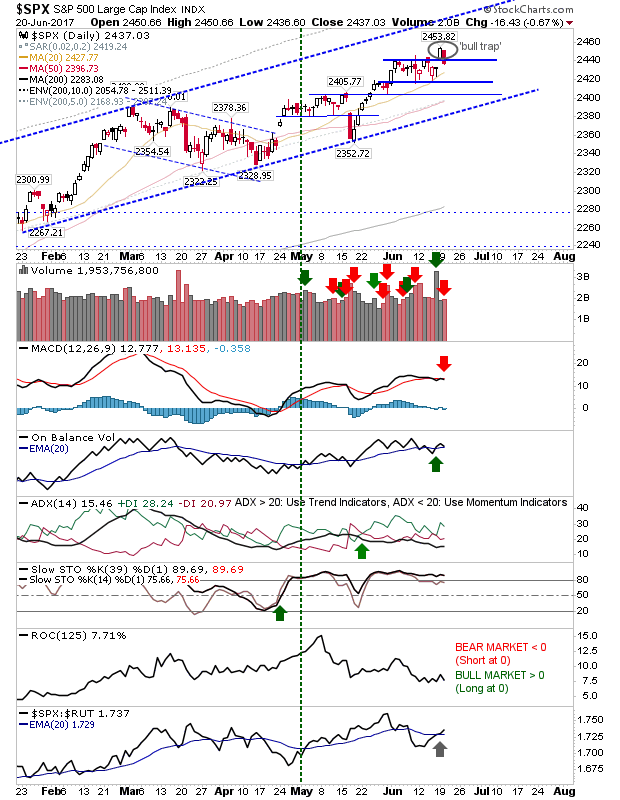

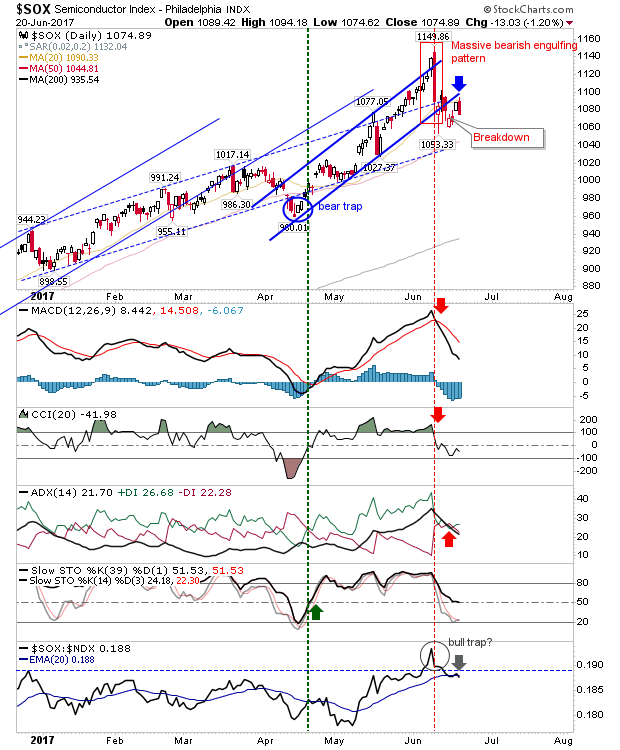

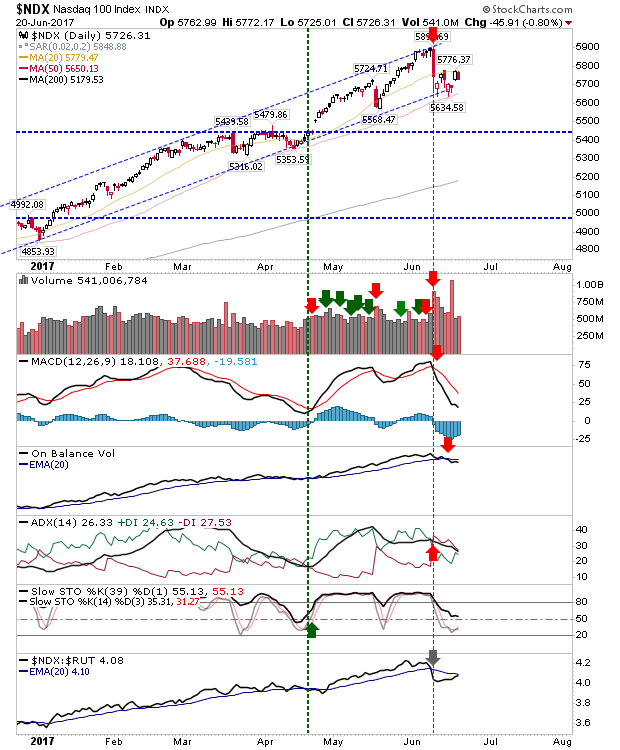

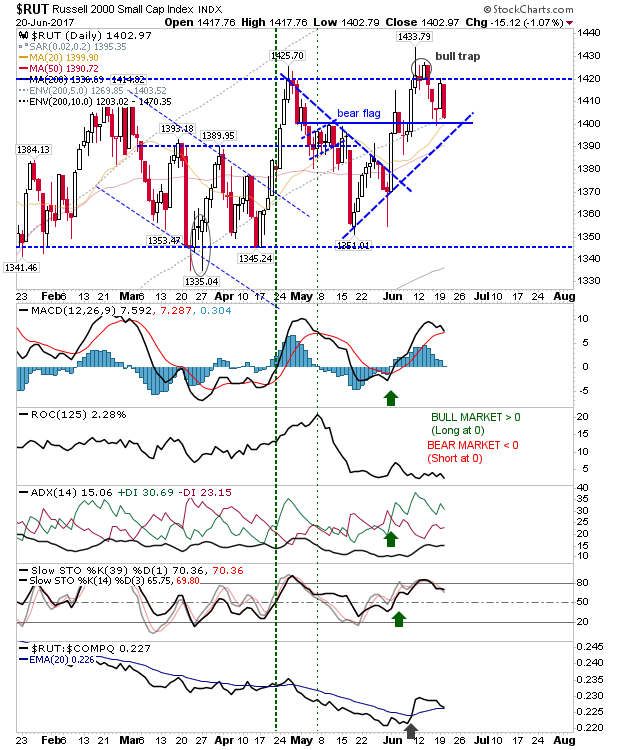

Monday's market gains were whipped away on higher volume distribution. This opened shorting opportunities in indices other than the Semiconductor Index.

The S&P closed with a 'bull trap' on higher volume distribution. Shorts could look to a position here with a stop on a move above 2,453. Technicals are still bullish but On-Balance-Volume and the MACD are vulnerable.

The Semiconductor Index reversed off converged resistance. Shorts who entered positions at converged resistance from former channel support will be comfortable with their position with stops on a move above 1,094. The index is also struggling with relative performance having fallen back inside its prior base. Watch for further weakness.

Similar action is playing out in the NASDAQ 100. Tuesday's loss for the index was not as great, meaning a short position is still possible with a stop above 1,577 – watch pre-market for leads. A rally from the open could be attacked after 30 minutes if the typical intraday reversal emerges.

The Russell 2000 did experience a big loss but given the index has fallen back inside its prior trading range the significance of it is not so great. Having said that, the earlier 'bull trap' is a strong marker for a move back to trading range support around 1,345. And Tuesday's action was one such step in the direction of 1,345.

For Wednesday, bears will likely try to force the issue and maintain the momentum lower. Bulls had little luck in delivering follow through, and falling prices can simply be achieved from the absence of buyers – which is likely to happen here. Semiconductors remain the index most vulnerable to selling, but the Russell 2000 could be the one to deliver the downside target of 1,345 over the coming weeks. Shorts may finally have an opportunity with the NASDAQ 100 and to a lesser extent, the S&P. In any case, all short positions will be negated on a move to new near-term (or all-time) highs.