Market Brief

The Reserve Bank of New Zealand took the market by surprise and cut its official cash rate by 25bps to 2.25%. Governor Wheeler argued that the deteriorating outlook for global growth, and more specifically the uncertainty surrounding China’s economic prospects, justifies this surprise easing move from the central bank. Obviously, the New Zealand dollar was heavily sold-off during the night as traders priced in the rate cut. The Kiwi was trading broadly lower across the board, down .65% against the Canadian dollar, 2% versus the Aussie, 1.64% versus the greenback and 1.23% versus the EUR. NZD/USD fell from 0.6785 to 0.6630 amid the decision. We believe it won’t take long for the Kiwi to return to around $0.65, which corresponds to the bottom of the currency pair monthly range.

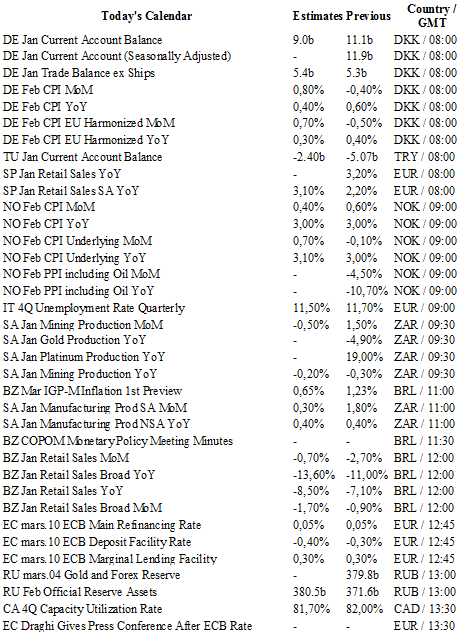

Finally, it’s Thursday and traders are bracing for wild swings in EUR crosses as Mario Draghi will most likely deliver. Traders are expecting another rate cut of the deposit rate, which currently stands at -0.30%, but are still wondering what will come with it. The ECB has a broad set of tools at hand, such as increasing the size of the QE, its duration or extending the list of bonds eligible. It is also difficult to know what is priced in, but one thing is sure, the market wants to see commitment from the ECB, and Mario Draghi would be better off not disappointing the market like he did on December 3rd. After being rejected by its 200dma, EUR/USD moved lower during the Asian session. The pair should trade trendless ahead of the ECB meeting as traders fine-tune their positions.

EUR/CHF will also be under the spotlight today as traders closely monitor the SNB's reaction after the ECB decision. Unlike in January last year, we expect the Swiss central bank to adopt a wait-and-see attitude as it would rather adjust its response to the market reaction instead of Mario Draghi's announcement. For now, EUR/CHF is trading between 1.09 and 1.10.

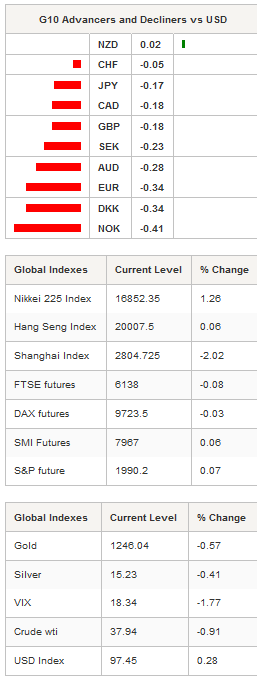

On the equity market, returns were mixed in Asia with Japanese shares gaining more than 1%. The Nikkei rose 1.26%, while the broader Topix was up 1.49%. In mainland China, the Shanghai Composite and Shenzhen Composite continued to slide lower as investors remained concerned about the government’s ability to successfully implement the required reforms. Elsewhere, in New Zealand shares were up 0.79%, while in Australia the ASX fell 0.14%. In Europe, equity futures are trading lower as traders are reluctant to load their portfolio ahead of the ECB.

Today traders will be watching industrial and manufacturing production from France; CPI from Denmark, retail sales from Spain; CPI from Norway; manufacturing production from South Africa; retail sales from Brazil, ECB rate decision from the eurozone; initial jobless claims and monthly budget statement from the US; manufacturing PMI and food prices from New Zealand.

Currency Technicals

EUR/USD

R 2: 1.1193

R 1: 1.1068

CURRENT: 1.0973

S 1: 1.0810

S 2: 1.0711

GBP/USD

R 2: 1.4409

R 1: 1.4284

CURRENT: 1.4221

S 1: 1.4108

S 2: 1.3836

USD/JPY

R 2: 117.53

R 1: 114.91

CURRENT: 113.55

S 1: 110.99

S 2: 105.23

USD/CHF

R 2: 1.0257

R 1: 1.0074

CURRENT: 0.9976

S 1: 0.9847

S 2: 0.9660