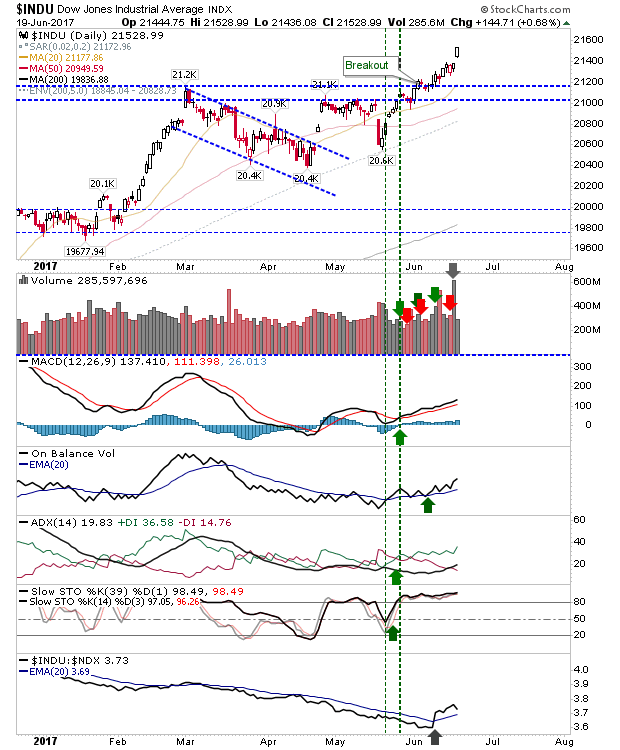

If volume wasn't just a little disappointing this would have been considered a super solid day for bulls. Having said that, shorts will be feeling the squeeze and anyone who shorted the Dow Jones would have been feeling particularly aggrieved.

Momentum bull-runner Dow Jones gapped at the open and finished at the high of the day. Relative performance actually dropped a little but the Dow is clawing back 6-months of under-performance so it can be forgiven for this.

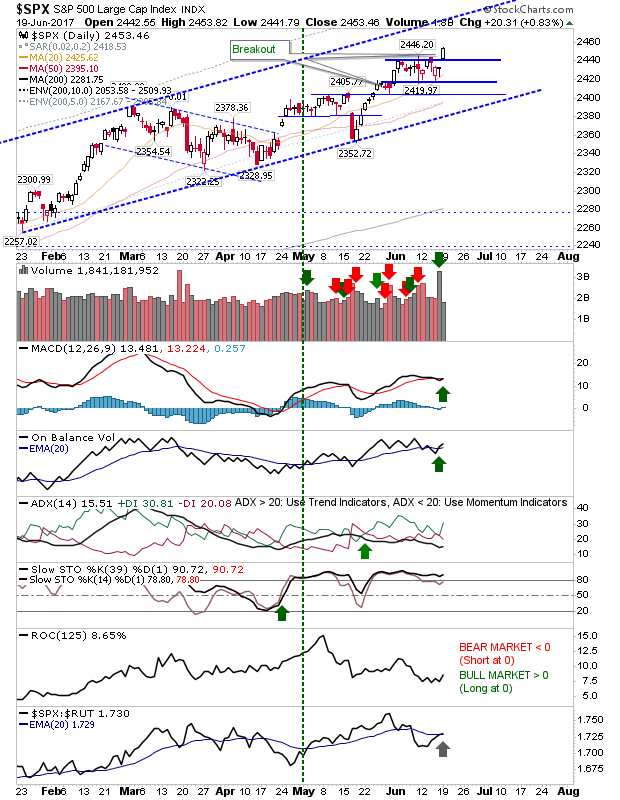

The S&P had a standard breakout – but a breakout which completed the sideways consolidation of recent weeks. This helps strengthen the technical picture, which was wavering a little. The MACD returned to a 'buy' trigger after a brief 'sell'.

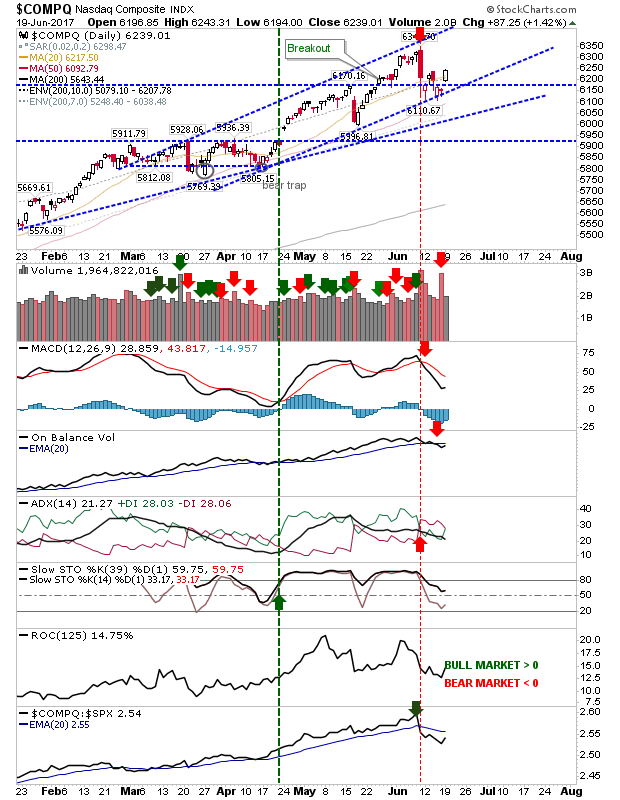

The NASDAQ gapped higher from channel support, although Thursday/Friday was the time to have bought. A challenge of recent highs, then a move to channel resistance are the goals to aim for. Technicals have work to do although stochastics haven't lost bullish territory.

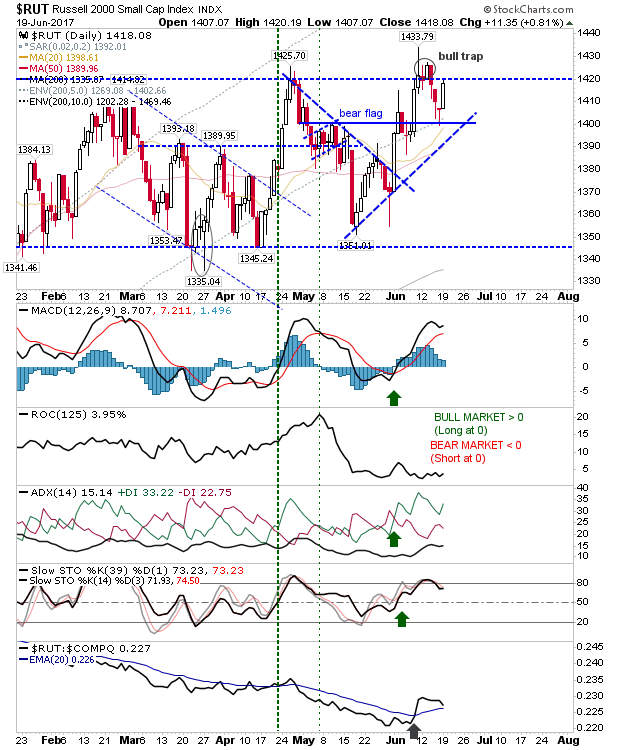

The Russell 2000 made solid gains but it hasn't yet challenged the June 'bull trap'. In the light of action for other indices, Monday was a low key affair but it was important in showing growing demand for speculative Small Caps.

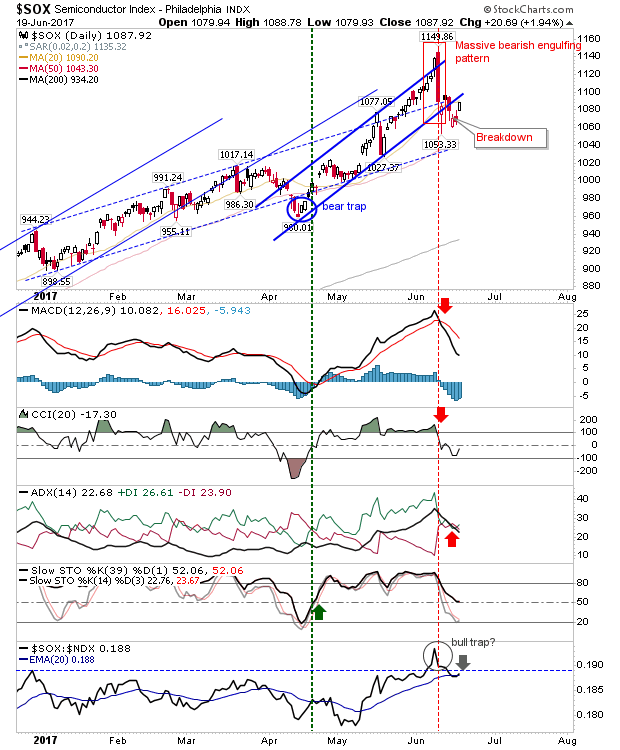

The Semiconductor Index is knocking on the door of former channel support turned resistance. The index had the best relative gain (nearly 2%), but with resistance converging shorts will have an opportunity to attack. The risk is high, but it's the only index really offering anything for short players.

For Tuesday, bulls can hold, bears can track the Semiconductor Index. Buyers need to watch pre-market and the first half hour of trading to get an idea what the rest of the day can bring.