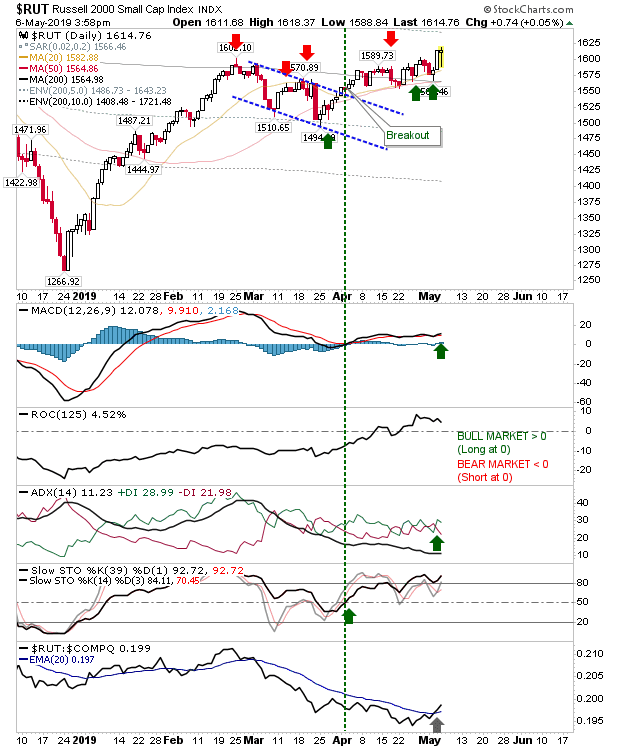

Yesterday's morning gap down on Chinese trade war fears was painted over by some decent buying action over the course of the day. Best of the action was reserved for the Russell 2000, which is now starting to outperform the S&P and NASDAQ; this is good news for bulls for all indices. Technicals are in good shape but I would like to see the MACD expand upwards.

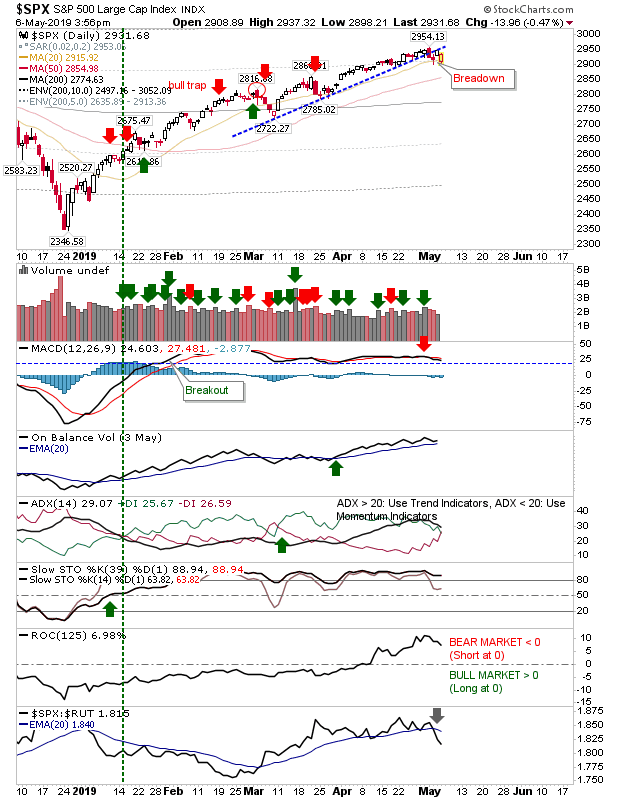

While the S&P gapped down from its trend last week, it did do well yesterday, closing near its high of the day. Like the Russell 2000, its MACD has flatlined, but unlike the Russell 2000, its MACD has ticked lower to a 'sell' trigger.

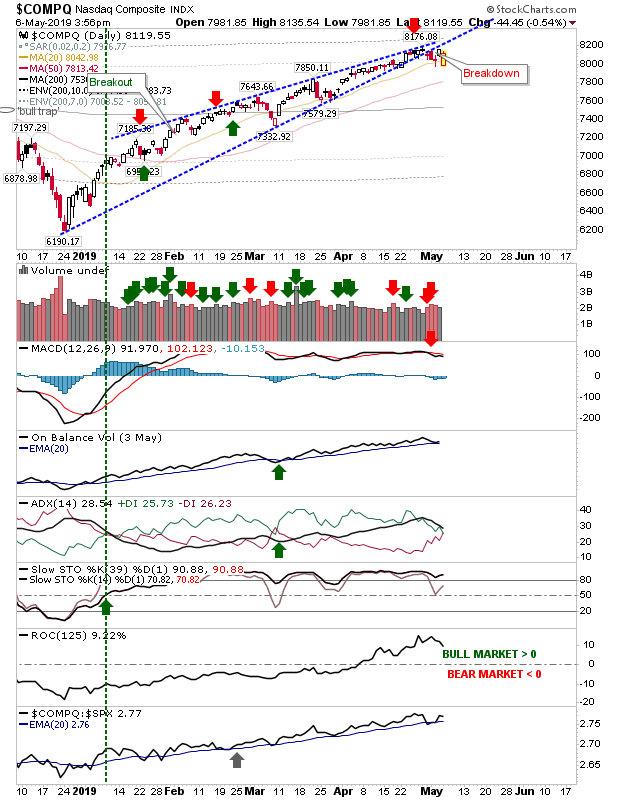

The NASDAQ, like the S&P, had last week breached support—in this case from a bearish wedge—but yesterday did not see an acceleration of the losses, which would have been typical in such a scenario. The likelihood of a new sideways consolidation coming out of this looks high, with either the 50-day or 200-day MA perhaps defining the lower part of this range. Healthy action for bulls no matter how you slice it.

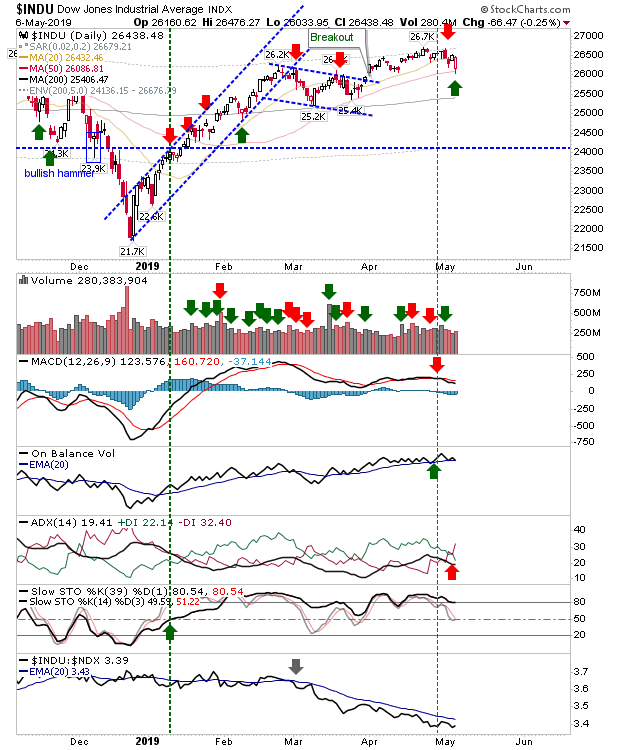

The Dow Jones Index actually managed a bullish defense of its 50-day MA; enough to suggest we may have seen a new 'buying' opportunity.

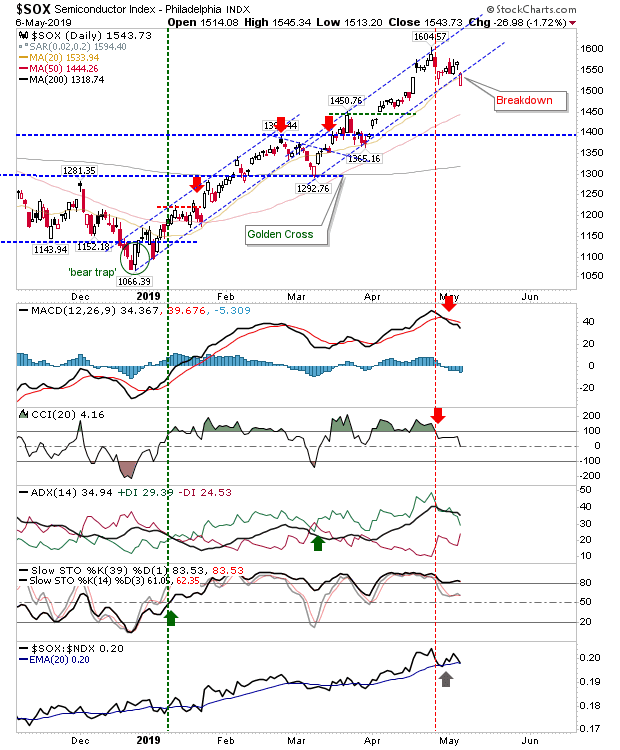

The only possible negative was the breakdown of the rising channel in the Semiconductor Index. This index has performed strongly throughout 2019, so this may just be a slowing of the upward trend.

For today, keep interest focused on the Russell 2000; it has the best set-up of all the indices. Other indices are looking more like evolving into sideways patterns, but if the Russell 2000 is able to kick on, it will bring the other indices with it.