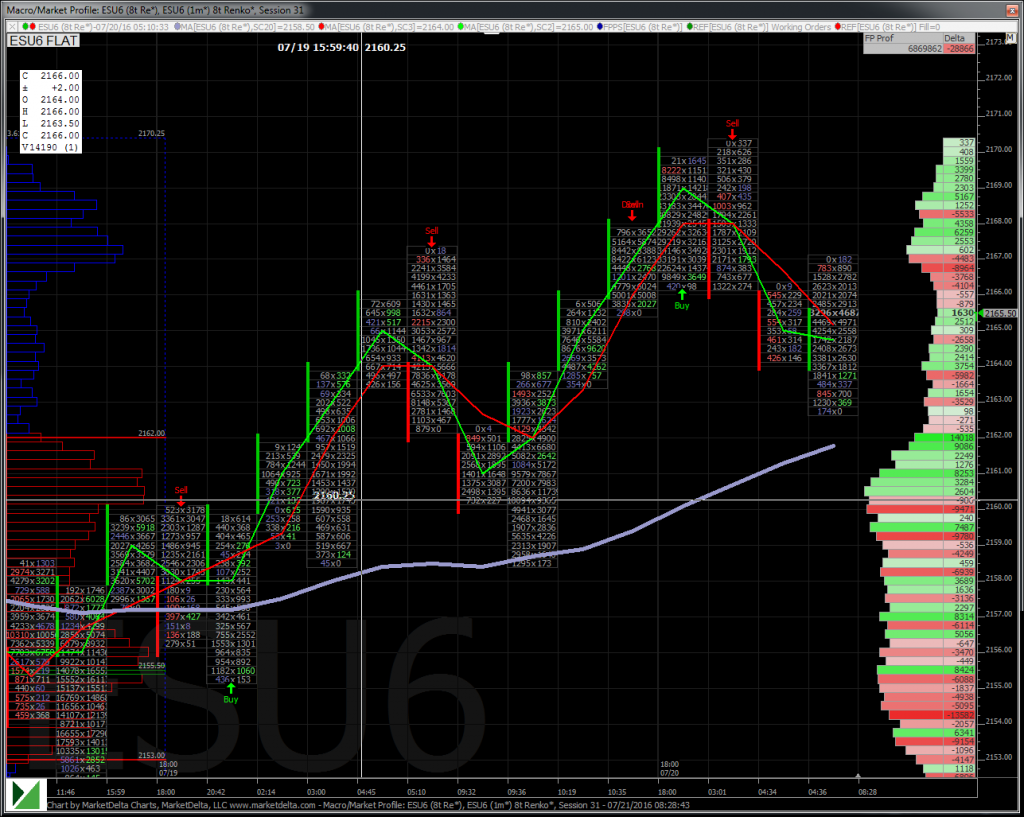

Yesterday was more of the same that has become the normal the last couple weeks. 1) A new high in globex. 2) Selling on the open. 3) An early low able to be bought. 4) The cash session unable to run sell stops higher. The benchmark index futures did make a new high at 2169.75 and then turned sideways, as the volume has been low. On top of that, the MOC’s (market on close) imbalances has been small, and the daily trading ranges have been small.

Where are the Buy Stops?

What can we say? The market has been quiet. There is not much to be said so today so this will be kept short and sweet. Right now the market is unable to run a serious amount of buy stops, but looking at sentiment reports, COT reports and open interest reports in ETF’s such as SPDR S&P 500 (NYSE:SPY), this indicates that the crowd is still short. I don’t know what it will take to run these. It’s possible that many of the short futures are banks and hedge funds who are also long the cash and are holding this hedge.

I’ll admit that I agree with what traders are telling me, that every new high looks tired and weaker, and possibly like a selling opportunity, but every time the bears drop the ball and new highs are made. For now it’s a summer market, and the best thing to do is embrace it as best as possible, because in a another month or so traders may be remarking how it went from quiet to huge volatility in what seemed overnight.

The VIX is at a strong support area, but it typically gets to the $12.00 area and doesn’t always bounce right away. It does eventually, but sometimes it takes a couple weeks. For the time being, the trend is your friend. The trend is quiet markets with early ranges.

It’s a Summer Market

Overnight, global equity markets traded mixed to higher as the ESU16 hit a new all time high of 2170.25 during the Globex session before retracing back to 2162.75. It looked like the ECB release at 6:45 am CST may give some direction, but the initial reaction has been muted thus far. Today’s calendar is the most significant of the week with Philly Fed, Existing Home Sale & more but it’s unsure how many anything will move the equity futures.

In Asia, 6 out of 11 markets closed higher (Nikkei +0.77%), and In Europe 8 out of 12 markets are trading lower this morning (DAX -0.05%). Today’s economic calendar includes Weekly Bill Settlement, 52-Week Bill Settlement, Jobless Claims, Philadelphia Fed Business Outlook Survey, Chicago Fed National Activity Index, FHFA House Price Index, Bloomberg Consumer Comfort Index, Existing Home Sales, Leading Indicators, EIA Natural Gas Report, a 3-Month Bill Announcement, a 6-Month Bill Announcement, a 2-Yr Note Announcement, a 2-Yr FRN Note Announcement, a 5-Yr Note Announcement, a 7-Yr Note Announcement, 10-Yr TIPS Auction, Fed Balance Sheet and Money Supply.

How High is High

Our View: How high is high seems to be the right question! Is the S&P going straight to 2200.00? Or 2250.00? In all my years of being part of the markets, and all the big ups and downs, the latest rally defies all logic. An almost 200 handle rally in the S&P in less than 4 weeks?

Brexit was not, and never was, going to be the big ‘turning point’ all the big talking heads were saying it was going to be. In fact it was a 1.5 day wonder that pushed the big funds and investment firms to hedge and lower the size of their positions. For the little guy it was another great example of not listening to all the noise.

In the end the S&P was going up anyways and all the extra hedging and position cutting did was help force the S&P higher when everyone covered. One of the things I continually talk about is how zero borrowing cost and the central banks trump all the bad news and it does. Our view? I made my bed, I said the next 40 handles was down, and I still feel that way. I bought some September S&P puts, and if i want, I can still play the ES from the long side. That said we lean to selling the rallies and buying weakness with the idea the ES is getting close to a high / pull back.