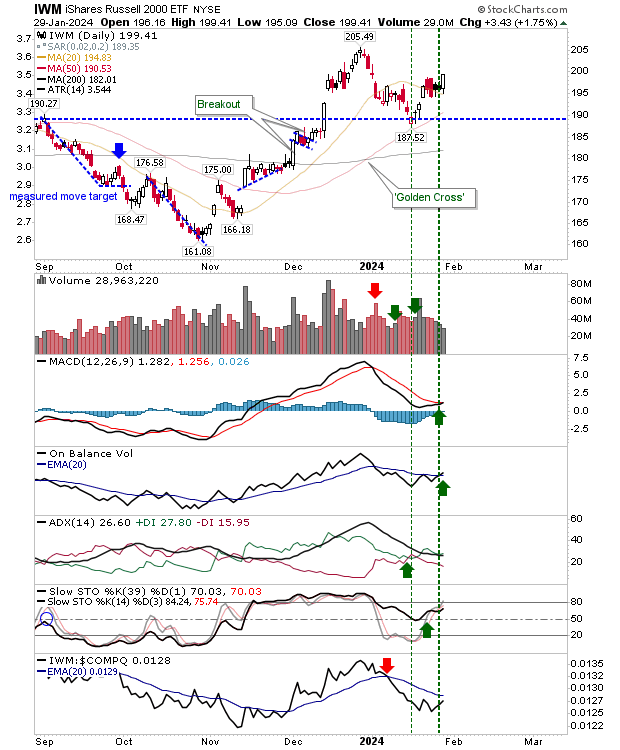

Yesterday offered a 'clean' trade for the indexes. After a series of inside range-days in the Russell 2000 (IWM) there was a white bullish candlestick to offer a solid direction for the index.

Buying volume was down on Friday, but there was a new MACD trigger 'buy' in the MACD and On-Balance-Volume, returning the index to a net bullish technical picture.

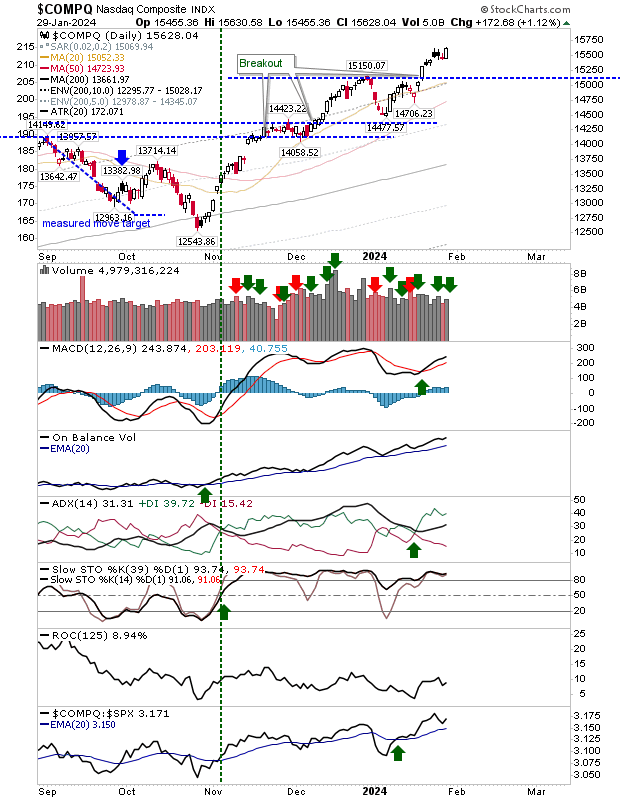

The Nasdaq closed at a high on heavier volume accumulation, and in doing so, negated what had been three days of scrappy action.

Technicals are net positive. Look for a series of small gains, similar to what's gone in November and December.

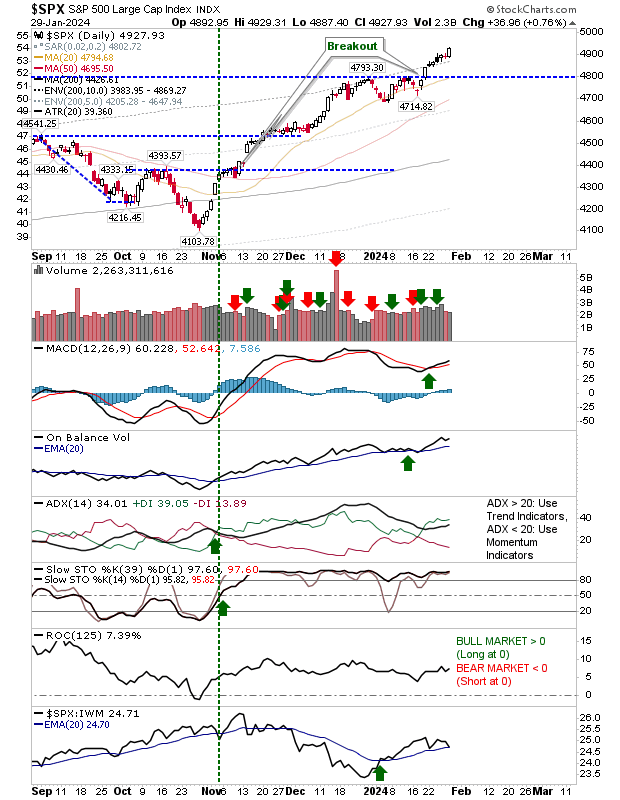

The S&P 500 closed at a new high, but without the higher volume accumulation of the Nasdaq.

Again, the index could continue its run higher with a series of small gains; not enough to rock the boat, but over the course of the week could deliver a good return.

For Yesterday, what happens pre-market will likely determine how much gain there is to bank. A gap higher may leave markets with little wiggle room to add more, but I would be looking for this bullish run to continue.

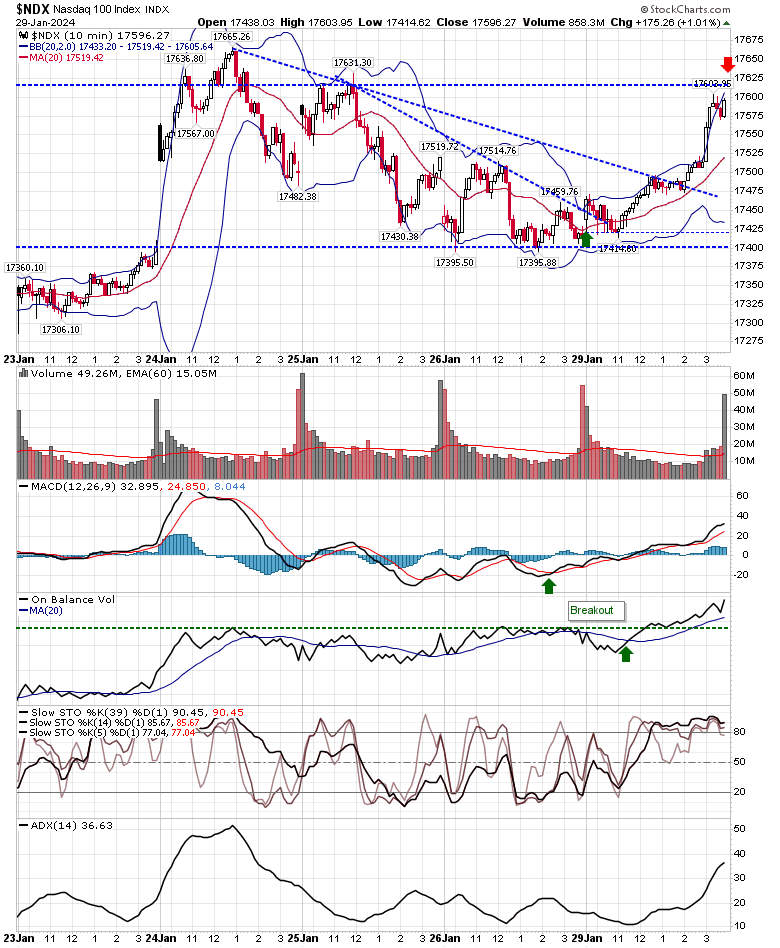

Nasdaq 100 Day Trade Delivers

It was a nice trade if you banked it for the Nasdaq 100, although all indexes did well. Harder to know what may come next, but a challenge of the January 24th high looks like a good prospect for the former index.