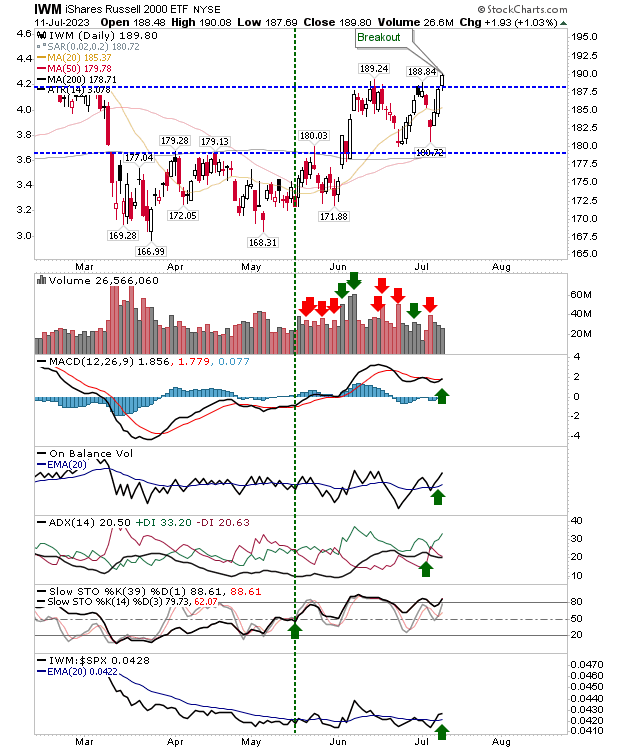

It's the holiday season, and blog traffic is way down, but while people are away enjoying their vacation, those traders left behind have decided to drive a break of resistance in the Russell 2000. There is no confirmed accumulation, but there was a new 'buy' trigger in the MACD and an outperformance relative to the S&P 500.

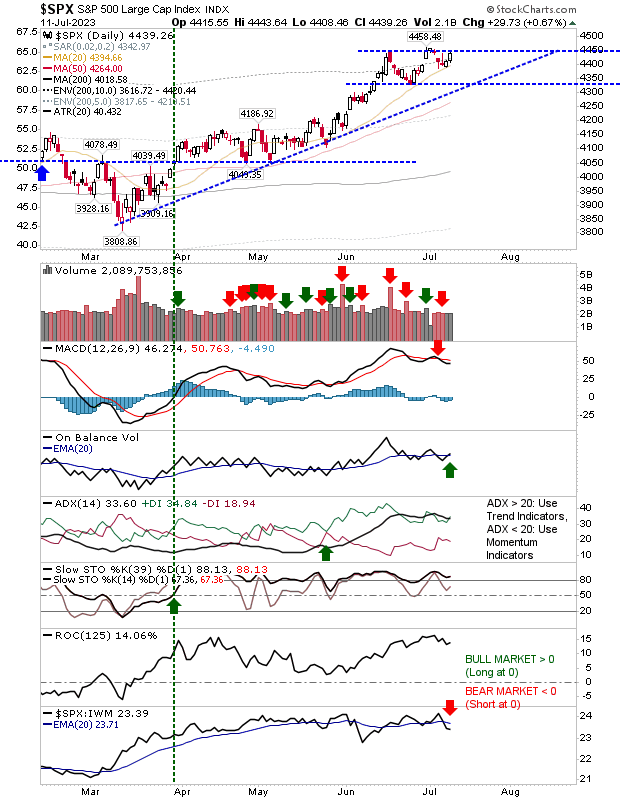

While the Russell 2000 (IWM) was making its move, both the Nasdaq and S&P 500 were making their own gains. The S&P 500 is closest to getting past 4,450 after bouncing off the 20-day MA in a successful support test.

Again, buying volume was low, but there was still enough to see a new 'buy' trigger in On-Balance-Volume. Having said that, the latter indicator has effectively flatlined since March, despite the price rally, so it needs to kick on if it's to support the action in price.

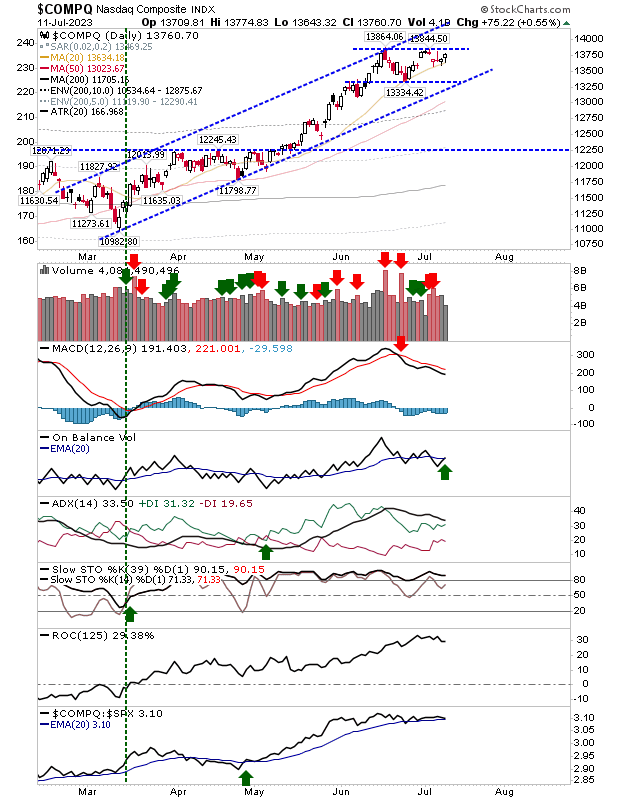

The Nasdaq also closed higher on the day, also successfully defending its 20-day MA but not quite reaching resistance. It, too, enjoyed a new 'buy' trigger in On-Balance-Volume, but has the same lack of trend that volume is experiencing in the S&P 500.

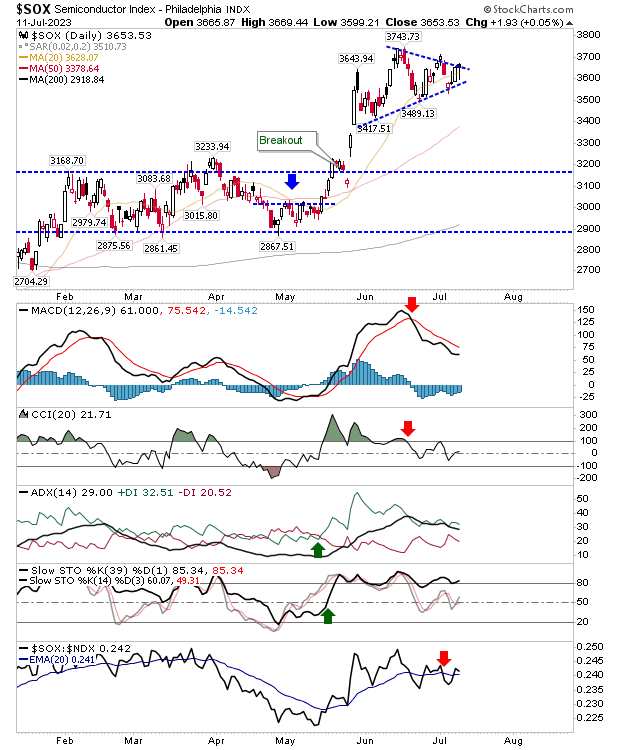

The Semiconductor Index didn't quite make it out of its consolidation triangle, but today's 'hammer,' while not in the traditional reversal position, does indicate the underlying demand for semiconductor stocks.

With vacation season in full swing, we will not see the volume move to back breakouts of support or resistance, so we just have to take things at face value. Let's see how action in the Russell 2000 evolves.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.