Investing.com’s stocks of the week

Tuesday most major equity indexes around the globe bounced back after Monday's weak start to the week. The Shanghai Composite surged 1.38%, the Euro Stoxx 50 closed with a 1.27% advance.

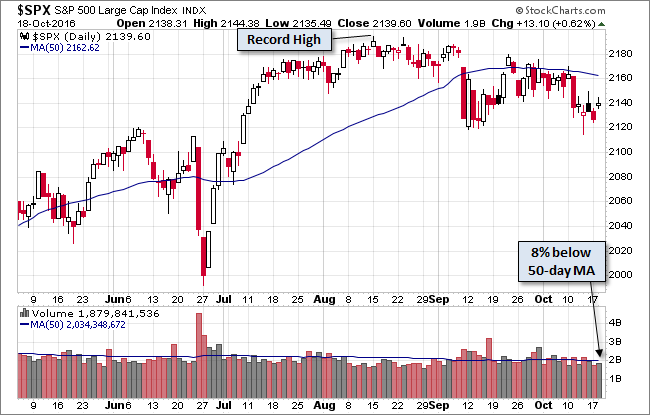

Our benchmark S&P 500 jumped at the open, sold off to its 0.42% intraday low near the end of the first hour of trading and rallied to its 0.84% mid-day high. It then traded sideway until the final hour, when some selling trimmed the closing gain to 0.62% — a welcome advance, but not as impressive as some of its key Asian and European index cousins.

The yield on the 10-year note closed at 1.75%, down two BPs from the previous close.

Here is a snapshot of past five sessions in the S&P 500.

Here's a daily chart of the S&P 500. Tuesday's trading volume was again on the light side.

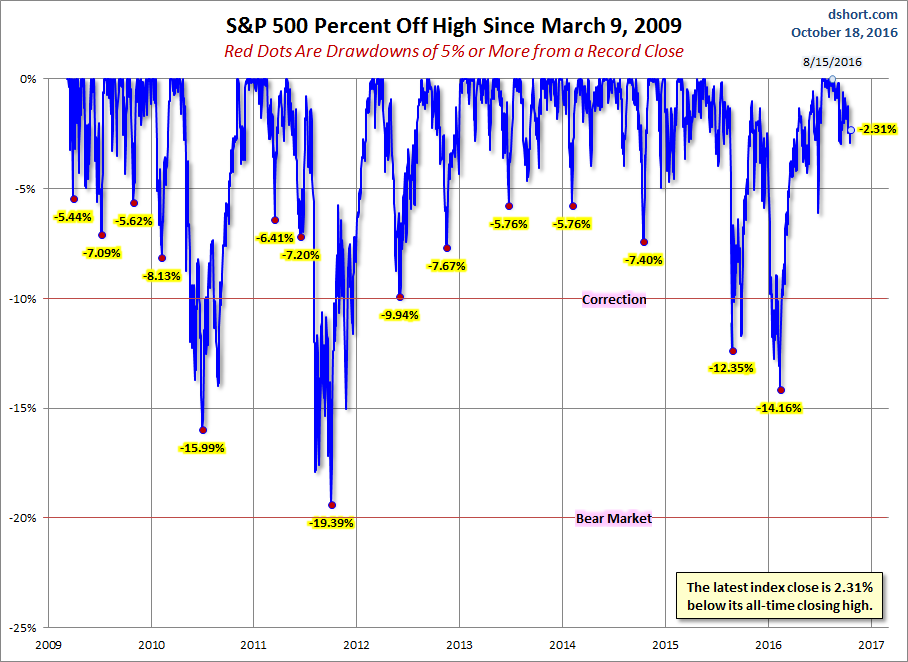

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

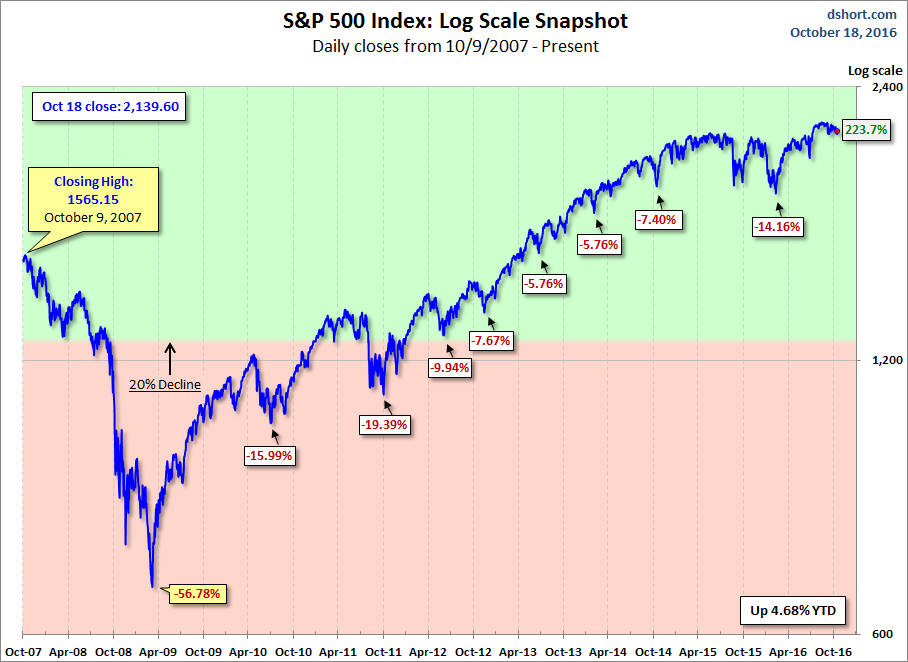

Here is a more conventional log-scale chart with drawdowns highlighted.

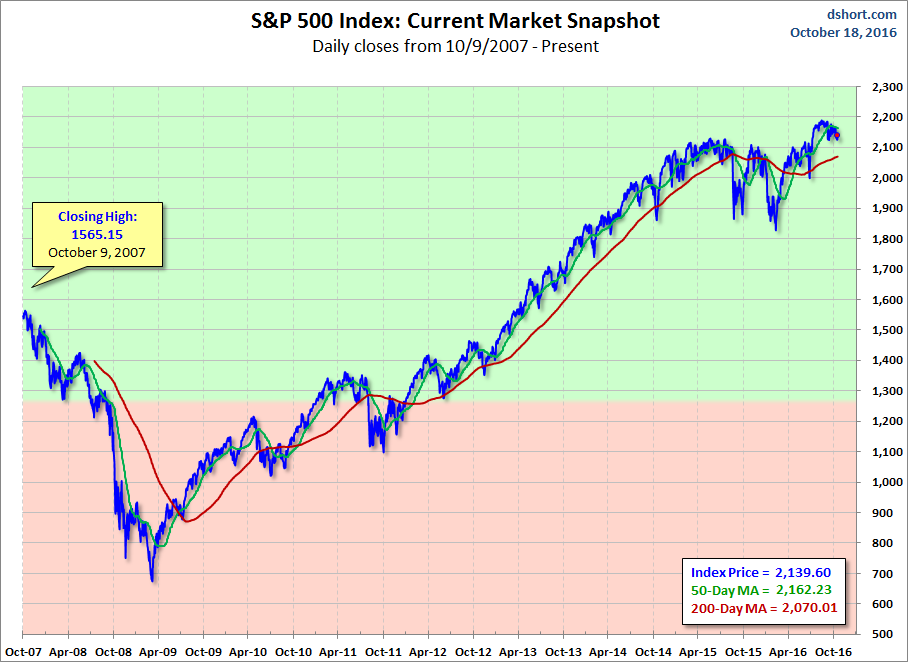

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

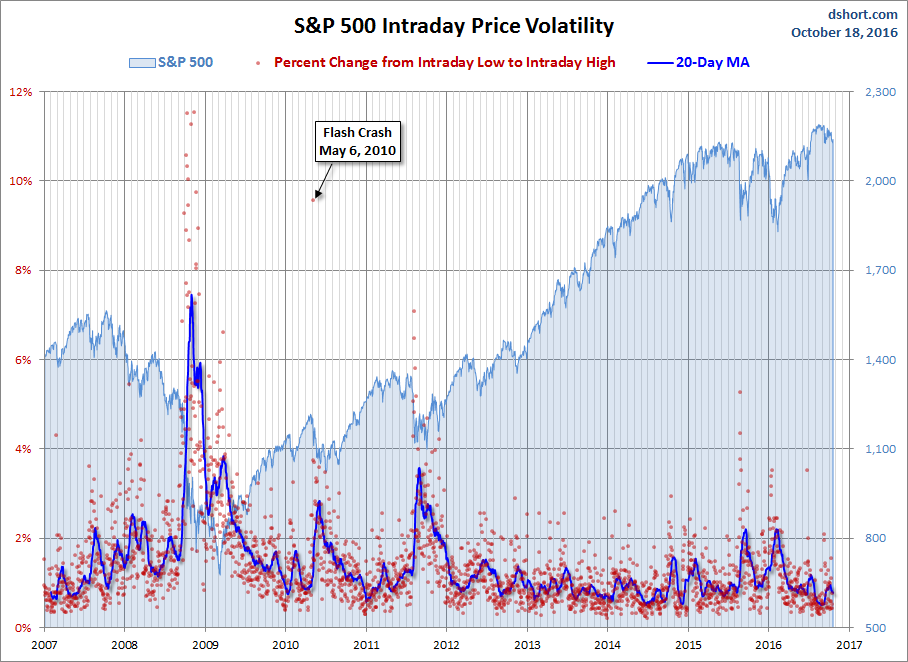

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.