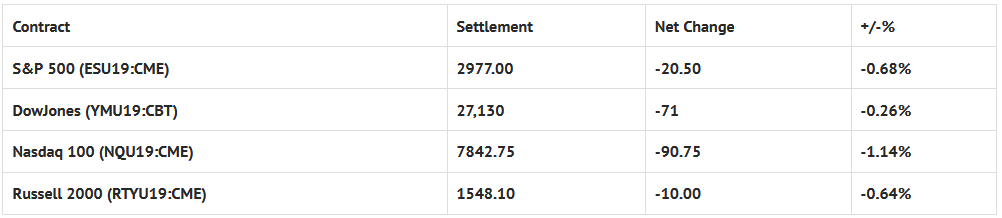

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed lower: Shanghai Comp -1.27%, Hang Seng -1.37%, Nikkei -0.23%

- In Europe 10 out of 13 markets are trading higher: CAC +0.17%, DAX +0.30%, FTSE +0.39%

- Fair Value: S&P 500 +2.30, Nasdaq 100 +15.68, Dow -14.12

- Total Volume: 1.46 million ESU and 83 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the Chicago Fed National Activity Index 8:30 AM ET.

S&P 500 Futures: Sell The Open

Chart courtesy of Scott Redler @RedDogT3 – $spx futures +5 as Strength was sold last week with a few faulty signals.

During Thursday nights Globex session, the S&P 500 futures (ESU19:CME) printed a low at 2996.25, then rallied to print a high at 3009.75, and open Friday’s regular trading hours (RTH) at 3009.25.

The high for the day was printed right on the 8:30 CT bell, and the futures immediately began to trade lower.

We could do a big ‘blow by blow’ of the days traded, but basically the futures made a sequence of lower lows throughout the day, bounce a little, and then got trounced on going into the close, dropping another 20 handles in the final hour.

In the end, it was a slow grinder to the downside, with the ES closing down 20 handles, or -0.66%, and the Nasdaq closed down -86.25 points.

This time, the rotation was to buy the Dow futures (YMU19:CME), and sell the S&P and Nasdaq (NQU19:CME) futures.

In terms of the markets overall tone, it was all about the markets lack of buying power. In terms of the days overall trade / volume, nearly 1.5 million futures contracts traded, which isn’t bad for a Friday going into the end of July.