Markets around the globe were cautious yesterday in advance of today's announcements from the Fed and the BOJ. Major Asian markets were fractionally lower yesterday, with the Nikkei closing at -0.16%. European markets were mixed in a narrow range. In the US, the Dow eked out a tiny 0.05% gain, the NASDAQ a larger 0.12% gain. Our preferred benchmark S&P 500 ticked up by a microscopic 0.03%.

The yield on the 10-Year note closed at 1.69%, down a single basis point from the previous session.

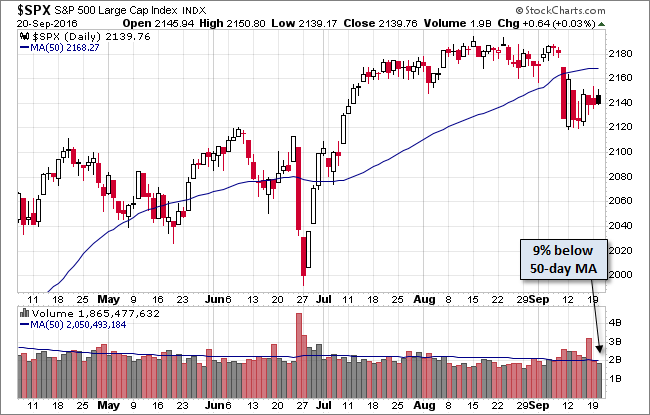

Here is a snapshot of past five sessions in the S&P 500.

Here is a daily chart of the index. Volume was predictably light in advance of the Central Bank Wednesday.

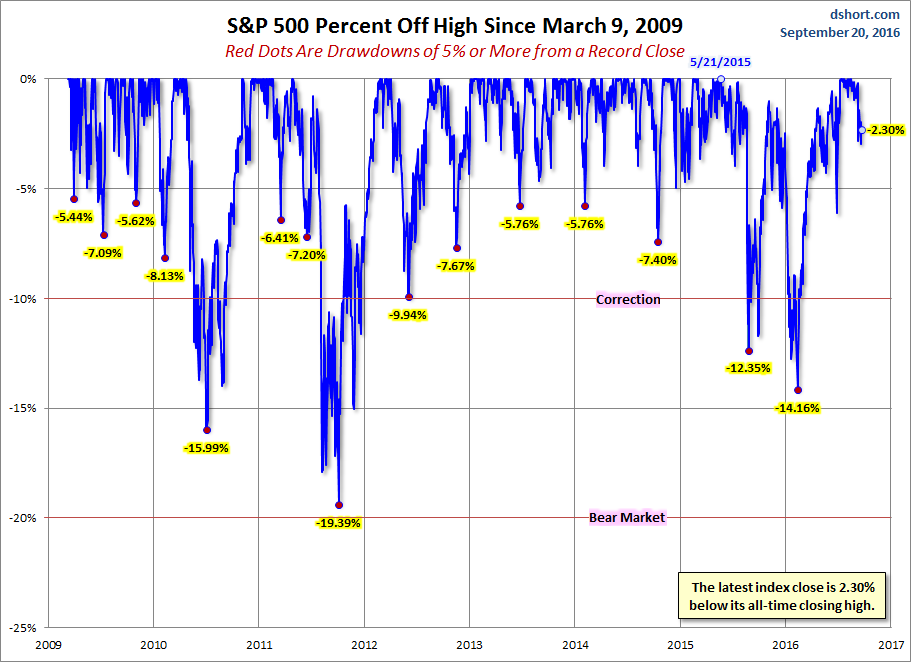

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

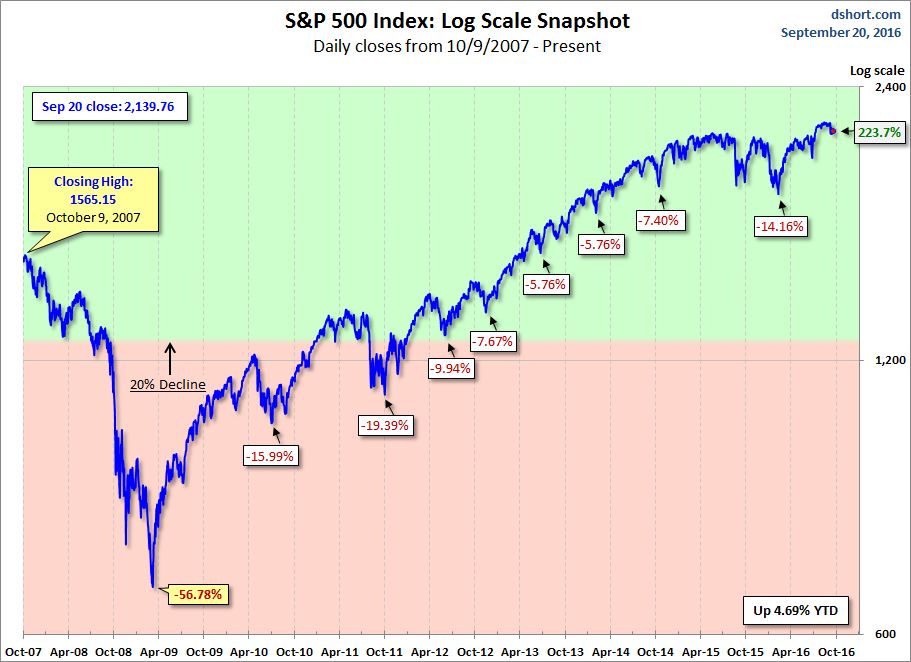

Here is a more conventional log-scale chart with drawdowns highlighted.

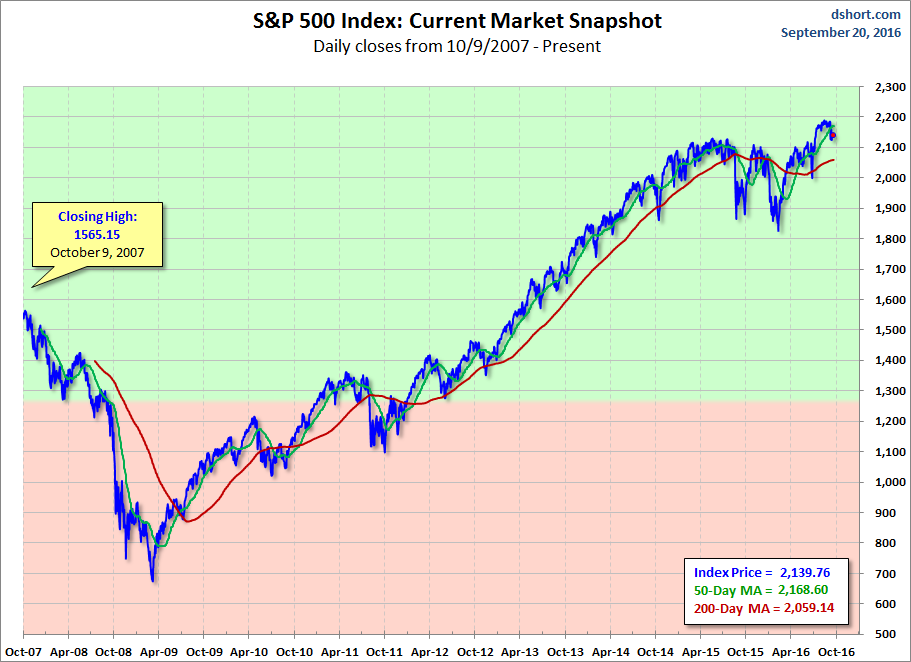

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

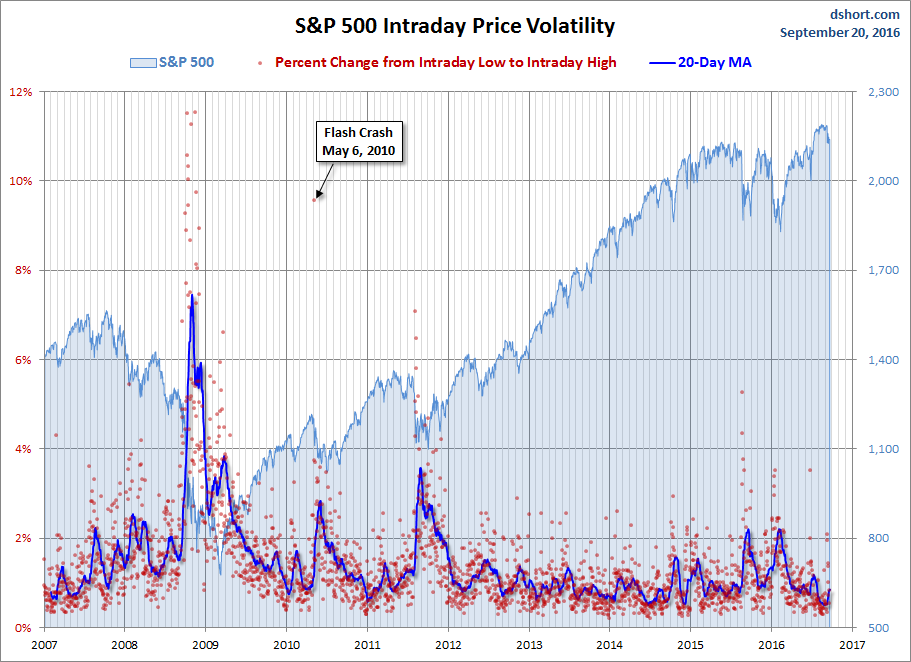

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.