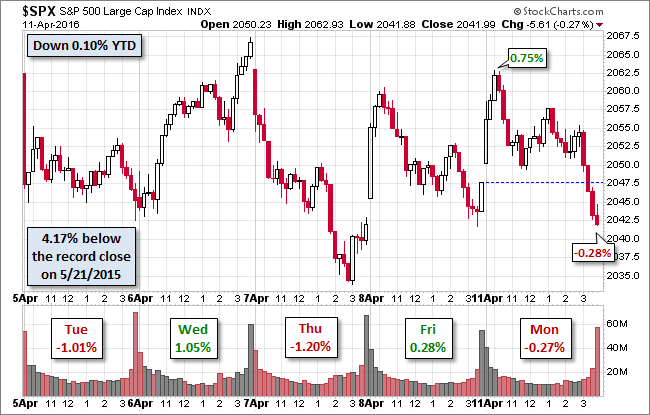

Futures were rosy before the US equity market opened. The Shanghai Composite had posted a 1.66% and most European indexes were in the green. The STOXX 50 would subsequently give back some of its mid-day advance to post a 0.42% closing gain. The S&P 500 rallied at the open and rose to its 0.75% intraday high about 40 minutes later. It then sold off in a couple of waves to its -0.28% close, which puts the index back in the red for 2016, down -10%. The mood is one of caution at the start of Q1 earnings.

The yield on the 10-year note closed at 1.73%, up one basis point from the previous close.

Here is a snapshot of past five sessions in the S&P 500.

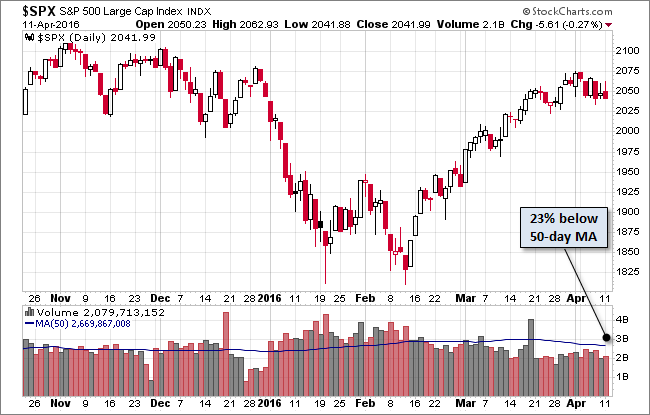

Here is a daily chart of the index. Trading volume on today's action remains light at the launch of earnings.

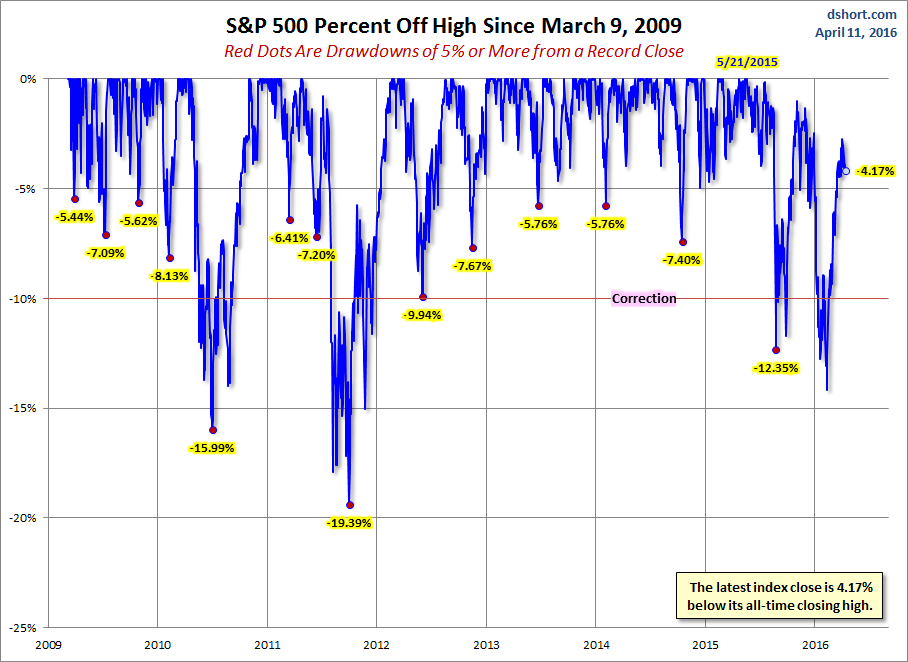

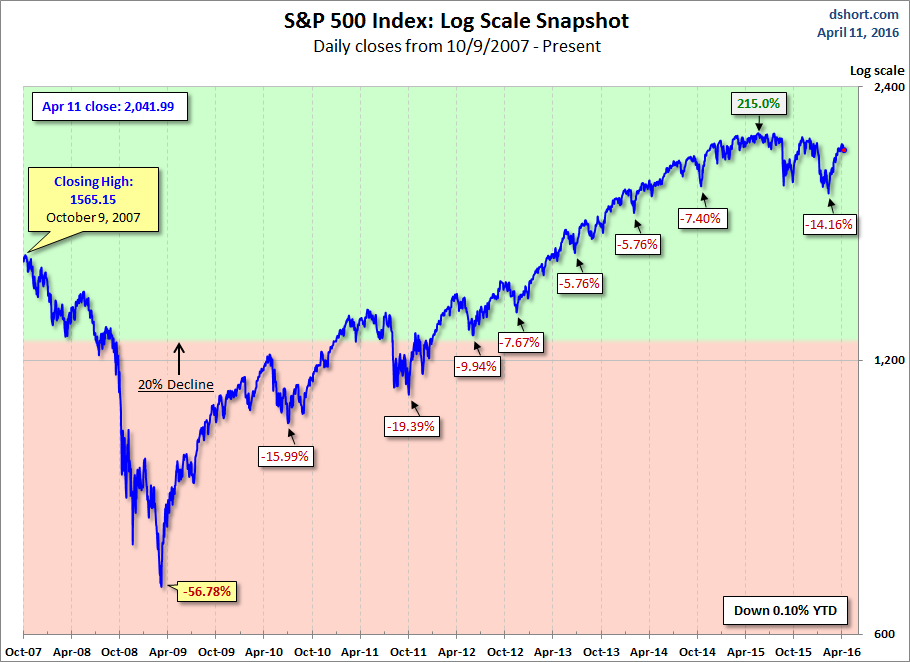

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

Here is a more conventional log-scale chart with drawdowns highlighted.

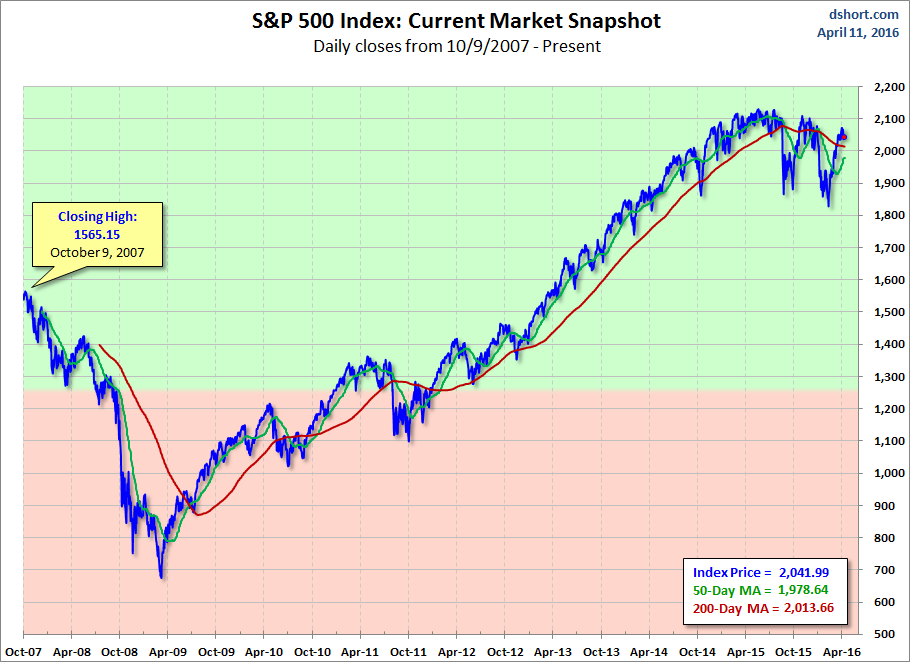

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

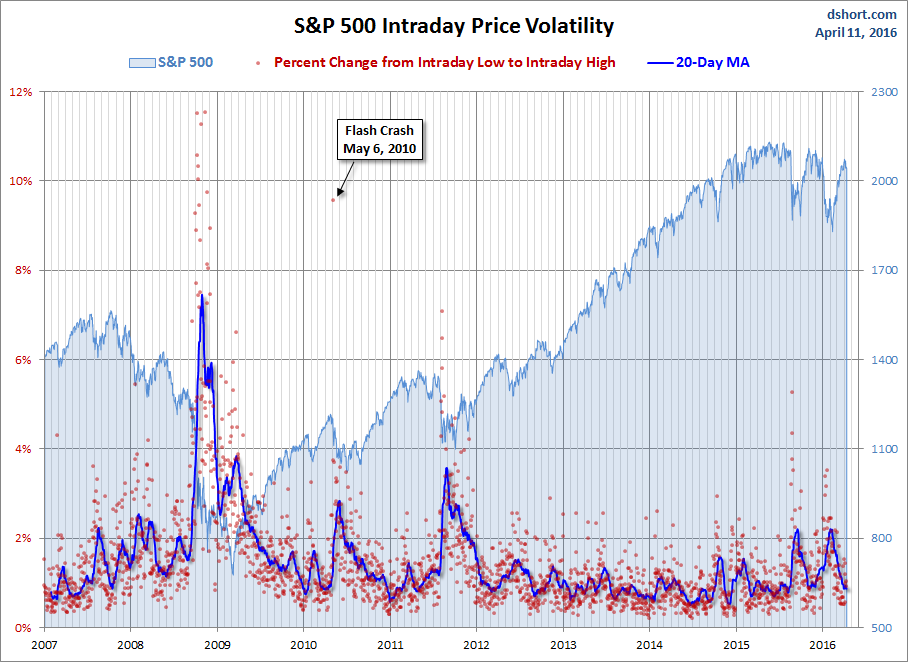

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.