Wednesday's action was quietly bullish. The fact none of the indices lost significant ground after pushing breakouts is of greater significance—suggesting few traders are willing to sell. As we approach end-of-year we have the Santa rally to look forward too. In reality, if sellers do make an appearance then we will want to see breakout support hold on a test (should a test occur).

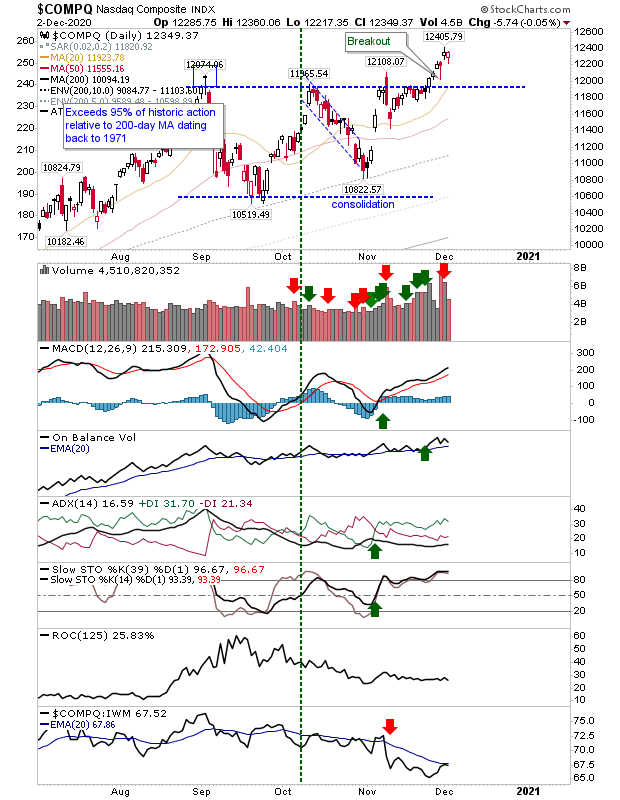

The NASDAQ is making up lost ground against the Russell 2000 as other supporting technicals remain net positive. The September high has been breached, neutralizing the outlook for a major top then, but with the index now riding 18.2% above its 200-day MA we now have to consider a new major top count; currently, we are in the 90% historic range of overbought action.

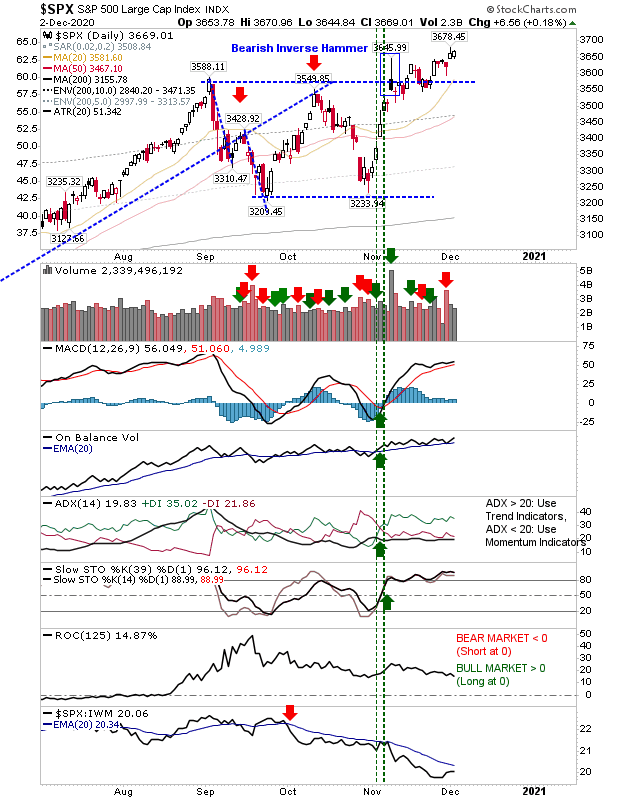

Likewise, if we look to the S&P, we had a small gain which left the index 14% above its 200-day MA; this similarly puts the index into the 90% zone of historic price action. Not surprisingly, technicals are net positive. It still has some work to do to make back its relative losses against the Russell 2000.

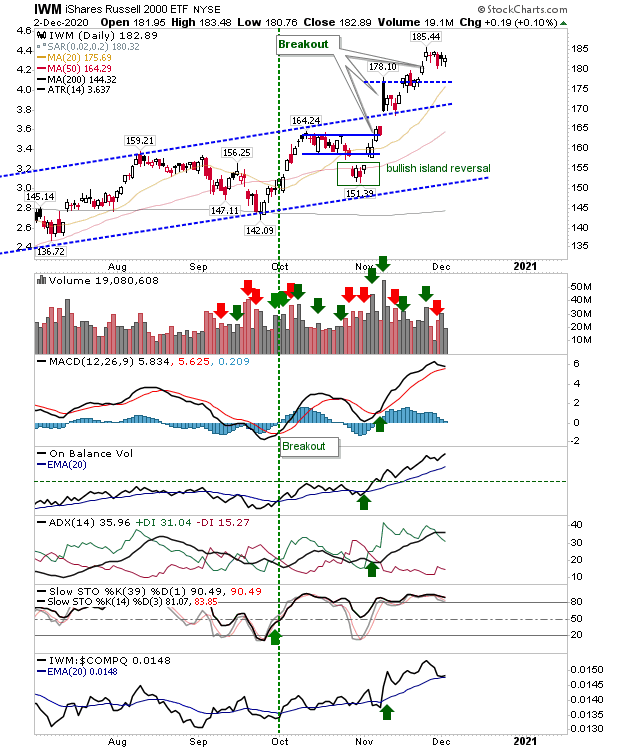

The Russell 2000 (via IWM) has moved well beyond the consolidation it traded in during the fall. As it stands, it trades 26.7% above its 200-day MA, which places it in the 99% zone of historic price extremes. The last time this happened was in February 2011—nearly 10 years ago. While things are still looking good, there could be a hard fall soon to follow.

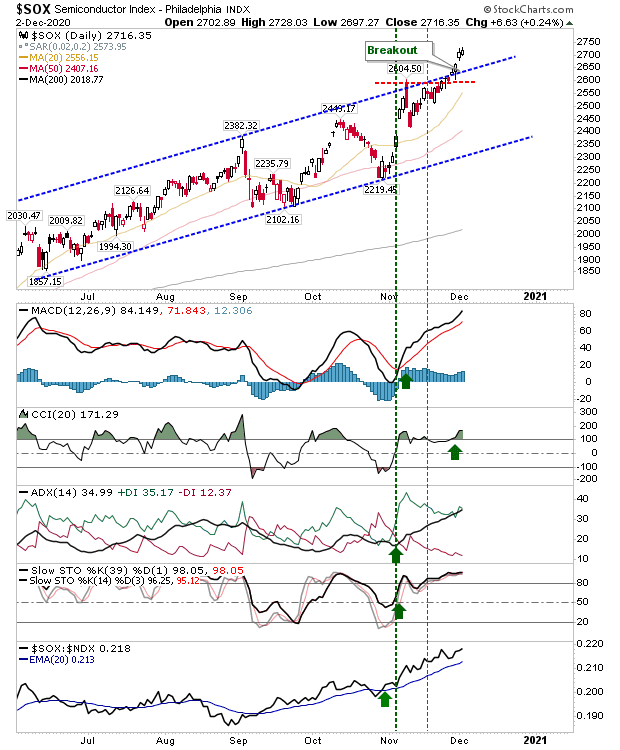

The Semiconductor Index kept the rally moving in an orderly direction. It stands 25% above its 200-day MA. Strength in this index will work in the NASDAQ's favor.

So, we head into the latter part of the week looking to reset the market top count. All indices look well placed to continue their advances, but time is ticking towards a major top which could make 2021 a dull year despite the current turmoil.