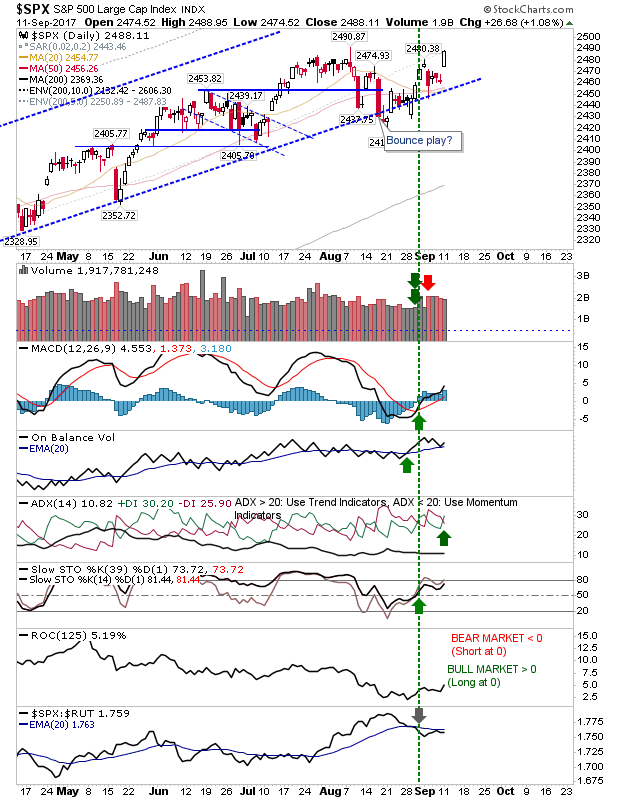

So with markets threatening support they instead gap higher and post further gains. Yesterday probably did enough to see markets post new all-time highs while shorts were left with little to work with.

The S&P gapped higher with technicals net bullish. Volume was a little disappointing (given the degree of gain) but all of this leaves markets ready for new highs.

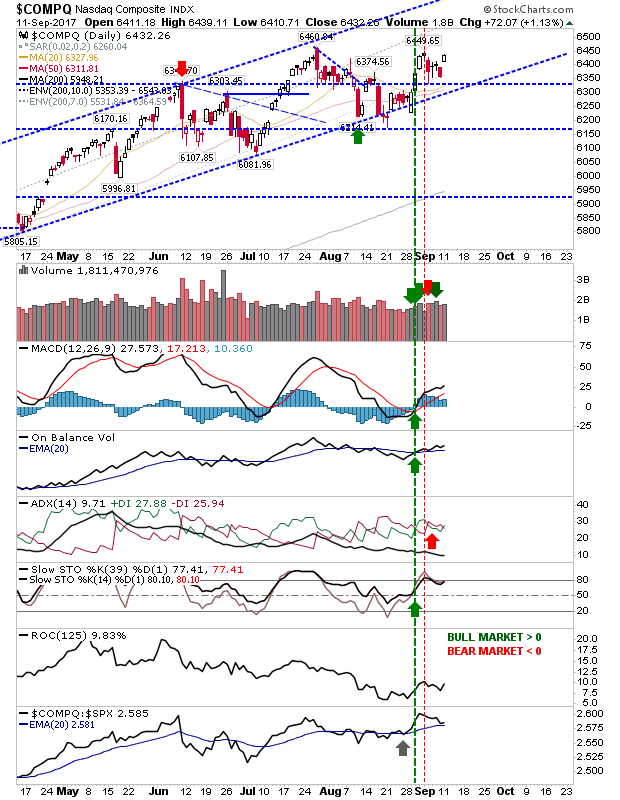

The NASDAQ gapped on higher volume accumulation. The index hasn't yet managed new highs but today could be the day this happens. Look for a move to upper channel resistance.

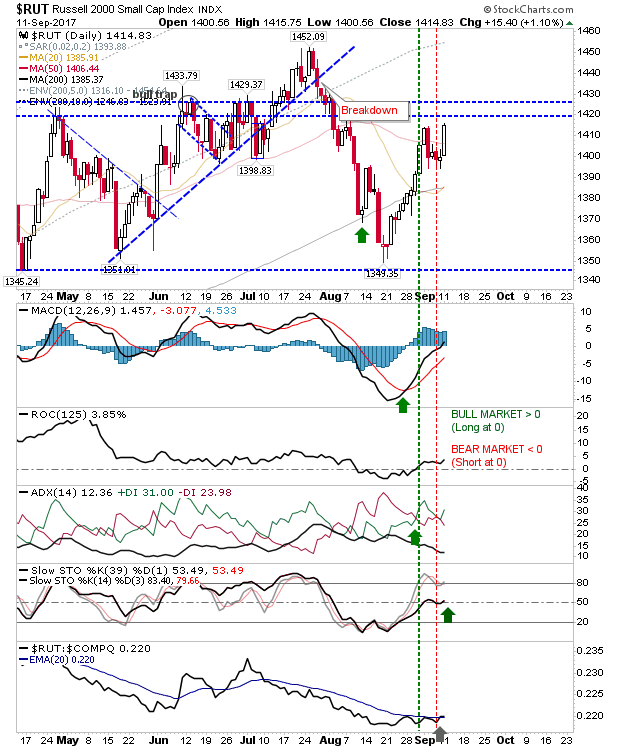

The Russell 2000 was the index offering the best chance for bulls. Yesterday saw a good solid day's action delivered below the radar; use GTC 'buy' orders to fish for fills down to 1,400 with stops on a loss of last week's lows.

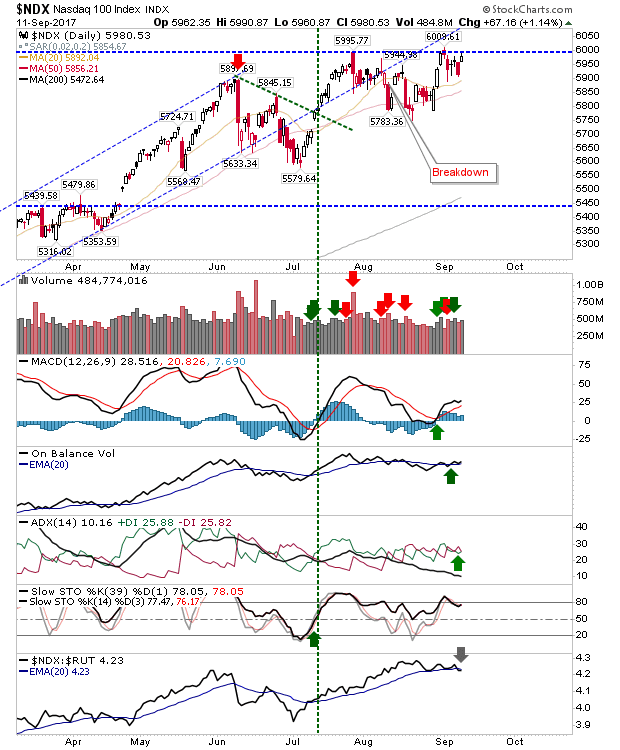

For bulls late to the game, keep an eye on the NASDAQ 100. The index is nicely primed for a breakout just below 6,000.

Today will be about holding on to as much of yesterday's gains as possible. For traders seeking new opportunities, a breakout in the NASDAQ 100 is probably the best play.