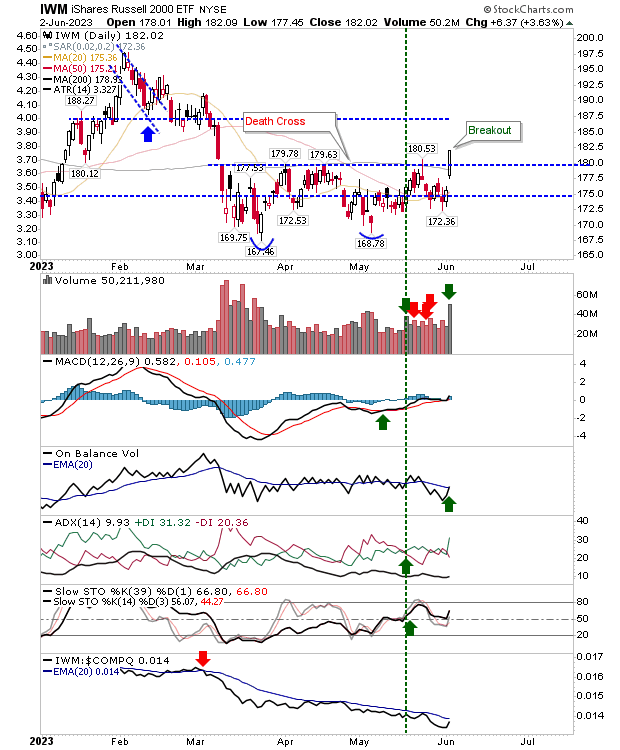

It was a good day for markets, but it was the Russell 2000 (IWM) that went on a bender, pushing itself out of its scrappy, multi-week base and slicing through its 200-day MA. Not only that, it managed to clear $180 resistance, which means it's now in the process of shaping a right-hand-side base.

This is an important development as other indexes challenge resistance on weekly timeframes. There is room for the Russell 2000 to test support, and an intraday spike below $180 would be acceptable as long as the index ends the day above $180.

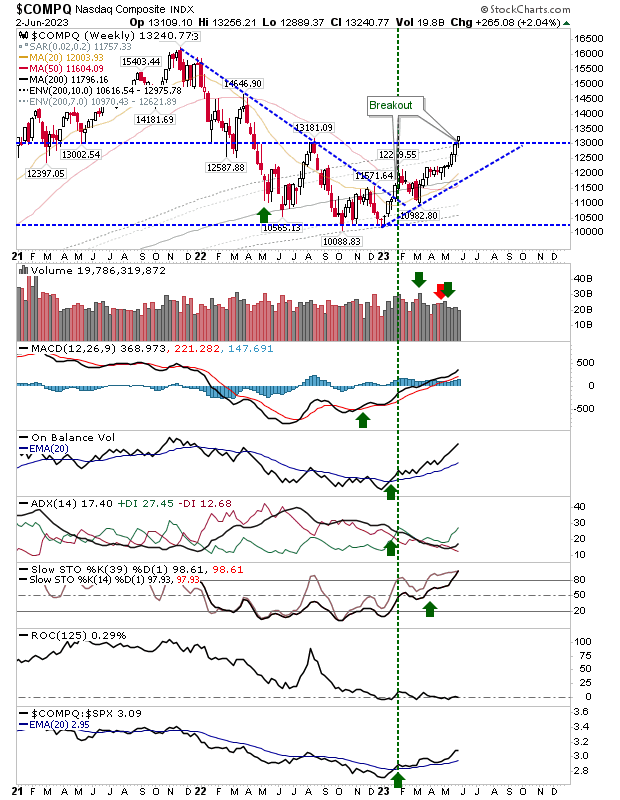

With the Russell 2000 making solid gains, we can see key developments in the S&P 500 and Nasdaq. The Nasdaq has managed to clock an end-of-week close above 13,000 resistance, marking it as a breakout, which incidentally was the swing high of last summer. Next up is 14,500 - although it could take until the end of the year before it gets there.

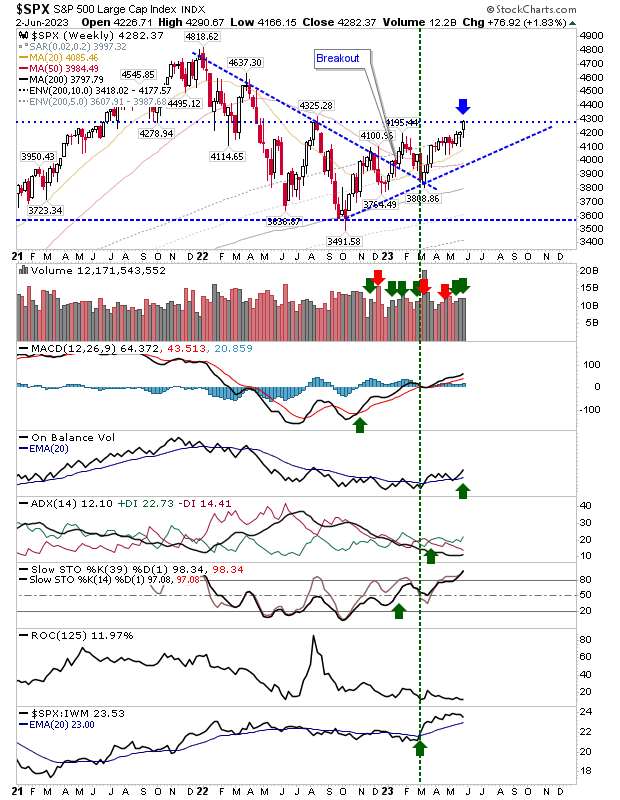

The S&P 500 also challenged last summer's high as it closed the week on resistance. If there is a chance for bears, it will be a reversal based on an end-of-week close below 4,300, but with technicals net positive, the probability of a resistance reversal is low.

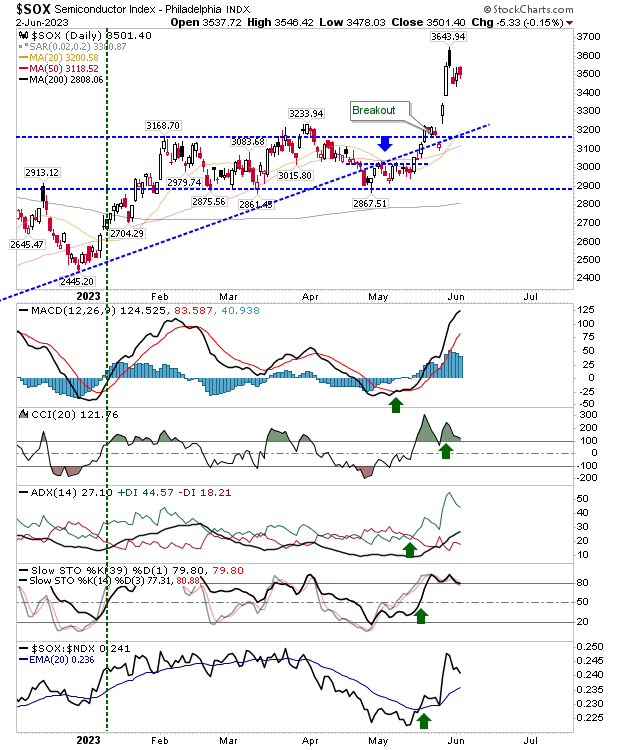

The breakout in the Semiconductor Index is consolidating after the initial 15% gain. Assuming it can hold the breakout, it will continue to feed the key weekly breakout in the Nasdaq.

This week's finish will be key, particularly for the S&P 500. With the positive move in the Russell 2000, there isn't a bearish index in the near term, and I suspect this will evolve into a more bullish stance on longer time frames across all indexes.