Over the course of my vacation, I have seen markets go from a nascent sell off to a recovery bounce. After four days of gains, markets finished the week slow close to, or at resistance.

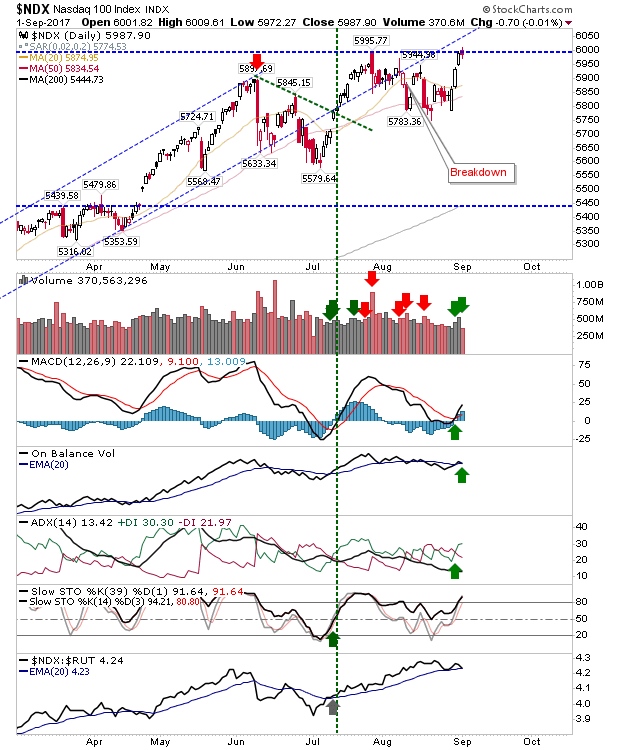

Shorts may find opportunities in Tech indices. The Nasdaq 100 is at resistance with Friday's doji marking a double top with the July bearish engulfing pattern. Adding to this, there is a potential relative performance switch (to weakness) against Small Caps. And there is natural resistance at 6000 to consider too. Technicals are net bullish but stochastics are overbought so some easing even if just turns into a bullish pullback is perhaps favored. Stops go above 6,010.

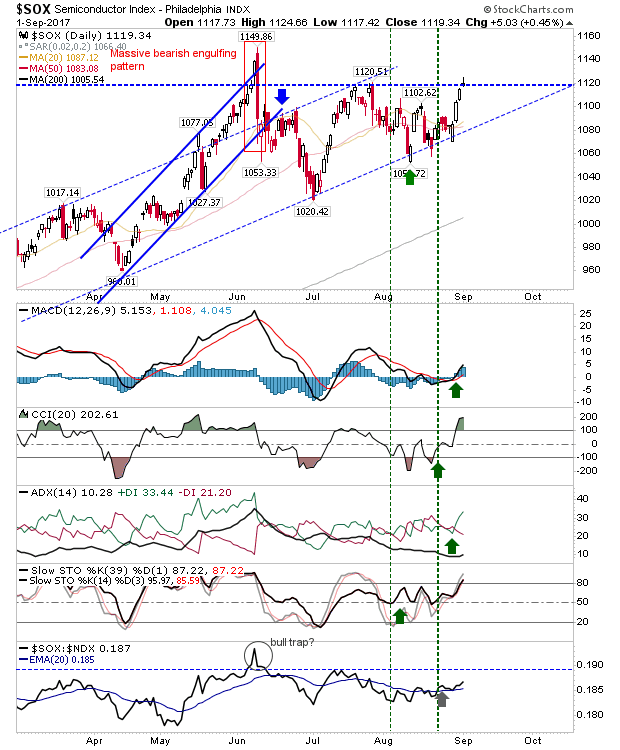

The Philadelphia Semiconductor Index is another shorting opportunity. The index is back again at 1,120 resistance with an inverse doji heavily influenced by the June bearish engulfing pattern. Technicals are net bullish but relative performance against the Nasdaq 100 is a long way from challenging the June 'bull trap'. Stops on a break above 1,125.

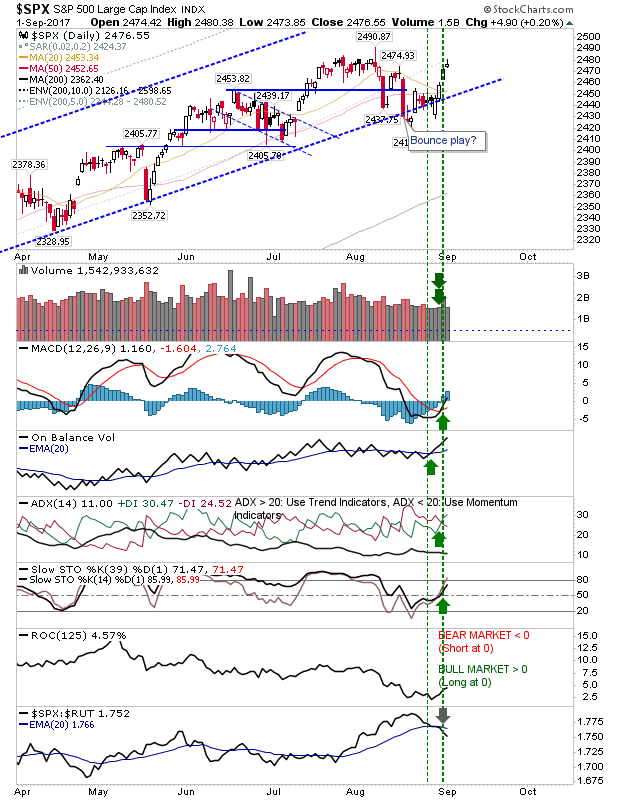

The S&P 500 finished with an inverse hammer inside the July consolidation. The August spike high (at 2,490) is dominant resistance and there is a significant relative performance loss against Small Cap but with technicals net bullish along with recent accumulation volume this has a good chance of pushing new highs. If looking to short the risk of whipsaw is likely to be quite high

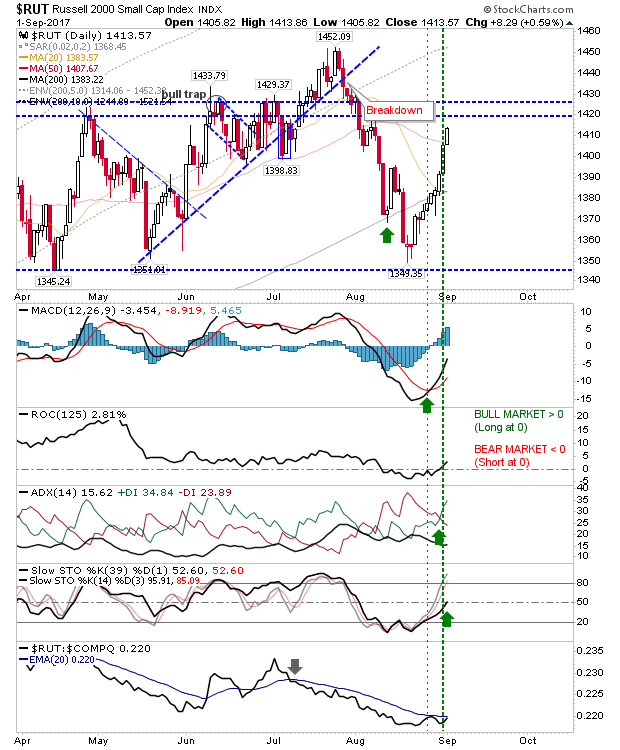

The index which has performed strongest in the last two weeks has been the Russell 2000. The index crossed above 200-day, 50-day and 20-day MAs over the course of the rally enough to see technicals turn net bullish. Relative performance is slowly improving after a spring and summer of under performance - all suggesting another uptick in the economy.

For tomorrow, any shorting opportunity will be heavily contingent on either a gap down or an open at Friday's close which fails to challenge Friday's high. While it's too late to be chasing the rally in the Russell 2000, bulls may find some joy in the S&P which is not yet overbought and may be at new highs by the time it is.