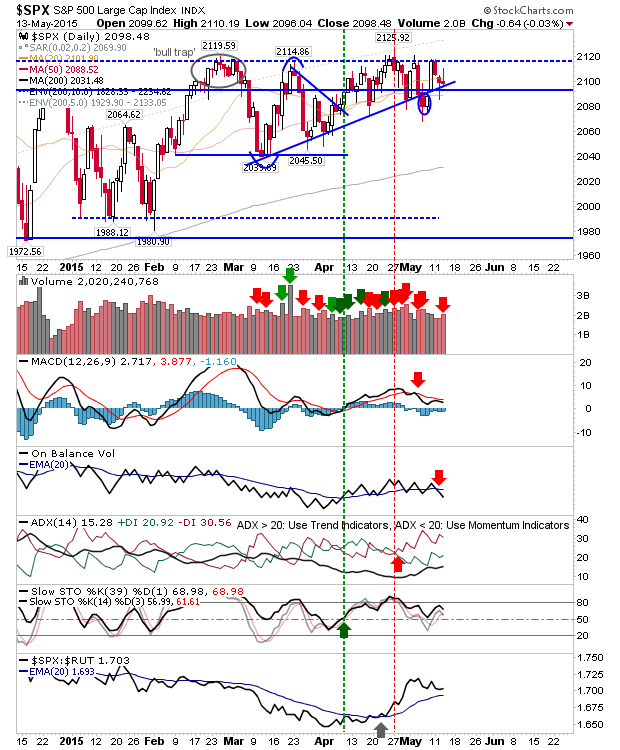

Yesterday's recovery followed with further highs, but then buyers went AWOL and things settled back to the day's lows. Rinse and Repeat.

TheS&P 500 has nestled itself against rising trendline support as today's action registered as confirmed distribution. Tomorrow, bears will be seeing if they can break the trendline, but I won't be holding my breath.

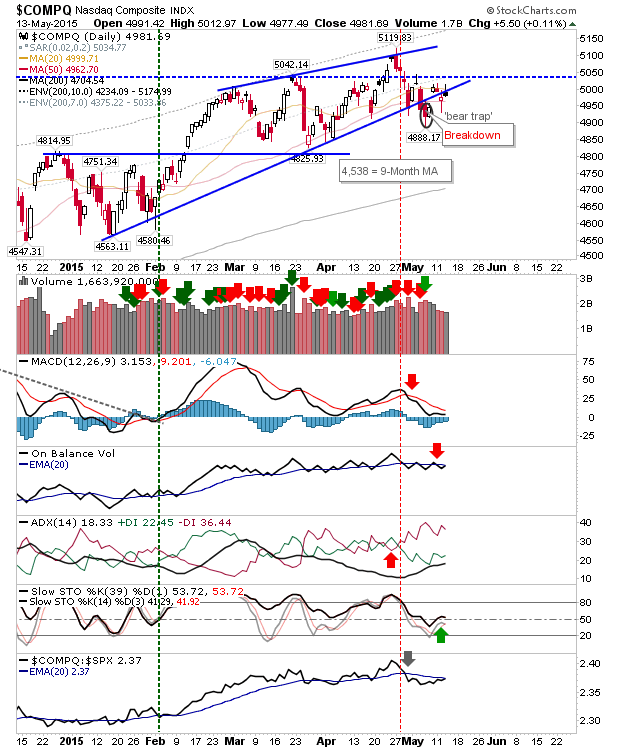

The NASDAQ tagged resistance and remains below the rising wedge. The 'bear trap' is still in play, but there needs to be a return inside the rising wedge if this is to be confirmed. A move above 5040 opens up for a challenge of high at 5119.

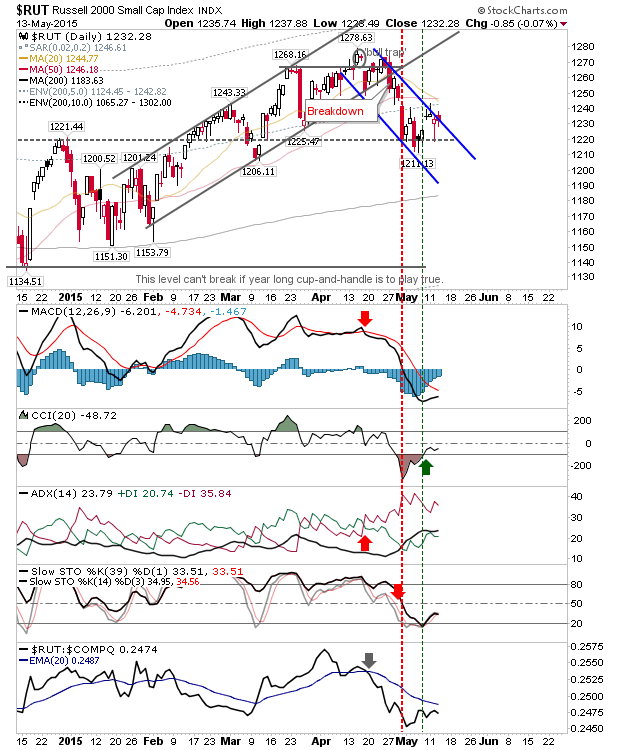

The Russell 2000 is at channel resistance, so the next move will either confirm resistance or deliver a breakout. Should this break upside, then the 'Death Cross' between 20-day and 50-day MAs will quickly come into play as alternative resistance.

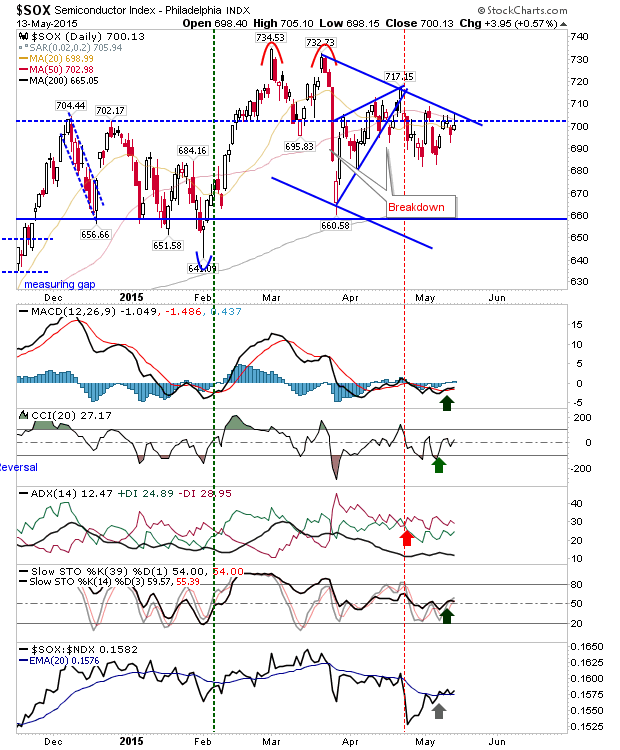

Another index at resistance and looking better as a shorting prospect is the Semiconductor Index. There is converged resistance of the channel, 50-day MA, and 704. Shorts may see some joy here tomorrow.

For tomorrow, the S&P may offer bulls a chance at trendline support. Shorts can look to the Russell 2000, Nasdaq and Semiconductor Index.