Investing.com’s stocks of the week

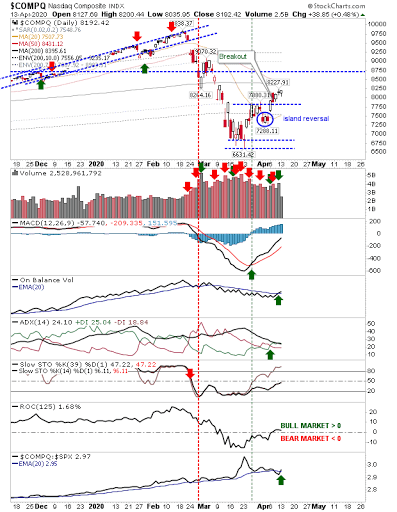

Some low key selling yesterday, from indices other than the NASDAQ, but not enough damage to reverse the breakouts. Bulls still doing enough to keep the bounce intact. Starting with the positive, the NASDAQ finished a little higher with a bullish hammer and a relative out-performance advantage against the S&P; although the 'bullish hammer' is not a true hammer because momentum is not oversold.

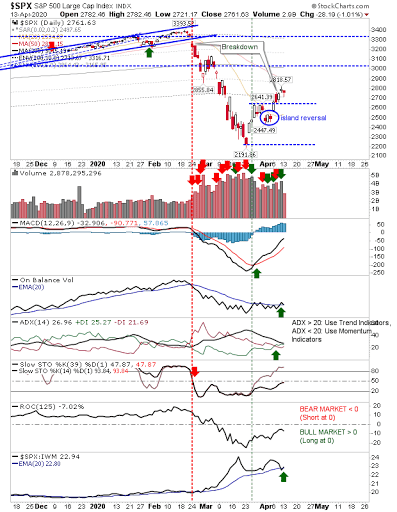

The S&P also finished with a bullish 'hammer,' but not enough to close higher—although the day felt bullish. There was a bounce off relative performance, which keeps things positive, but it has lost a lot of ground since.

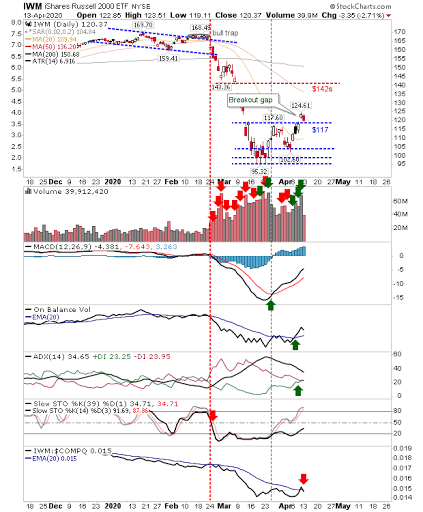

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) lost nearly 3%, finishing on breakout support and losing relative ground against the NASDAQ.

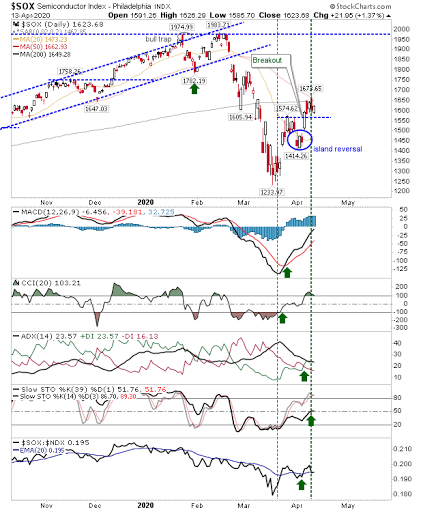

The Semiconductor Index is building a 'bullish flag' just shy of the 'death cross' between the 50-day and 200-day MA.

Tuesday will be about defending breakout support and pushing through overhead 200-day moving average resistance.