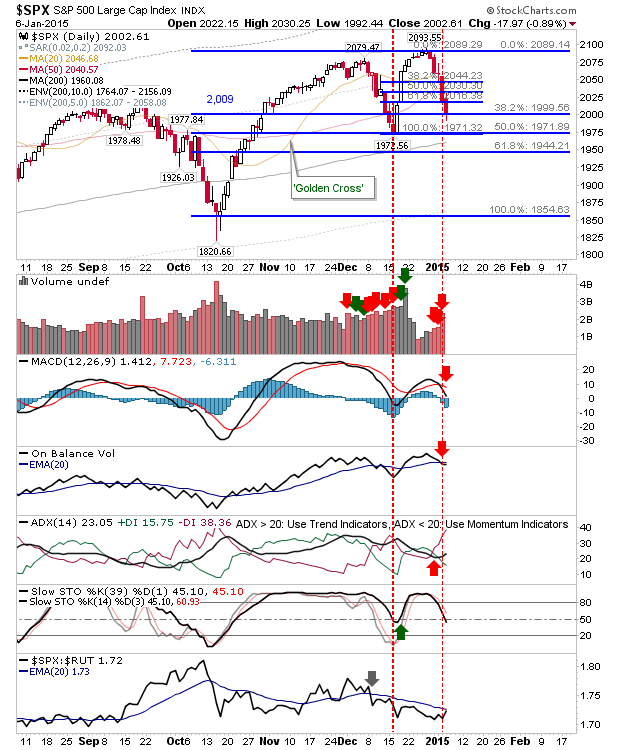

Those looking for a pullback from the December-January rally in the S&P are now looking at a Fib overshoot. The loss of the 61.8% level typically means a retracement of the entire move, which in this case is a test of 1,971.32. If this does indeed happen it will set up a possible head-and-shoulder reversal, involving a rally back to 2,079 and then a move back to 1,971 - and below. However, first step is to see a test of 1,971.

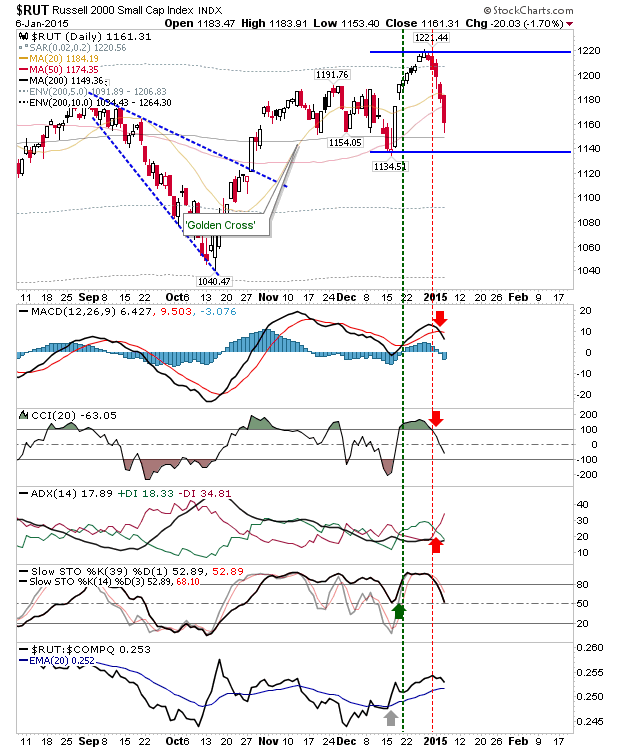

I have also redefined the support/resistance levels for the Russell 2000. The December swing low is the last stand of the 'handle' for the year long cup-and-handle. If this breaks, the Russell 2000 falls back inside its broader base, and the clock timing the breakout keeps on ticking.

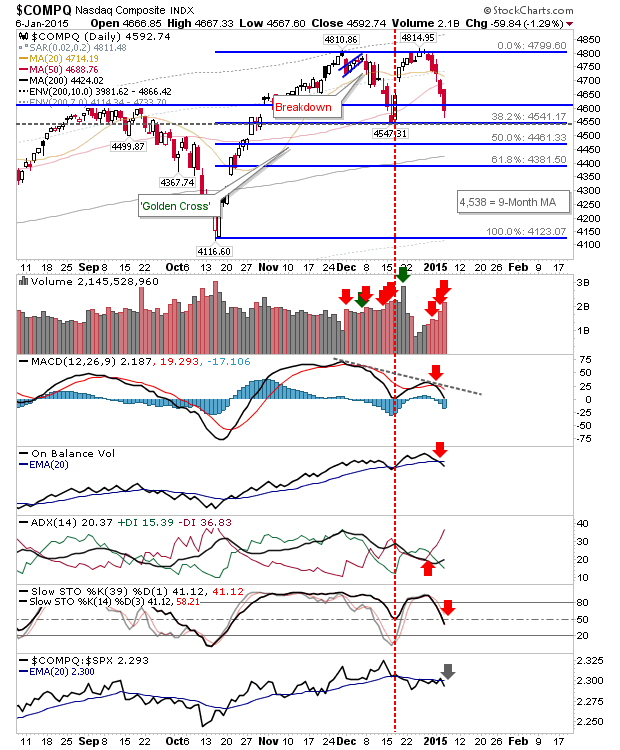

The NASDAQ also experienced a sell off which placed it very close to its December swing low. It looks to be a race between Tech and Nasdaq in testing this support. A bounce is likely, but it may find it hard to attract buyers, and shorts will get aggressive if it gets back to 4,800.

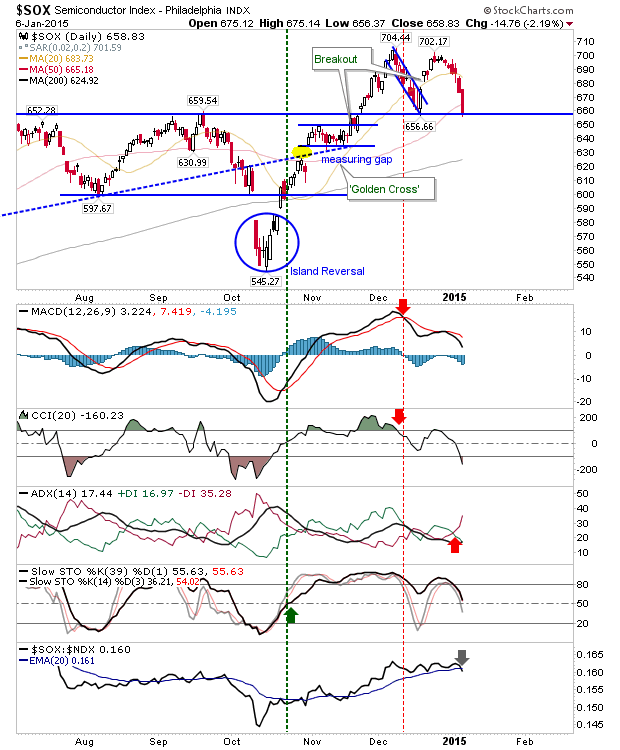

More worrying, the Semiconductor Index has already tested the December low, which itself is threatening the breakout. The undercut of the 50-day MA doesn't help either as there was no stall at this support level.

The worrying thing about this decline is that it has come so close to December's. The distribution volume doesn't help either. There are still support levels to work with, first of which is the December low. Next come the 200-day MAs. The Russell 2000 will be the first index to test this important moving average. Watch closely, but wannabe buyers might want to sit this one out for now.