- RBA decided to remain on hold as it was widely expected by the market and kept its interest rate at +1.50%. The accompanying statement had an upbeat tone, with comments on inflation being likely to remain low for some time, to then gradually pick up and reach a bit above +2.0% in 2018. The statement also identified the outlook for household consumption as a continuing source of uncertainty. Specifically, it mentioned that household incomes are growing slowly and debt levels are high. AUD/USD was practically not influenced by the RBA decision, which is indicative of a neutral effect as the market was expecting the outcome.

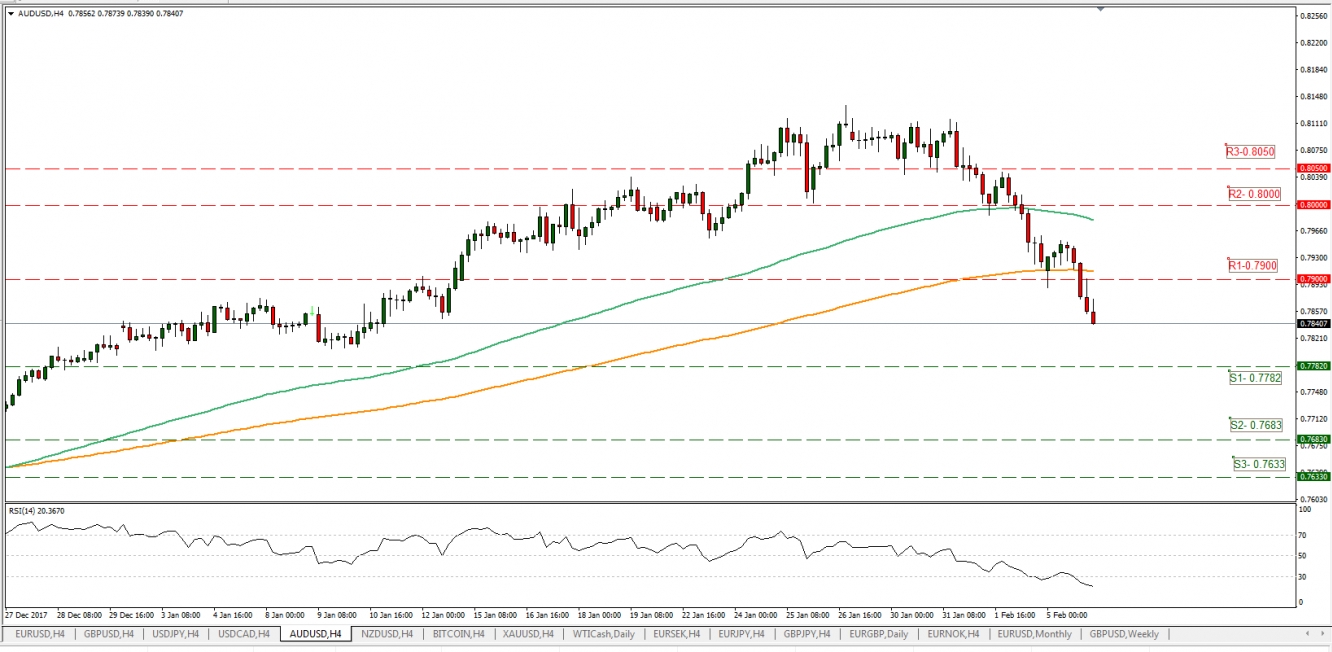

- AUD/USD began to trade in a sideways manner with a bullish tone yesterday, however dropped heavily later on during the US session, breaking the 0.7900(R1) support level (now turned resistance). The pair could continue to trade with some bearish tone, however we see a case for it to stabilize later on, as the Relative strength index is already below 30, possibly signaling an overcrowded short position. Should the bears continue to have the upper hand, we could see it breaking the 0.7782 (S1) support level and aim for the 0.7683 (S2) support barrier. On the other hand should the bulls take the driver’s seat, we could see them drive the pair beyond the 0.7900 (R1) resistance level, aiming for the 0.8000(R2) resistance hurdle.

- The Dow Jones erased all of its 2018 gains in one day as the US stock market plunged in a volatile trading on Monday. The reasons behind the sell-off could be found amidst concerns for rising bond yields and higher inflation, which could have prompted worries of a faster rate hike pace. Friday’s strong US employment report strengthened the argument for such a case. The US dollar gained on buying interest, as investors sought its relative safety according to various media reports. It would be indicative that the USD outperformed most of its rivals but the JPY. Overall we expect the USD to continue to strengthen, however the gains could be somewhat limited.

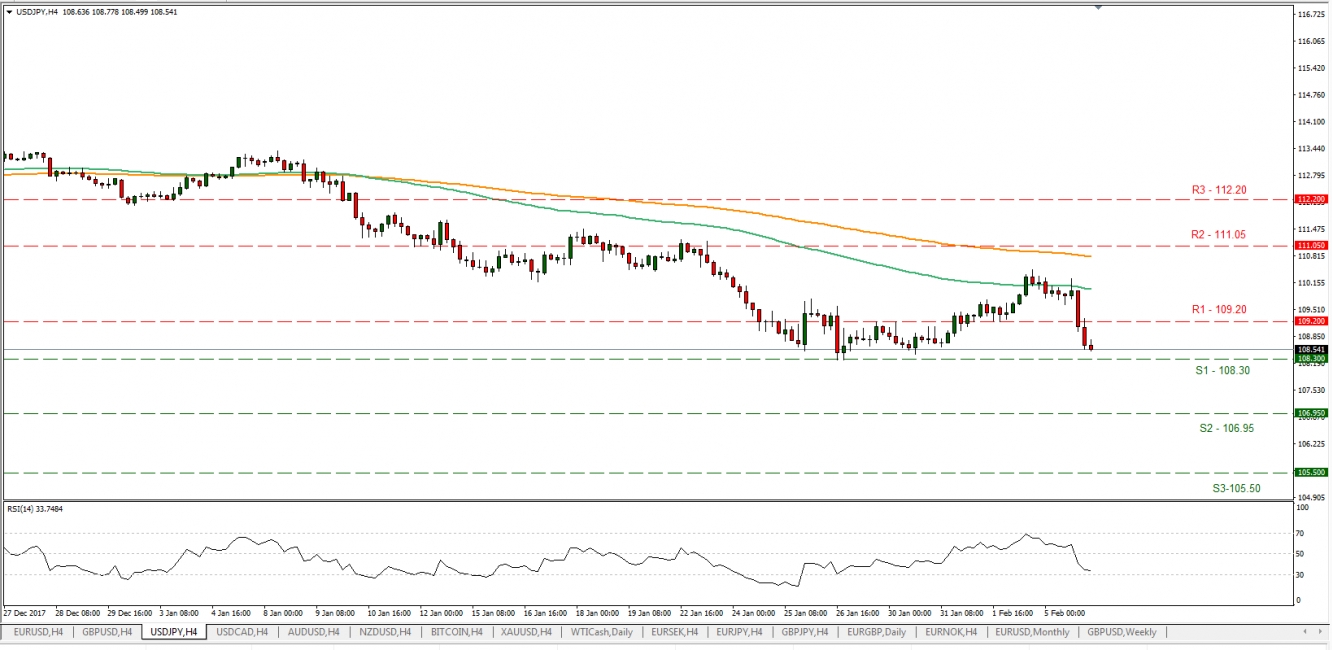

- USD/JPY dropped yesterday breaking the 109.20 (R1) support level (now turned to resistance). The drop could be interpreted as JPY outperforming the USD as a safe haven. However we would not hurry to call for a further sell off, as the Relative Strength Index has approached 30 and in the hourly chart, volatility is decreasing. We could see the pair stabilizing during the day and even experience some bullish pressures in a possible correction phase. Should the pair find new selling orders, we could see it breaking the 108.30 (S1) support level and aiming for the 106.95 (S2) support area. On the other hand, should it find fresh buying orders, we could see it breaking the 109.20 (R1) resistance line and aim for the 111.05 (R2) resistance zone.

- During the European morning, we get Germany’s factory orders for December and later on New Zealand’s milk auction data, US and Canada’s trade balance for December, as well as Canada’s Ivey PMI for January. Last but not least we get New Zealand’s unemployment reading, which could move the NZD, as the release is one day ahead of RBNZ’s interest rate decision.

- As for speakers, German Bundesbank President Weidmann and FOMC member Bullard speak.

U.S. dollar strengthens as U.S. stock market plunges

As for today’s other economic highlights:

AUD/USD

Support: 0.7782(S1), 0.7683(S2), 0.7633(S3)

Resistance: 0.7900(R1), 0.8000(R2), 0.8050(R3)

USD/JPY

Support: 108.30(S1), 106.95(S2), 105.50(S3)

Resistance: 109.20(R1), 111.05(R2), 112.20(R3)