been bull-wrecked is the Dow Jones Composite, which is a hair’s breadth away from emerging from its own diamond pattern, although it has not done so yet:

My main focused continues to be energies (I don’t have a single domestic ETF of any kind). The Oil and Gas index is getting deliciously close to closing its own important gap. The close it gets to doing so, the more interesting the opportunities are:

That’s it from me, the last bear standing!