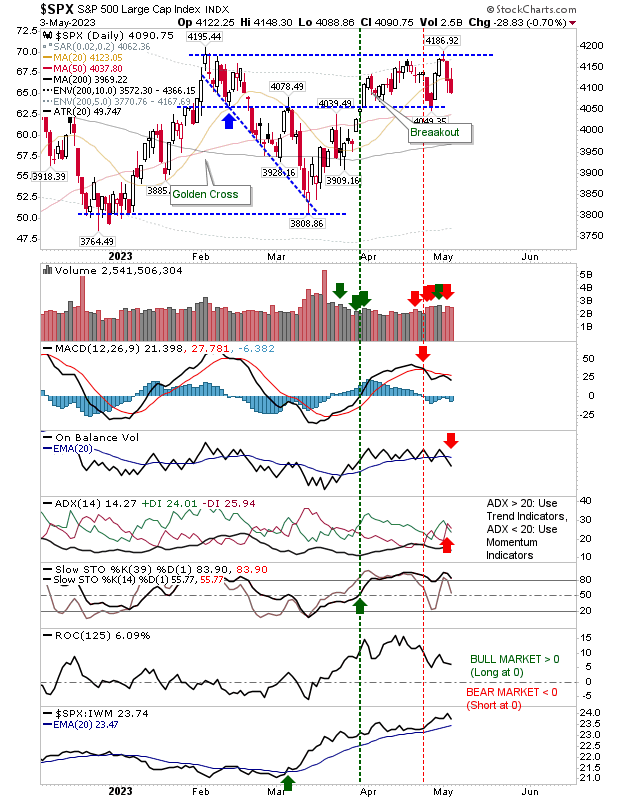

It wasn't a great day for indices, particularly as volume ranked as confirmed distribution for the S&P 500 and Nasdaq, with daily volume traded higher than any prior buying day. Neither market is down at key support, and as long as this remains the case, this still looks like a prelude to a breakout; it would take a loss of 50-day MAs in both indices to reverse my optimism.

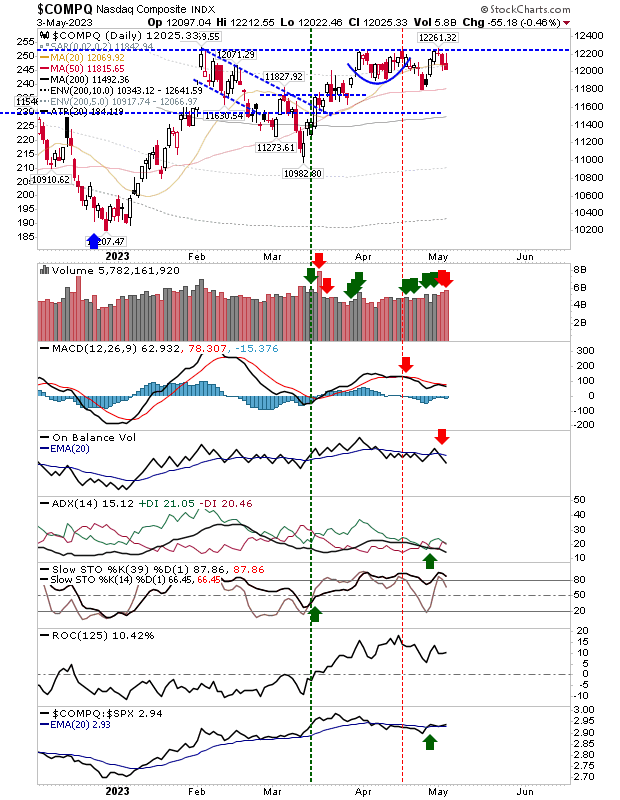

The Nasdaq is dealing with 'sell' triggers in the MACD and OBV, but the index continues to outperform the S&P 500.

The S&P 500 triggered 'sells' in the MACD, On-Balance-Volume, and ADX to go with the increased selling volume. While we await to see if a new support test is in the making, we will likely see such a test first in the S&P 500 before the Nasdaq.

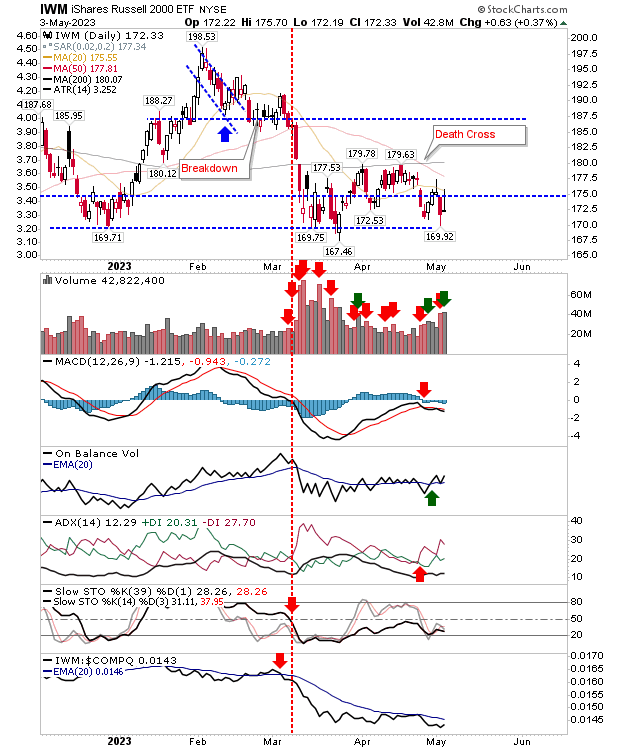

The Russell 2000 ({14202|IWM}}) remains more problematic. We have a second day where we have had 'gravestone' doji with large upper spikes, representing excessive supply that will be hard to shift. My optimism for the S&P 500 and Nasdaq does not extend to the Russell 2000. Momentum (stochastics) is firmly bearish, along with significant underperformance to the Nasdaq and S&P.

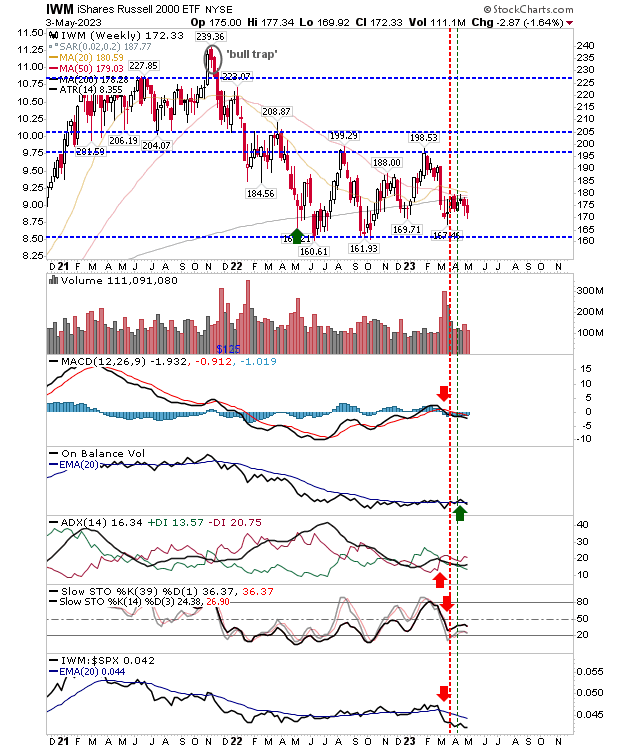

If you look at the weekly chart of the Russell 2000 ($IWM), you can see how the index is struggling below the 200-week MA, with the 50-week MA about to bearish cross the slower moving average.

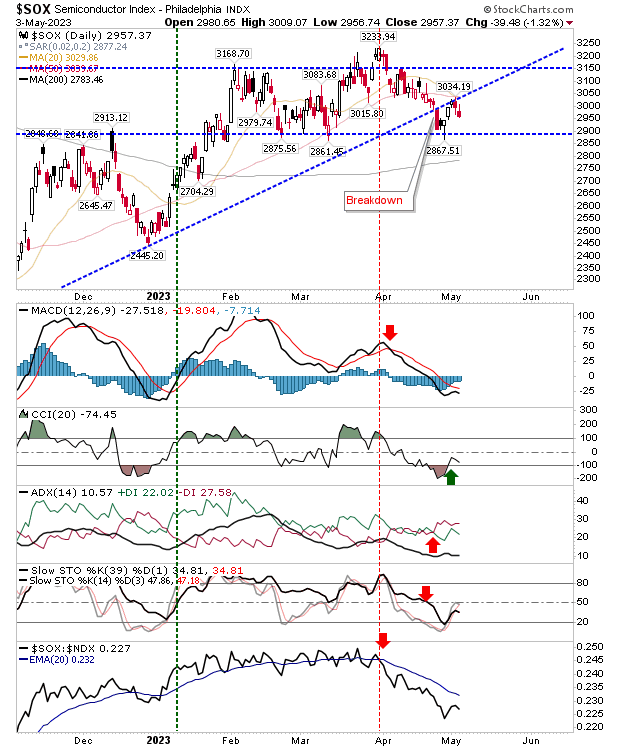

The other struggle is in the Semiconductor Index. It has lost rising trend support on bearish technicals (bar the CCI). This is not good news for the Nasdaq, although it hasn't yet influenced this index. The sharp relative underperformance against the Nasdaq 100 isn't helping.

While today's (and yesterday's) action favors bears, one day's buying may be enough to reverse it. I'm still looking for breakouts in the Nasdaq and S&P ahead of further losses, but will the market deliver?