Market Brief

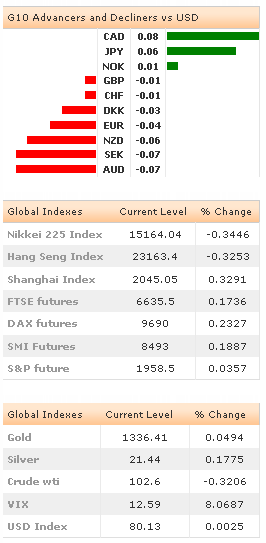

The risk appetite has been greatly squeezed amid fears of insolvency in Portugal triggered aggressive sell-off in European stocks and peripheral bonds. US and Asian stocks followed the panic unwinding. Quickly, the issue is about panicked investors after Espirito Santo Financial (LISBON:ESF) missed payments to “few clients” and lead to an aggressive 17% drop in its biggest shareholder Espirito Santo Financial Group’s shares. The stock has been suspended after hitting 51 euro/share. The panic fueled fears across the European continent. Portugal’s PSI 20 index lost 4.4%, IBEX 35 wrote-off more than 2.0%, followed by FTSE 100 (-0.7%), CAC 40 (-1.3%), S&P 500 (-0.4%), Dow 30 (-0.4%), Nikkei 225 (-0.3%) and Hang Seng (-0.3%). Euro-zone peripheral yields rallied; led by 10-Year Portuguese government yields, Greek, Italian and Spanish bonds sold-off. Inflows eased Swedish, German, Netherlands and Swiss government yields. The sell-off in EZ peripheral bonds lead to weakness in EUR/USD. The pair hit 1.3589 in New York yesterday and remains offered below its 21-dma (1.3613). Technically, June-July uptrend channel rotates/flattens. We see limited upside today as the uncertainties should continue weighing on the entire EUR-complex. A weekly close below 1.3576/80 (Jul 7 low / MACD pivot) should further decrease the short-term appetite in EUR/USD. The key issue of the day is developments around the Portugal situation. In fact, Espirito Santo Bank is not big enough to generate a systemic risk, yet large enough to trigger a contagion. The downside pressures on high-beta and EM currencies should continue.

The reaction due to Fed minutes remained short-lived due to these more challenging headlines. Right before the Portugal panic started, USD/JPY has hit 101.07, the pair recovered to 101.39 in Tokyo as Japanese traders preferred to take advantage on lower levels rather than to jump on the bearish trend. Trend and momentum indicators are flat-to-negative, the key support stands at 100.76 (2014 low). If the Portugal situation gains momentum, risk-off returns may push the levels towards 2014 lower bound. Stops are eyed below. EUR/JPY consolidated losses in the tight range of 137.68/92. Technicals turn mild.

AUD/USD remains offered below 0.9400 (21-dma / optionality). The technical bias is marginally negative, first line of bids are seen at 0.9339/51 (Fib 61.8% on Oct’13 – Jan’14 drop / 50-dma), selling pressures should intensify below. Action on AUD/NZD is limited below 1.0660 (former support becomes short-term resistance) pre-weekend (intraday range 1.0645/59).

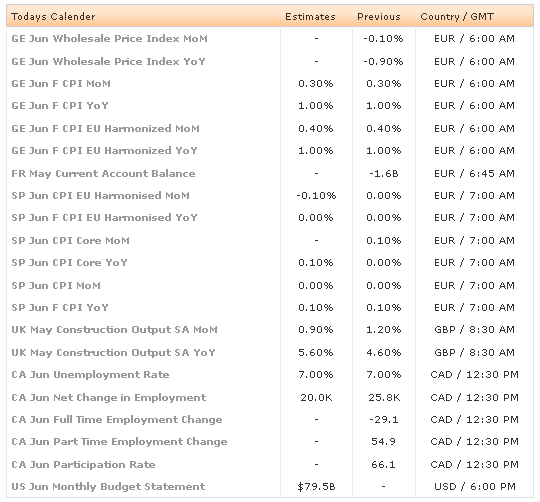

Canada will release jobs data today; markets anticipate a steady unemployment rate at 7.0%. USD/CAD has stabilized within 1.0600-1.0700 range since June 27th, the short-term bearish momentum vanishes. The labor data is important today. Although we believe that the probability for further BoC easing is no more up-to-date, any negative surprise on labor side will suggest renewed attempt to 1.0700-resistance. A breakout on either side of the current trading range is required to talk about fresh short-term direction.

The economic calendar of the day: German June Wholesale Price Index m/m & y/y, German and Spanish June (Final) CPI m/m & y/y, French May Current Account Balance, UK May Construction Output SA m/m & y/y, Canadian June Unemployment and Participation Rate and finally US June Monthly Budget Statement.

Currency Tech

EUR/USD

R 2: 1.3678

R 1: 1.3651

CURRENT: 1.3610

S 1: 1.3576

S 2: 1.3503

GBP/USD

R 2: 1.7273

R 1: 1.7180

CURRENT: 1.7126

S 1: 1.7086

S 2: 1.7000

USD/JPY

R 2: 102.47

R 1: 101.88

CURRENT: 101.36

S 1: 101.07

S 2: 100.76

USD/CHF

R 2: 0.9013

R 1: 0.8960

CURRENT: 0.8912

S 1: 0.8908

S 2: 0.8857