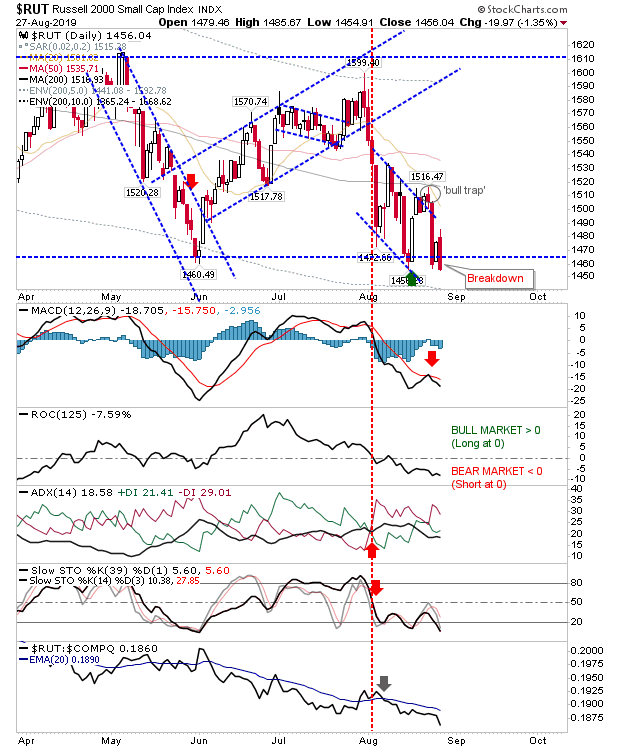

It was a second rough day for indices yesterday, with the Russell 2000 taking the brunt of the selling. More troubling, what should have been a good bounce off support was swept away by the bearish engulfing pattern—made all the worse by the recent strong bounce, which has now failed.

Technicals are again net bearish for the index. It will again be time to look at the relationship against the 200-day MA to give us an indication as to when the indices reach historic extremes; the first such test for the Russell 2000 will be when it gets to 1,441.

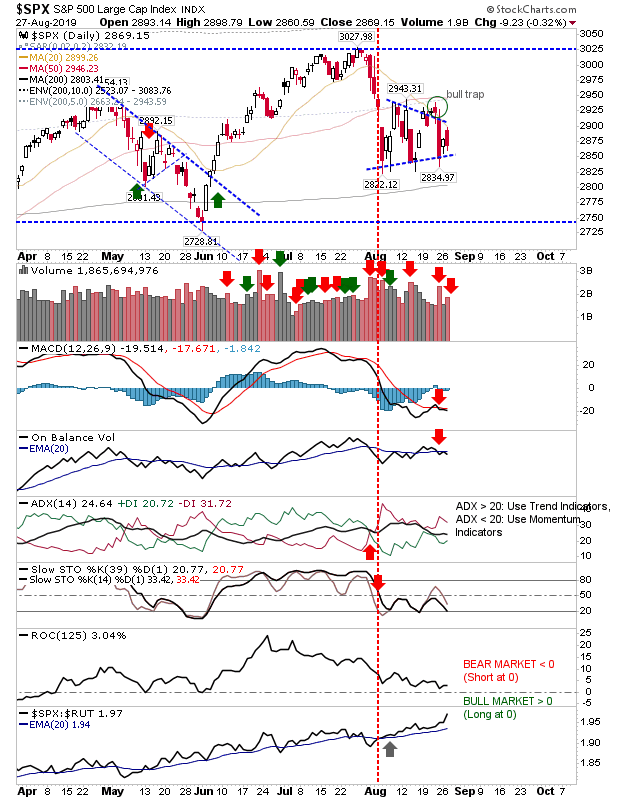

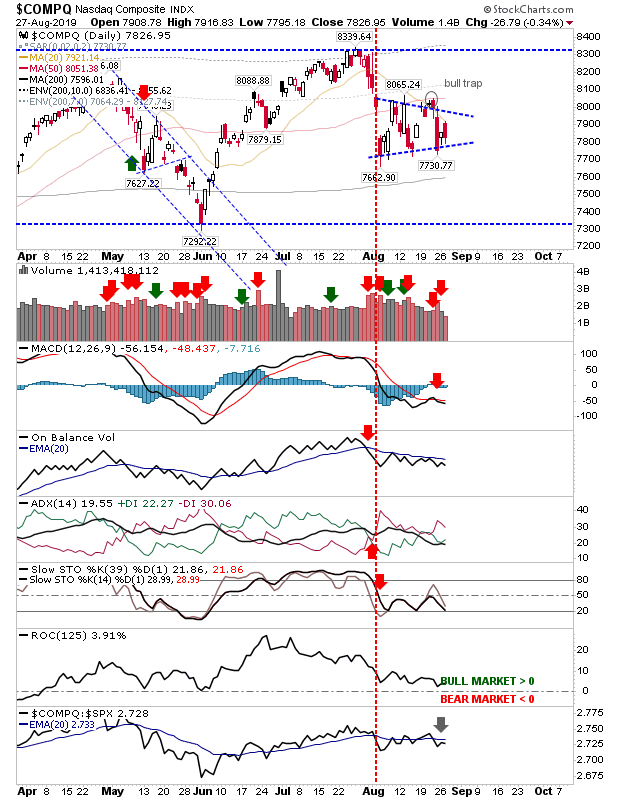

While it was an ugly day for the Russell 2000, other indices still managed to remain inside their mini-consolidations (nested within a larger consolidation). Though all eyes should be on what happens in the Russell 2000, as it will determine which way the S&P and NASDAQ will go, it's still a tricky trade to call for latter indices as the potential for whipsaw remains very high.

For the S&P, yesterday's selling was accompanied by higher volume distribution. And there was the benefit of another relative performance uptick (only because yesterday's loss was not as great as what impacted the Russell 2000).

The NASDAQ closed with a 'bearish cloud cove' pattern, which is not as bearish as the engulfing pattern, and trading volume was lighter—so there was no real damage done to this index. Technicals are still net bearish but it escaped yesterday relatively unscathed.

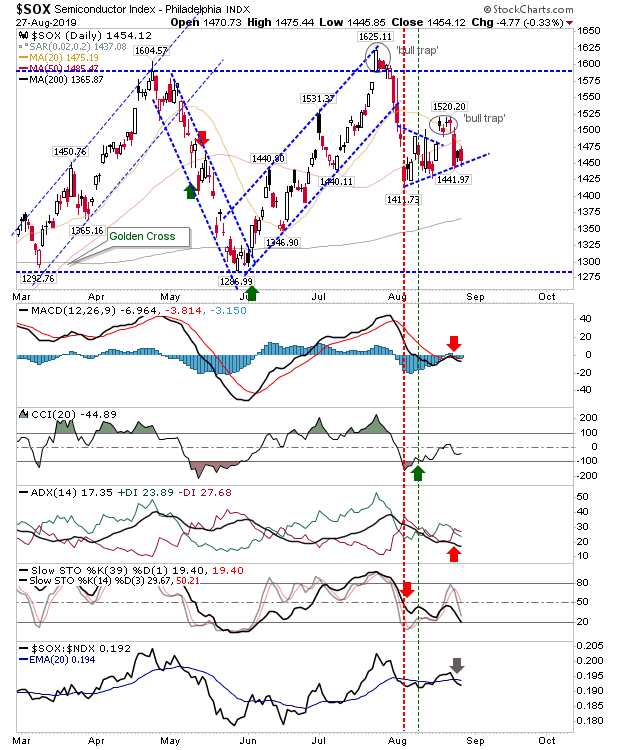

The Semiconductor Index finished on (former) pennant support, but the sequence of three bearish candlesticks in a row suggests this support will fail. Technicals are not as bearish as for the NASDAQ, but they are not exactly great either.

For today, look to the Russell 2000 to lead other indices, with the NASDAQ and S&P likely to head lower in a 'catch-up' move to the Russell 2000, particularly if the latter accelerates downward.