Investing.com’s stocks of the week

Market Brief

The rebound in the US economy is likely to be modest. The March factory orders were due yesterday afternoon and came in slightly better-than-expected at 2.1% verse 2% expected, 0.2% prior read. EUR/USD didn’t react much on the news and is trading sideways since then. Since May 1st, the euro has a negative bias and is slowly sliding toward the key support standing at 1.1043 (multi highs). Further, one can find a support around 1.0660-1.0814 (lows from late April and Fib 61.8% on April rise).

The Royal Bank of Australia cut its cash rate by 25bps to a record low of 2%, effective tomorrow. First, the AUD/USD depreciated sharply to 0.7788 before bouncing back to 0.7896. This morning the Aussie is trading higher, around 0.7905, as the RBA made clear that further easing is highly unlikely unless the outlook worsen significantly. The pair should find some support at 0.78 (Fib 50% on April rally and psychological level) while on the upside the Aussie will need some fresh boost to break the high from April 29th at 0.8076. Australia’s trade balance was also due, March trade deficit narrowed to AUD -1,322mn from -1,609mn last month while markets were expecting a trade deficit around AUD -1,000mn.

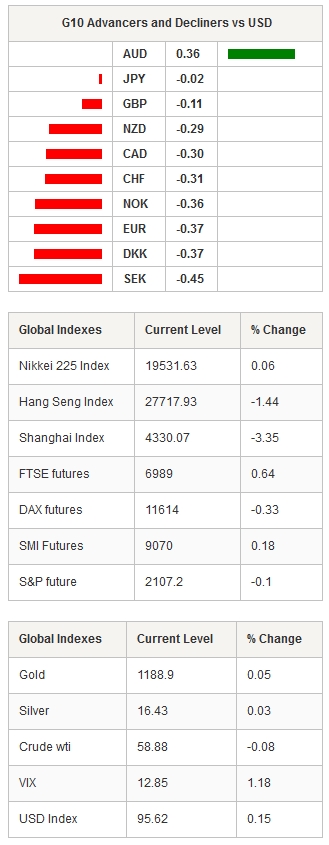

Asian equities are broadly lower, the Shanghai Composite is down -2.65%, Hang Seng -1.30%, Indian Sensex edges up +0.17% while Australian equities lost -0.10%. Japan’s market is still close due to Children Day. As a result USD/JPY remained in the 120-120.25 range. Last week, USD/INR couldn’t break the strong resistance standing at 63.90 (high from November 2013) and is retreating lower. The next support stands at 63.11 (low from April 29th); if broken the road is wide open to 62.15.

In Europe, equity futures are mixed this morning with FTSE0 up 0.70%, Euro Stoxx 50 down -0.20%, DAX down -0.21% while the SMI is up 0.22%. In UK, GBP/USD is stabilising around 1.5117 after retreating almost 2.50% over the last four days as the outcome of the UK general election is still highly uncertain. EUR/GBP edged down to 0.7350, the nearest support stands at 0.73 (psychological level), the next one can be found at 0.7243 (Fib 38.2% on March-April rise).

EUR/CHF is sliding toward the next resistance standing at 1.0389 (low from April 2nd), despite worse-than-expected March Manufacturing PMI from Switzerland (released yesterday morning). The figures came in at 47.9 verse 48.2 expected. The market firmly believe in the resilience of the Swiss economy as the Swiss franc is still appreciating. USD/CHF is testing the 0.93 support since April 30th and will need fresh boost to break it.

Today traders will watch April unemployment rate from Spain, March Industrial Production from Sweden, April Markit /CIPS UK Construction PMI out of the UK, March US Trade Balance (expected at -$41.7bn), April Final Markit US Composite and Services PMIs and ISM Non-Manufacturing PMI.

Currency Tech

EUR/USD

R 2: 1.1450

R 1: 1.1380

CURRENT: 1.1097

S 1: 1.0900

S 2: 1.0521

GBP/USD

R 2: 1.5600

R 1: 1.5560

CURRENT: 1.5117

S 1: 1.4943

S 2: 1.4750

USD/JPY

R 2: 121.52

R 1: 120.18

CURRENT: 120.12

S 1: 118.33

S 2: 117.95

USD/CHF

R 2: 0.9948

R 1: 0.9754

CURRENT: 0.9367

S 1: 0.9300

S 2: 0.9184