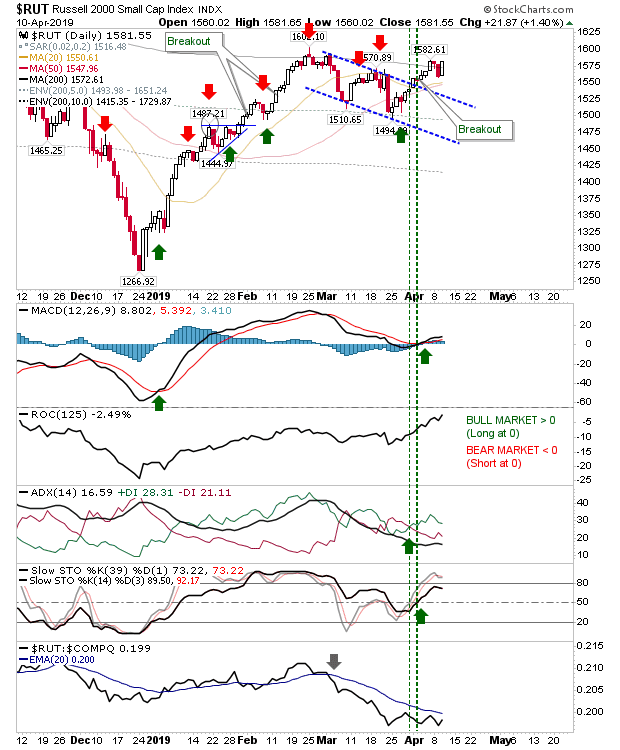

Another day of low key gains yesterday, with the Russell 2000 doing most of the leg work. The Russell 2000 returned above its 200-day MA after rebounding off the moving average on Tuesday. The Russell 2000 is still underperforming against the NASDAQ, but it's working towards fresh leadership.

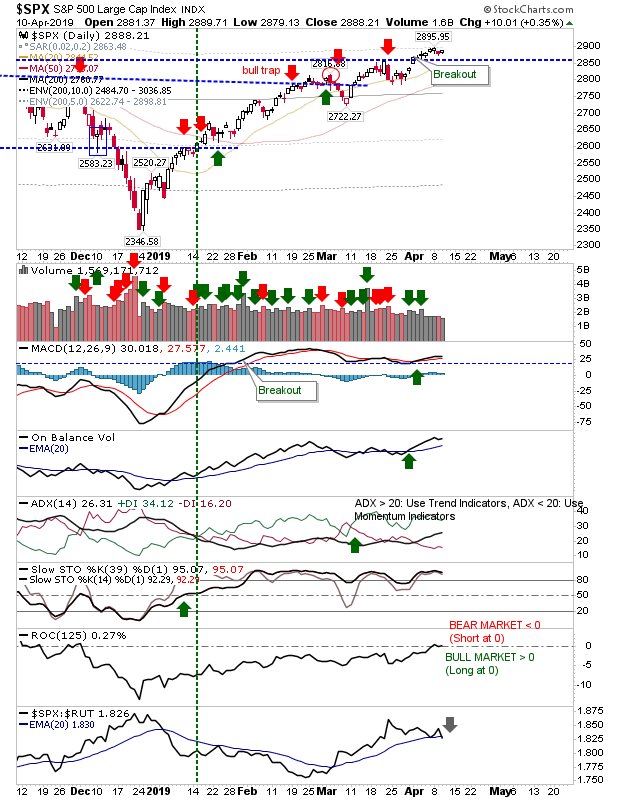

One index which the Russell 2000 is outperforming is the S&P. The index gained less than 0.5% but this translated as a 'sell' trigger in relative performance—which would be considered bullish for the broader market (if bearish for the S&P) as money rotates into more speculative, Small Caps issues.

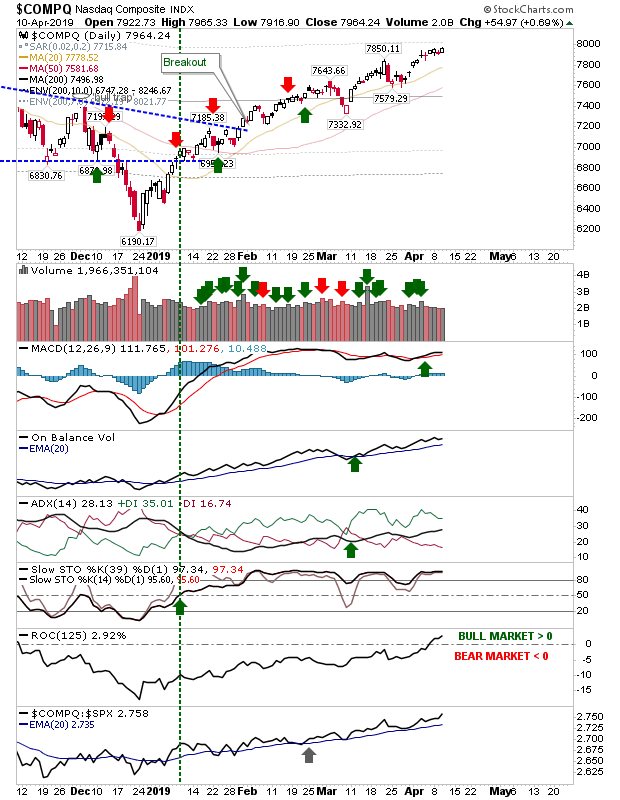

The NASDAQ maintained its relative performance advantage over the S&P, caught a little between action of Large and Small Caps for attention.

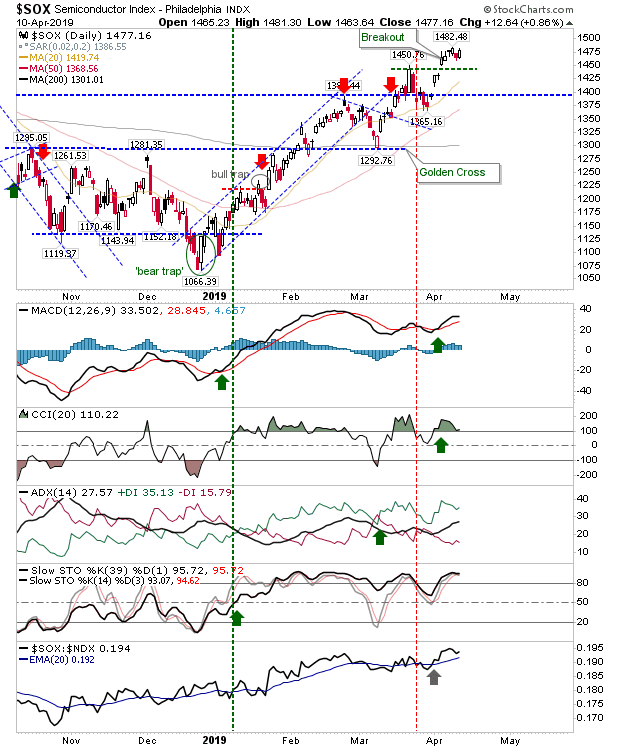

While the NASDAQ may be flying below the radar as the Semiconductor Index is doing a good job in driving a Tech rally.

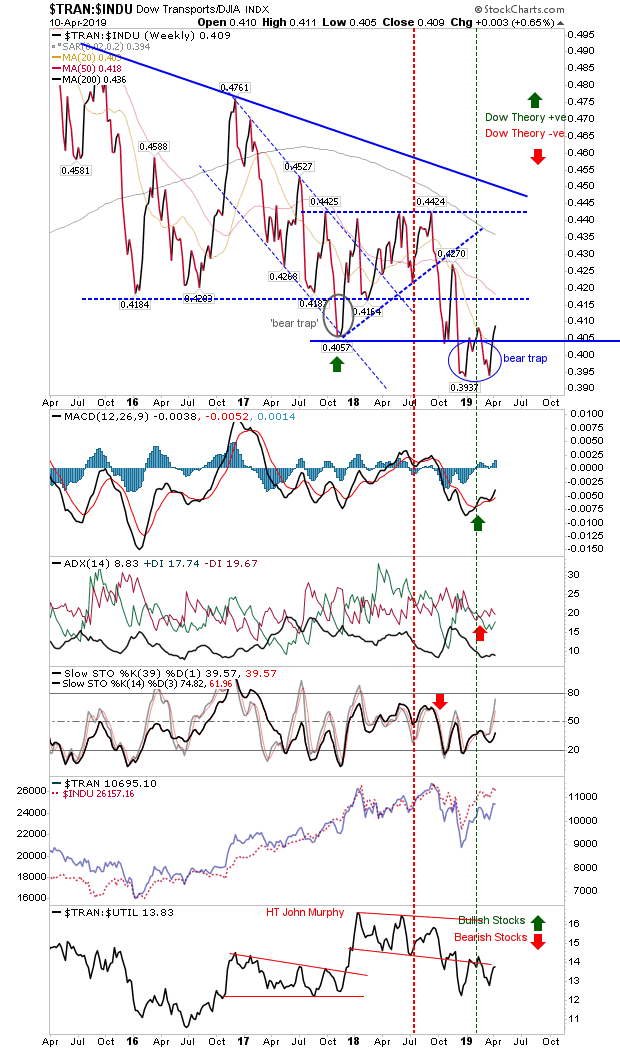

In the relationship between the Dow Transports and Dow Index there is a potential bear trap which offers another tick in the bull column.

For today, I will be looking for further gains in the Russell 2000 to help drive the broader rally. It's increasingly looking like the December 2018 swing low will be as significant as the one back in 2016.