Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

The current U.S-China trade war has been going on longer than expected and it doesn’t appear that normalcy will return anytime soon. For one, President Donald Trump has imposed a 20% tariff on about $200 billion worth of Chinse goods and he has floated the idea of imposing another 25% tariff on some $325 billion worth of Chinese products. As expected, China has hinted that it might retaliate with sanctions of its own such as placing a restriction on imports of rare earth minerals and to drastic measures such as dumping its huge portfolio of U.S. treasuries.

Interestingly, the war will have serious ripple effects across the global economy. For instance, companies in Southeast Asia where components are manufactured for consumption in the U.S. could find their ‘loyalties’ being tested in addition to increased tariffs and reduced trade volumes.

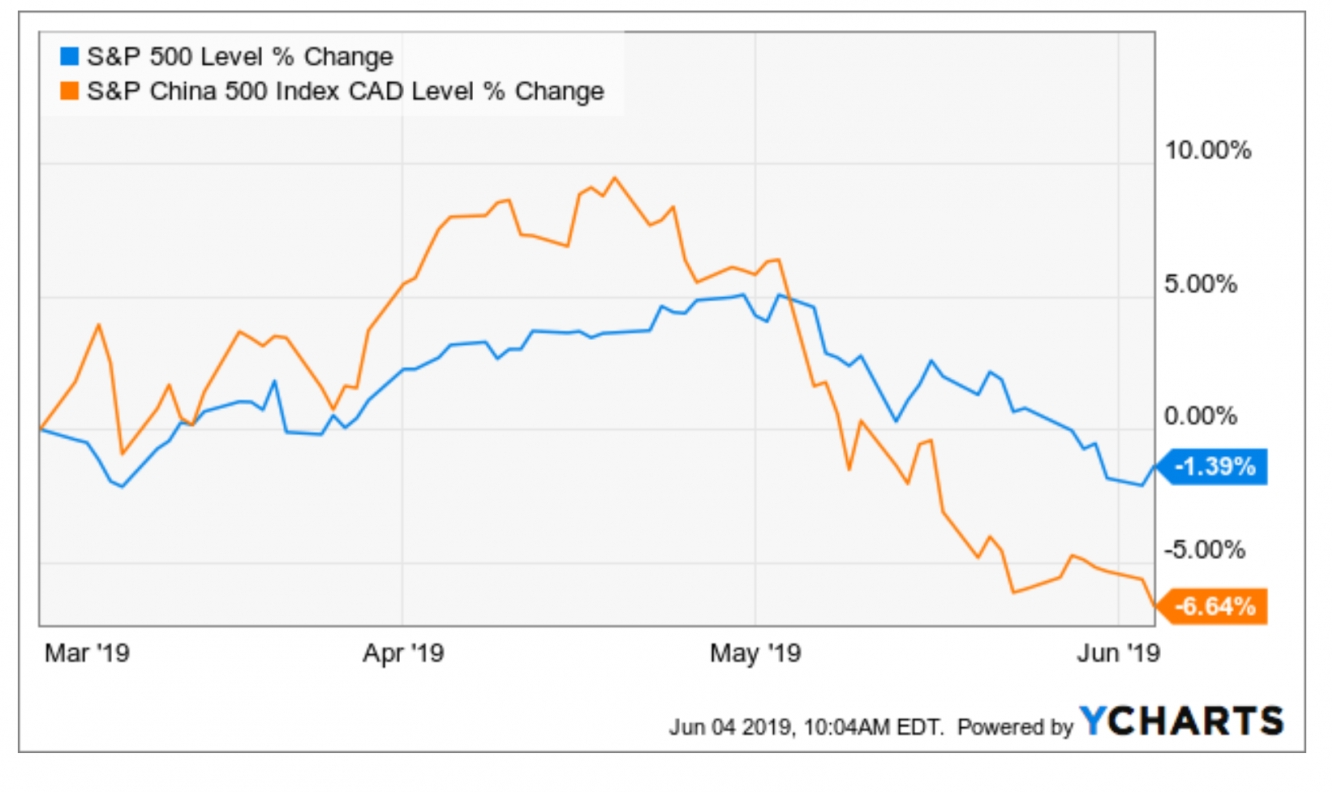

However, the ground zero would still be the U.S. and China where the biggest effects of the trade war will be felt. The Shanghai Composite index declined more than 6% in May, the S&P 500 was down 6.83%, and NASDAQ Composite was down more than 10%.

Taken deeper, the S&P China 500, which comprises of 500 of the largest, most liquid Chinese companies with a weighted approximation of the broader Chinese equity market is down 6.44% in the last three months while the S&P 500 is down 1.39% in the same period.

REITs are becoming the darling on Wall Street

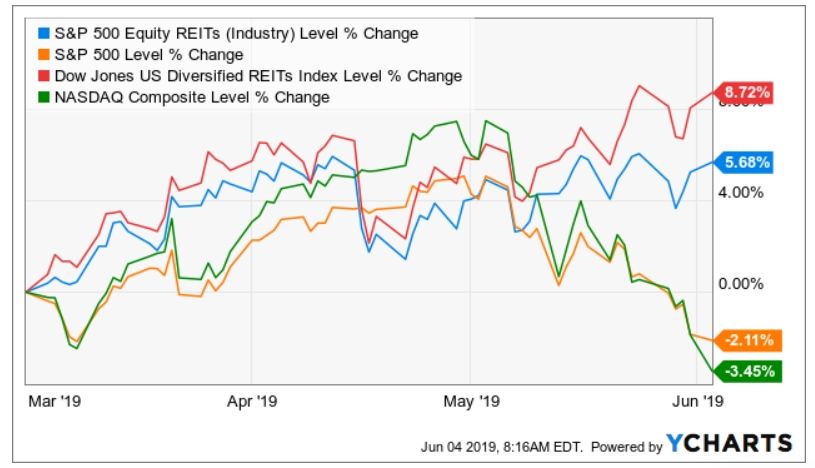

Correlation is not always causation, but it is hard to distance the fall in the U.S and Chinese stock markets from the ongoing trade war, the uncertainties it brings, and investor’s propensity to reduce their exposure to risk. Interestingly, U.S. investors seem to be turning to real estate stocks in search of safe havens as the trade war continue to drag on.

REITs- Real Estate Investment Trusts are simply a class of assets that gives investors a share of ownership in companies that own a range of real estate assets such as shopping malls, office towers, hotels, and other types of commercial properties. REITs are typically focused towards the domestic real estate market; hence, it is not surprising that they are less susceptible to the effects of the tariffs that the U.S. and China are imposing on each other’s economy.

In the last three months, Dow Jones Diversified REITs Index has gained more than 8% and the S&P 500 Diversified REITs has gained 5.68% in the same period. In contrast, the S&P 500 has lost 2.11% and NASDAQ Composite is down 3.45% in the last three months. Digging deeper, healthcare and residential REITs seem to offer investors the strongest form of defense against the increased shock-effects of the trade war and its attendant tariffs.

Last year, Omer Amsel, co-founder and COO at real estate equity crowdfunding platform StraightUp noted that real estate may provide a safe haven during a bear market. In his words, “Real estate exhibits low correlation with public markets and due to its fundamental value, is uniquely positioned to weather downturn”. He also maintained that real estate investments are not “typically impacted by changes in market sentiment as quickly as equities,” thereby creating an opportunity for investors to derisk their investment portfolios with against the volatility of other assets such as bonds and stocks.

Limited downside for REITs

The trade war also has some innate risks for property owners and by implication, to REITs. If the trade war drags on for too long, it can trigger an economic slowdown in the U.S. especially when coupled with the political instability of the coming general elections and the natural volatility of the capital markets. In addition, the real estate industry can suffer headwinds arising from reduce labor supply and increased construction costs as imported components suffer tariffs.

Nonetheless, many stakeholders believe that real estate investments tend to be better suited to absorbing shocks and providing safe haven protection. For one, many real estate leases on commercial property, (apart from hotels) usually lasts between five and 10 years. In fact, it is not uncommon to see commercial real estate leases lasting more than 10 years.

Hence, it is highly unlikely that tenants are in a position to make reactionary changes to short-term shocks. Therefore, REITs are in a better position to provide more protection to your portfolio than other assets classes as the trade war continues to trigger bouts of short-term volatility.