In the last few weeks I have been big about trying to gain a “feel” for the markets. Despite the vicious fighting going on in Iraq and the Russians still supplying the separatists in eastern Ukraine, the S&P 500 has shaken off the bad news like a good soldier and kept on climbing.

Okay, here’s a chart. But even the chart just says what your gut is telling you.

Yesterday the Federal Reserve released its latest monetary policy decision. There was really nothing new. We did not hear about hiking rates quicker and nor did we hear anything about “tapering the taper.”

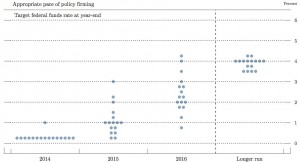

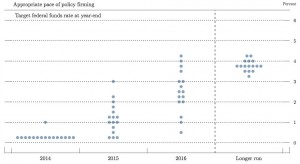

With the Fed taking off another $10 billion of its monthly asset purchases and the S&P less than 1% off its contract highs, the S&P (CME:SPU14) started moving higher, but the question is why? The Fed’s latest Summary of Economic Projections includes the “Dot Plot,” which shows what the members of the FOMC are predicting will be the path of potential rate hikes.

The latest Dot Plot showed an even wider dispersion than usual of opinion about where interest rates will be in the next 3 years and over the long run. The report basically showed there is no consensus in the FOMC at this time.

Connecting the Dots

As you can see, the projection for the end of this year remains unchanged, but one FOMC member sees rates going to +0.25% to 2.25% by the end of 2015. Interest rates and projection for 2016 have moved from 0.50% to 0.75%.

Conclusion: There is no consensus right now on where the Fed thinks rates are going. With no change in the statement, it may be a good idea to “follow the dots.” With the ECB lowering to negative rates and the U.S. stock market on new highs, there seems to be no reason to hurry to raise rates anytime soon.

In Asia 6 out of 11 markets closed lower (Shanghai Comp -1.55%) and in Europe 11 of 12 markets are trading higher. Today’s economic schedule starts with the jobless claims, Philadelphia Fed survey, leading indicators, EIA natural gas report, 2-5-7-yr note announcement, 30-yr TIPs auction, Fed balance sheet, money supply and earnings from Kroger Company (NYSE:KR), Oracle Corporation (NYSE:ORCL), BlackBerry (NASDAQ:BBRY), and Rite Aid (NYSE:RAD).

NO FEAR

Our view: The S&P roll is over and the June Quad Witch is on tap. Today, the June expiration study shows the cash S&P (SNP:^GSPC) up 18 and down 12 of the last 30 occasions and Friday’s stats are even better: up 21, down 9 of the last 30. By now “everyone” is bullish and my concern is, what does the S&P do for an encore after such a big push up?

But the other side of the coin is the CBOE’s fear gauge: the VIX. It sold off to a record low of 10.57 yesterday and my gut is telling me it’s going into the low 9.00s at some point. There is no fear.

Our view is to continue to go with the trend; sell the early rally if you like or just make it easy on yourself—follow the trend and buy weakness. The ESU is going to 1965-1970 soon.

As always, please make sure to use protective stops when trading futures…

- In Asia, 6 of 11 markets closed higher: Shanghai Comp. -1.55%, Hang Seng -0.09%, Nikkei +1.62%.

- In Europe, 11 of 12 markets are trading higher: DAX +0.80%, FTSE +0.80%

- Morning headline: “S&P Seen Flat Ahead of Jobless Claims”

- Fair Value: S&P -8.00, NASDAQ -8.30, Dow Jones -80.20

- Total volume: 1.75mil ESU and 20k SPU traded

- Economic calendar: Jobless claims, Philadelphia Fed survey, leading indicators, EIA natural gas report, 2-5-7-yr note announcement, 30-yr TIPs auction, Fed balance sheet, money supply and earnings from Kroger, Oracle Corporation, BlackBerry, and Rite Aid.

- E-mini S&P 500 1958.00+1.00 - +0.05%

- Crude Oil 102.15+0.02 - +0.02%

- Shanghai Composite 0.00N/A - N/A

- Hang Seng 23167.73-13.99 - -0.06%

- Nikkei 225 15361.16+245.36 - +1.62%

- DAX 10008.32+77.99 - +0.79%

- FTSE 1006825.62+47.06 - +0.69%

- Euro 1.3635