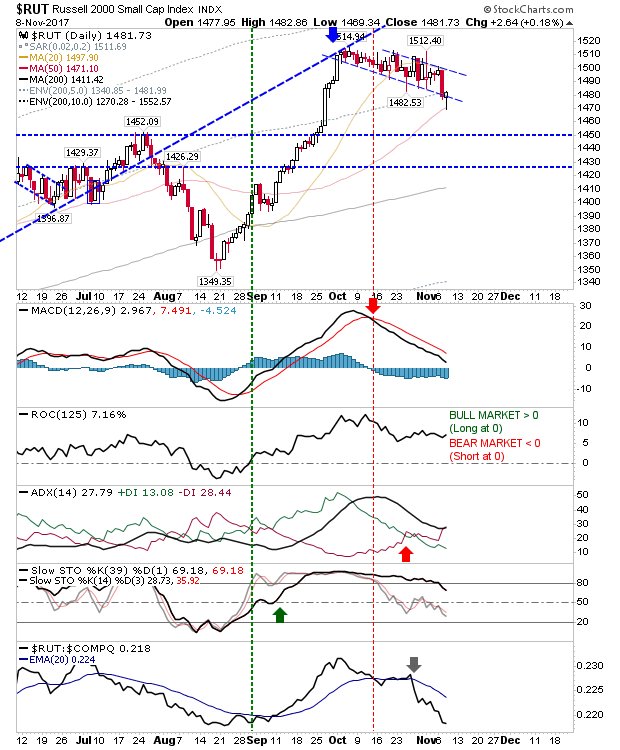

There were gains for all market but the Russell 2000 was able to dig in and come back after an early loss of 'bull flag' support. The Russell 2000 was able to rally back after testing its 50-day MA; those traders waiting for this will have benefitted from a handy risk:reward.

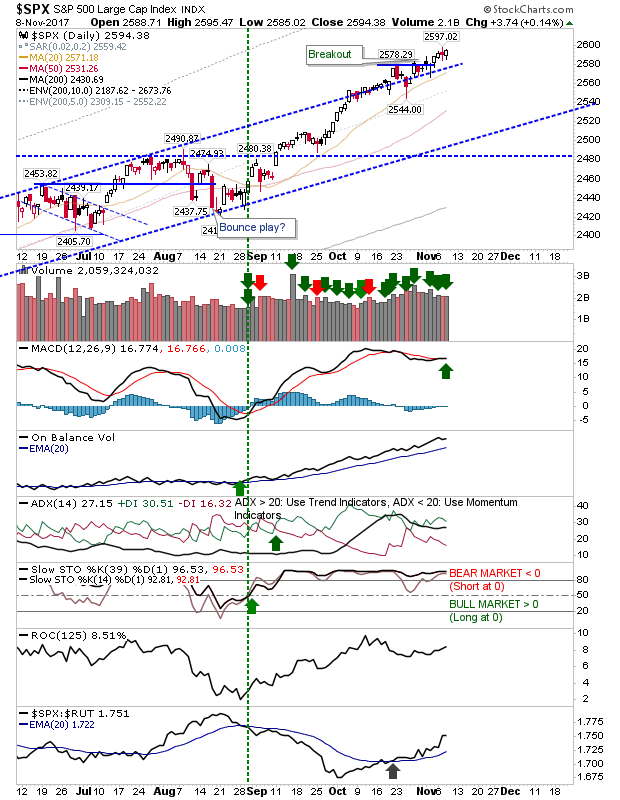

The S&P 500 generated a fresh MACD trigger 'buy' on higher volume accumulation. Technicals returned to net bullish technicals with accelerating relative performance.

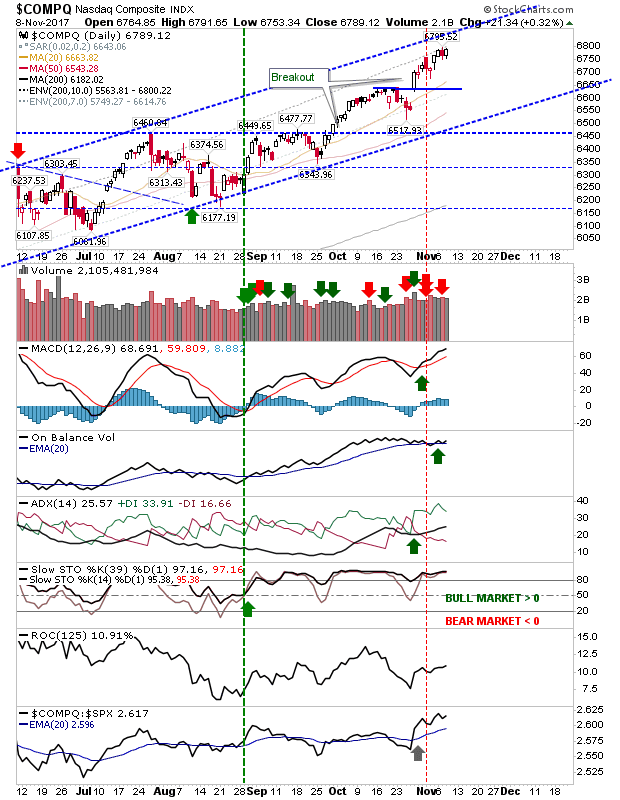

The Nasdaq undid yesterday's losses and return it on course to test channel resistance. Relative performance is also good.

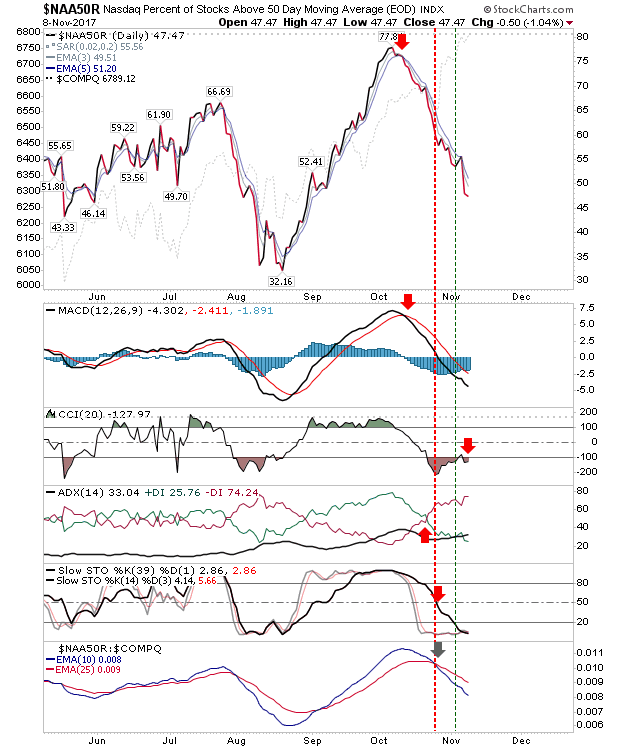

However, the Percentage of Nasdaq Stocks above the 50-day MA accelerated lower; the early 'buy' signal in the CCI reversed down with other technicals bearish. This bearish divergence with respect o the Nasdaq has been playing out for the last few weeks - there can be only one winner and bears look more likely to take it.

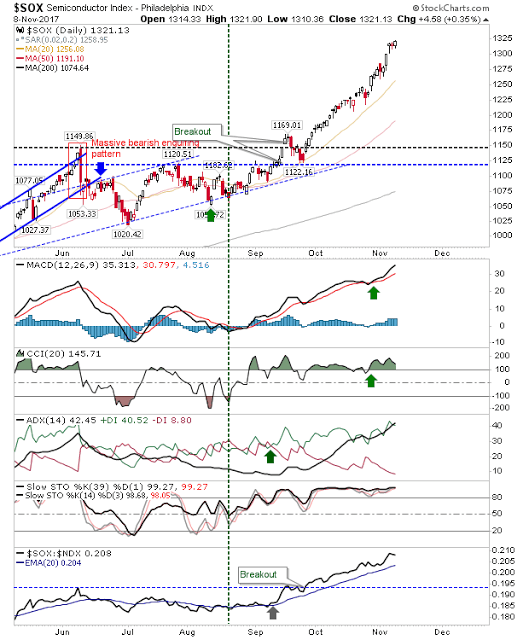

Meanwhile, the most bullish Philadelphia Semiconductor Index Index managed a new closing high. It would appear traders are unwilling to sell as they wait for ever higher profits.

For tomorrow, look to the Nasdaq to continue its quest to tag upper channel resistance. Value buyers can look to the Russell 2000 to build on its bullish 'hammer'. The Semiconductor Index will soon reward shorts but it may yet be too early for this.