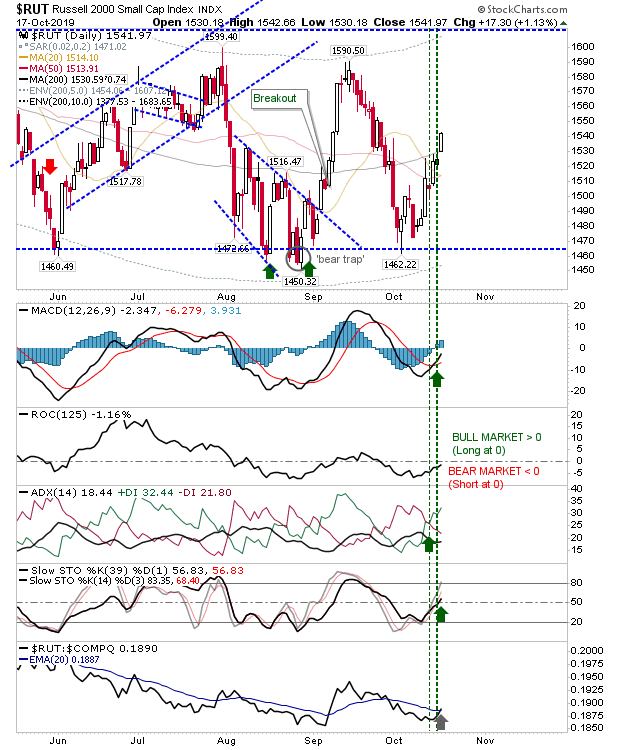

The Russell 2000 pushed above its 200-day MA as other indices had a quiet day. Although all indices remain stuck inside their multi-year trading ranges, the Semiconductor Index is again trying to break clear.

With the gain in the Russell 2000 technicals moved into a net bullish technical stance. It's still a long way from challenging trading range resistance but it has at least squeezed shorts who were perhaps banking on a support breakout in early October.

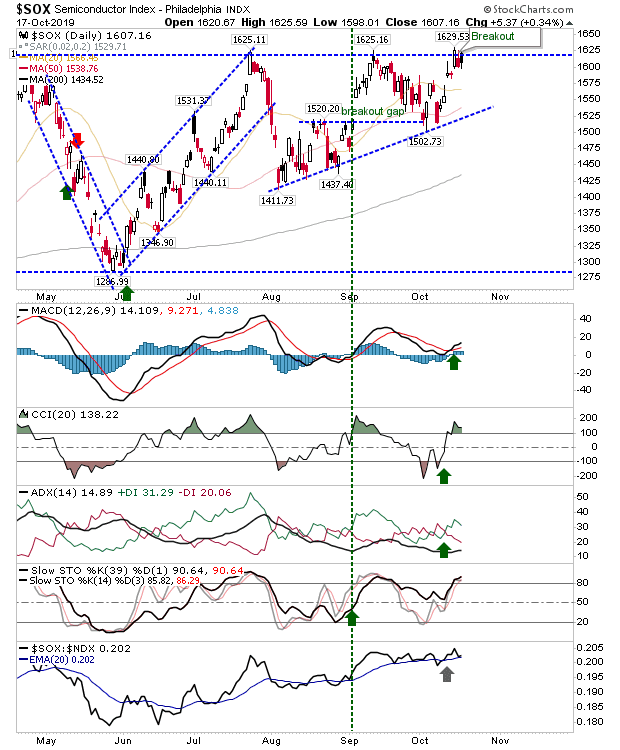

The Semiconductor Index continues to toy with a breakout. The potential 'bull trap' looks to have failed after one day - another good sign that it's only a matter of time before the breakout is confirmed. Technicals are net bullish and relative performance, while scrappy, has moved steadily higher. This will help the Nasdaq and Nasdaq 100 in their attempt to breakout.

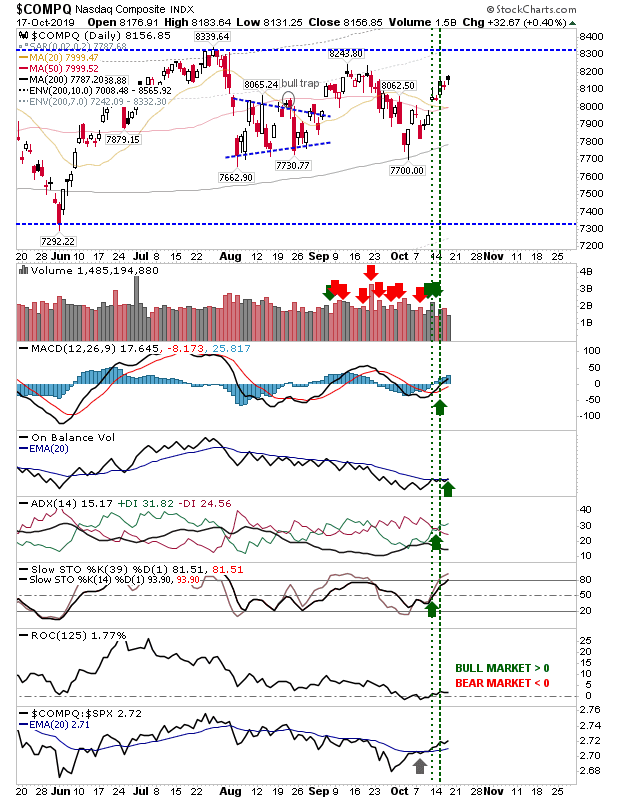

While the Nasdaq and Nasdaq 100 will benefit from strength in the Semiconductor Index, there wasn't much going on in these indices today.

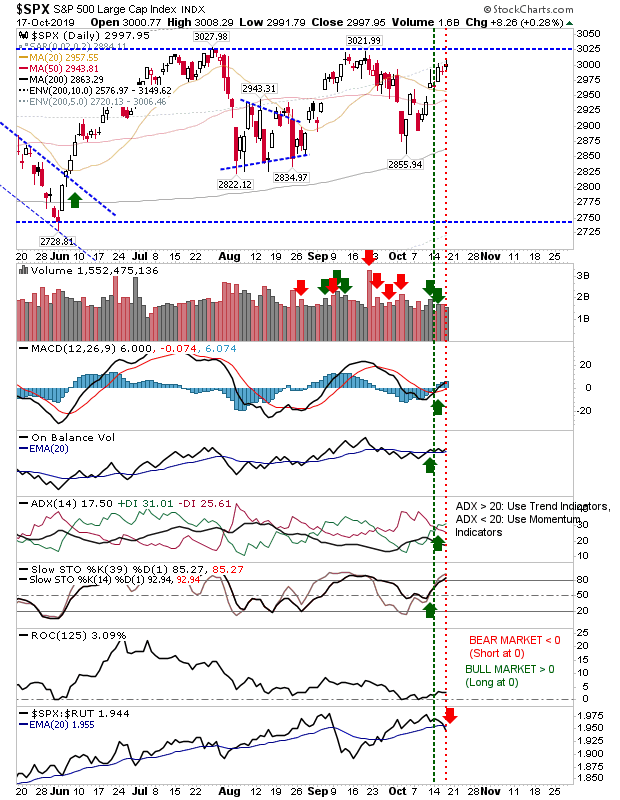

The S&P didn't do a whole lot either.

While the Russell 2000 is doing its best to garner some headlines it's a long way from making any real noise. The Semiconductor Index is the only game in town at the moment.