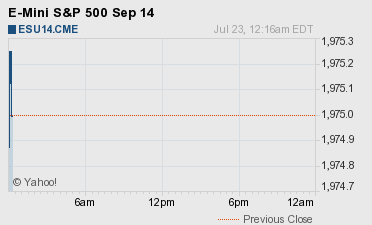

The CME Group’s Emini S&P 500 futures (ESU14:CME) closed 5.25 points lower yesterday, completing the sixth day in a row that the S&P has gone from closing higher one day to closing lower the next.

Starting Monday July 14 the ESU14 closed July +8.60 handles, July 15 – 3.0 handles, July 16 +6.8 handles, July 17 -21.20 handles, handles July 18 +18.0, July 21 -5.3 handles. The Dow futures (YMU14:CME) closed down 49 and the NASDAQ (NQU14:CME) closed down 4.5 tics at 3925.80.

Traders and Investors

Lets face it: for most investors the S&P is too high to buy and too firm to sell. While the well-known market timers continue to sound the alarm button on almost every negative from the Ukraine to the Gaza, what they should do is go with the flow, not against it.

We understand that this goes against conventional wisdom, but they have still not accepted that zero-rate borrowing is the single most important aspect of the current rally and the one that holds everything together. It’s what drives all the mergers & acquisitions and stock buybacks.

It cannot go on forever but until the US Federal Reserve raises rates the S&P 500 will continue to turn bad into good.

Numbers and Earnings

So far the volume in the S&P has not dropped to the low levels I expected. It seems like there is always turmoil moving the ESU14.

This week has few economic releases and a lot of earnings reports. Most investors still believe the Q2 earnings season will help determine whether the stock market can continue to post gains like it has.

This week 146 companies of the S&P 500 and 12 Dow Industrial components report including big names like Ford Motor Co. (NYSE:F) Microsoft Corporation (NASDAQ:MSFT) and Apple (NASDAQ:AAPL).

MICEX Erases $28 Billion

Being on the right side of the trade all the time is hard to do. In the case of President Vladimir Putin, his image at home may be of a brave man but as a trader he has not been doing so well.

The invasion and annex of Crimea and the Russian separatists controlling eastern Ukraine sent jitters through the Moscow Exchange (MICEX) but the downing of Malaysian Airlines Flight 17 has only added to the fear. Protecting against a Russian bond default, which has already cost the Russian economy more than other emerging markets’ debts, has become even more expensive since flight 17 was shot down.

Since February, the Micex has lost 4.2% or $28 billion in market cap while the US stock market is trading at its all-time highs. Other BRIC countries, such as India, are also enjoying stock rallies, while the Russian economy just posted zero growth in the second quarter.

War is politics by another means, said the Prussian general Clausewitz. But he didn’t mention the economic cost of mixing the two. The Micex lost 6.1% in the three days through July 21, its largest selloff since March.

The Asian majors closed sharply higher and in Europe 10 out of 12 markets are trading higher. Today’s schedule includes Consumer Price Index, Redbook, FHFA Housing Price Index, Existing Home Sales, Richmond Fed Manufacturing Index and earnings from McDonald’s (NYSE:MCD), Microsoft (NASDAQ:MSFT), Coca-Cola Company (NYSE:KO), and Verizon Communications (NYSE:VZ).

Our view

If you are a momentum player you went home short the ESU14s on the close. The MiM was showing $-200 million to sell and the actual MOC was -$600M. This pushed the futures from 1970 back down to 1966.00 by 3:15 PM Central.

As I said in Friday and yesterday’s videos, I think we can see some early weakness this week then a push back up to new highs. The PitBull said he thinks we are in a range; 1950 to 1985.

Whatever the case, July is coming to a close and that should mean more people going on vacations. At the end of August most schools will be starting up again. Can you believe how fast the summer is disappearing?

We are in a funk with the up-a-day/down-a-day stuff. If we continue to see higher lows the Emini will take out the contract high. You can sell today’s early rally and buy weakness or just be patient and buy weakness.

Above 1973 is a big line of buy stops that goes up to 1978 and above 1979.70 is another line of buy stops that takes the ESU14 up to 1987-1990; you can take it from there.

As always, please use protective buy and sell stops when trading futures and options.

- In Asia 10 of 11 markets closed higher: Shanghai Comp. +1.08%, Hang Seng +1.69%, Nikkei +0.84%.

- In Europe 10 of 12 markets are trading higher : DAX +0.76%, FTSE +0.76%

- Fair Value: S&P -6.10, NASDAQ -7.57, Dow -66.65

- Total Volume: 1.42M ESU and 3.3K SPU traded

- Economic and Earnings Calendar:Consumer Price Index, Redbook, FHFA Housing Price Index, Existing Home Sales, Richmond Fed Manufacturing Index and earnings from McDonald’s (NYSE: MCD), Microsoft (NASDAQ: MSFT), Coca-Cola Company (NYSE: KO), and Verizon Communications (NYSE: VZ).

- E-mini S&P 500 1975.00+0.25 - +0.01%

- Crude 104.30-0.12 - -0.11%

- Shanghai Composite 0.00N/A - N/A

- Hang Seng 23939.471+157.361 - +0.66%

- Nikkei 225 15345.27+1.989 - +0.01%

- DAX 9734.33+122.28 - +1.27%

- FTSE 100 6795.34+66.90 - +0.99%

- Euro 1.3464