Global markets were a bit erratic on the first trading day of May. The Nikkei did a -3.11% swan dive, the Shanghai and FTSE took a May Day holiday, and the Euro STOXX 50 posted a fractional 0.14% gain. The S&P 500 opened in the shallow green and traded in a narrow range through the morning. It then accelerated its upward trend to its 0.88% intraday high a few minutes before the close. Selling in the final 15 minutes trimmed the gain to 0.78%. A "Sell in May" strategy could emerge at some point this month, but it wasn't the case on Monday.

The yield on the 10-year note closed at 1.88%, up five basis points from the previous.

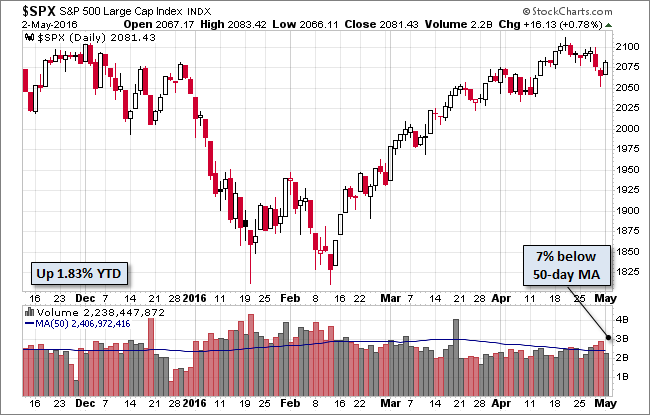

Here is a snapshot of past five sessions in the S&P 500.

Here is a daily chart of the index. Volume was unremarkable on the first day of May trading.

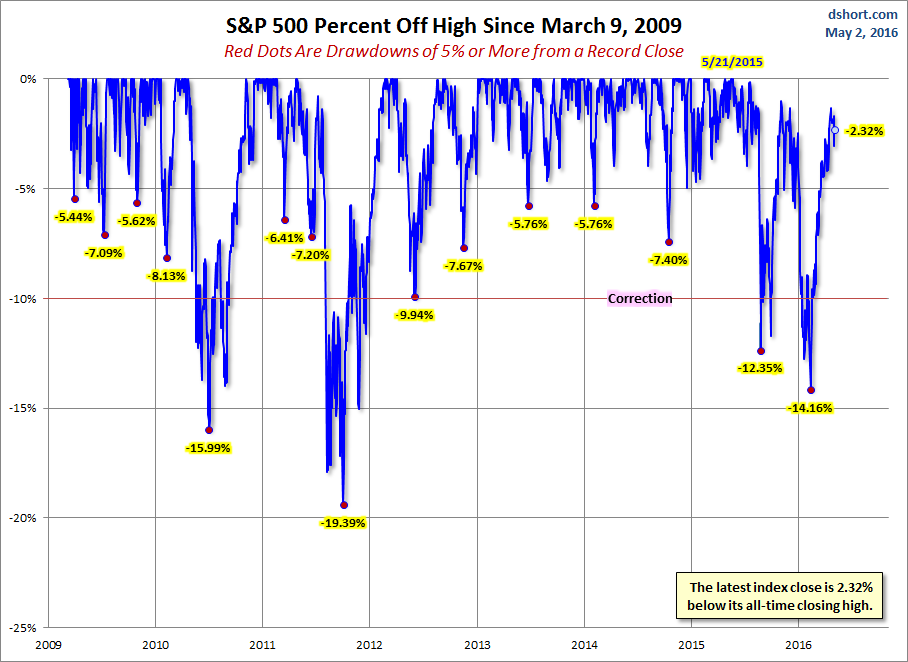

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

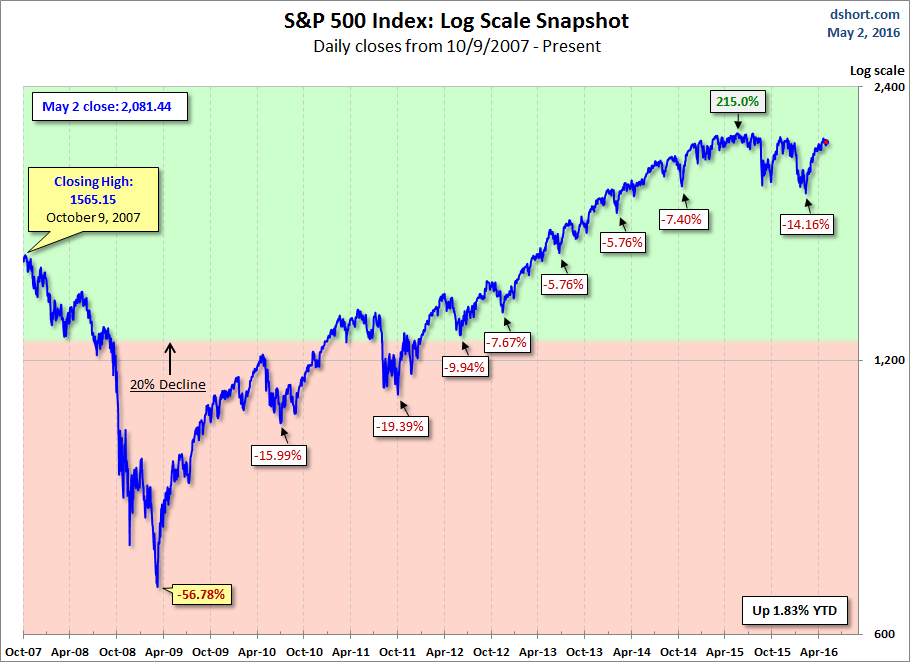

Here is a more conventional log-scale chart with drawdowns highlighted.

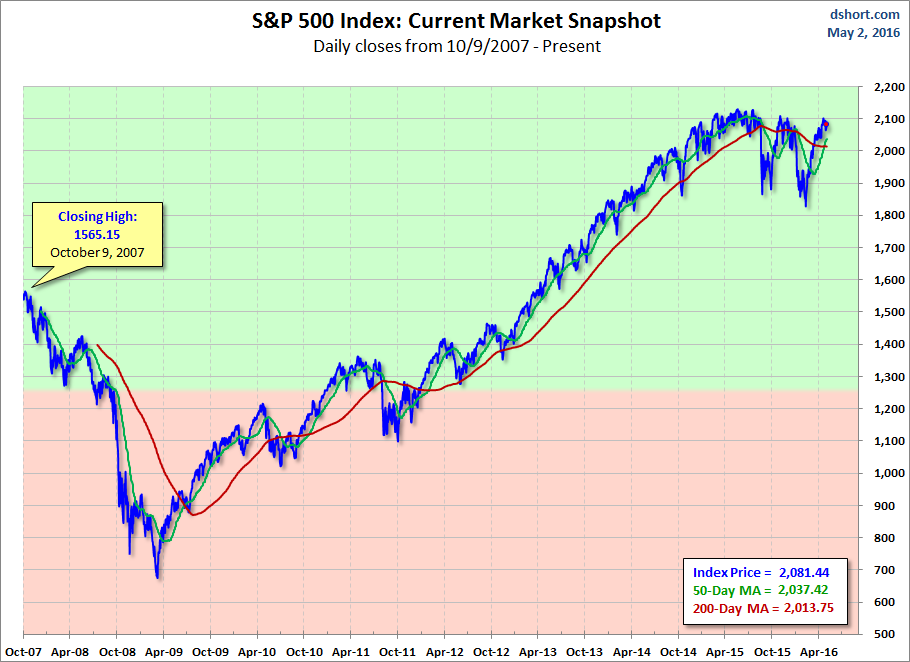

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

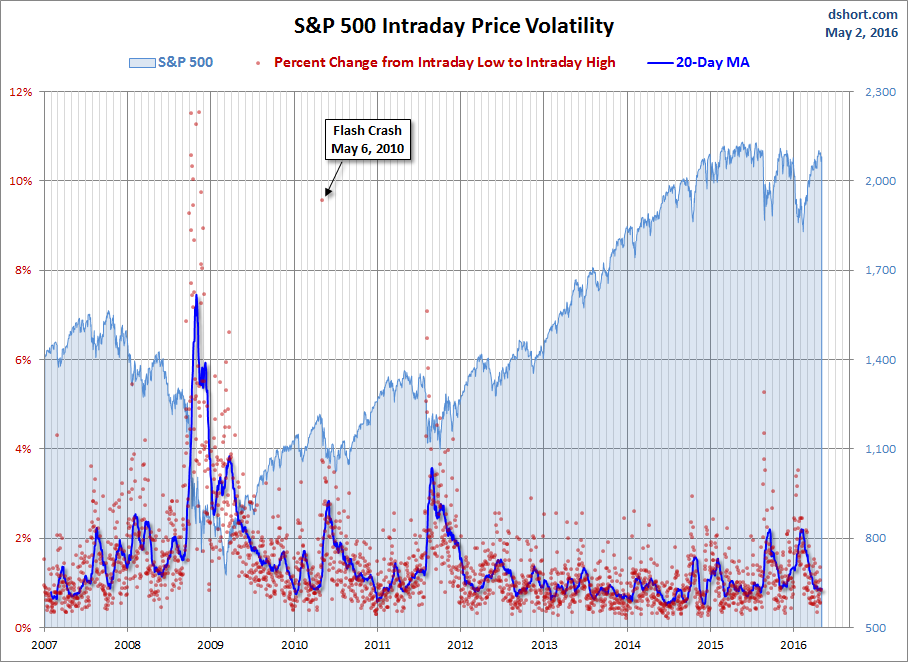

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.