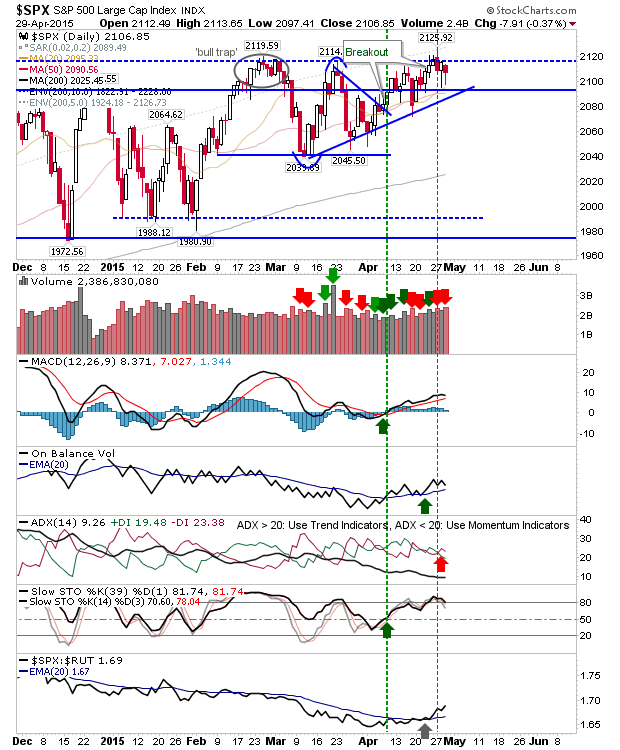

Lots of movement during the day yesterday, but by close of business there was little to say. The S&P registered higher volume distribution as it was able to defend converged 20-day and 50-day MAs.

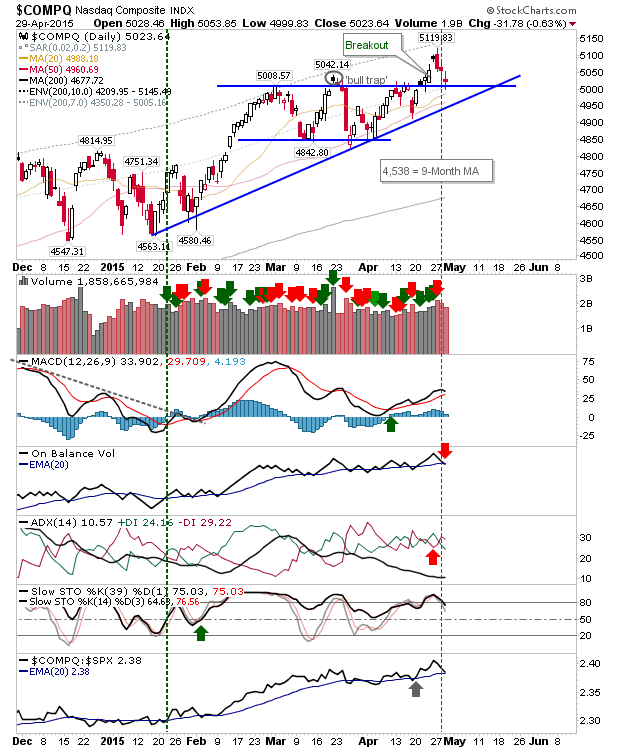

The NASDAQ finished with a spinning top doji as it toyed with psychological 5000 support. Unlike the Nasdaq, there was no distribution. Technicals show with a 'sell' trigger in On-Balance-Volume and between +DI and -DI.

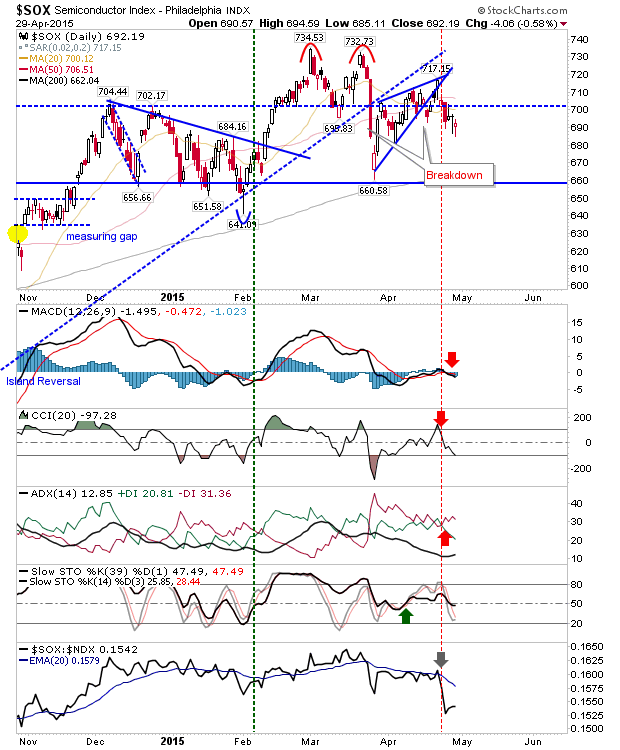

The Semiconductor Index continued its run of weakness. The 200-day MA is singing a Siren's song. Will it dash itself against the rocks?

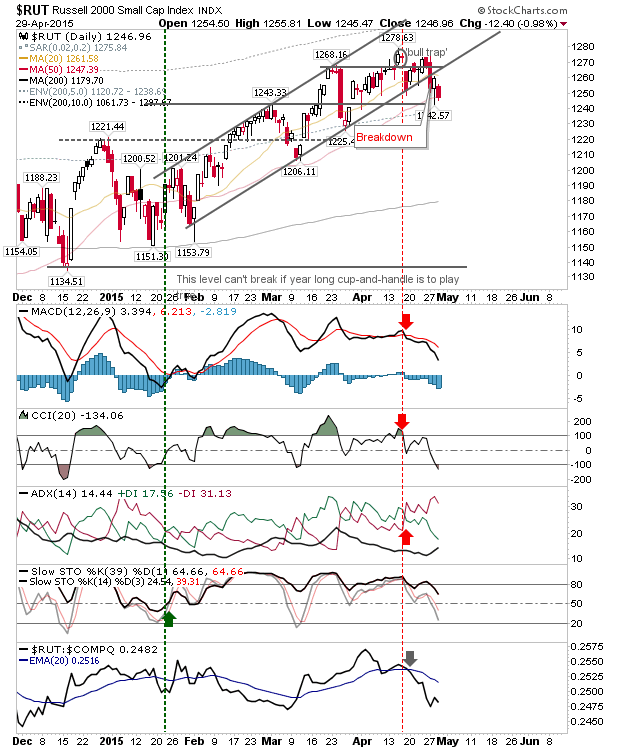

The Russell 2000 is toiling at its 50-day MA, closing a shade just below after the earlier loss of channel support.

Today is another chance for both sides to put on the pressure. Support and Resistance are well defined, but which side will breach first?