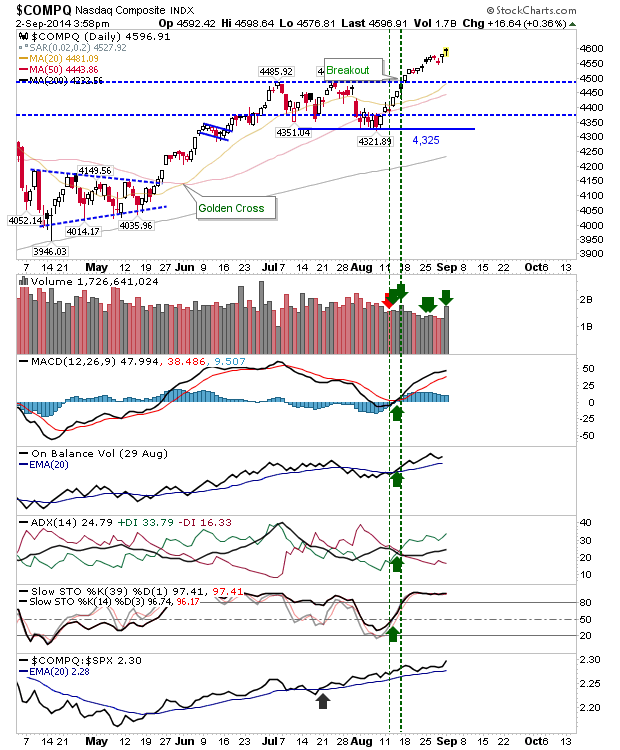

There wasn't much to say about yesterday after the long weekend. The NASDAQ added to Friday's gain with another narrow day of higher volume accumulation. The gain was small, but as part of the rally from the August swing low it's currently up 6.3%. Technicals are good, and not suggesting any immediate weakness is forthcoming.

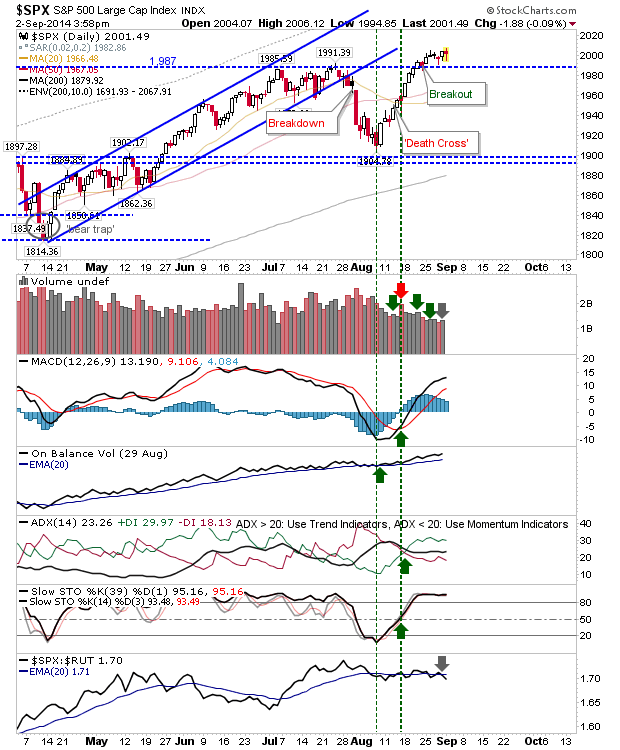

The S&P 500 is hovering over 1,967 breakout support, shaping a small handle which offers a long-side opportunity on an upside break.

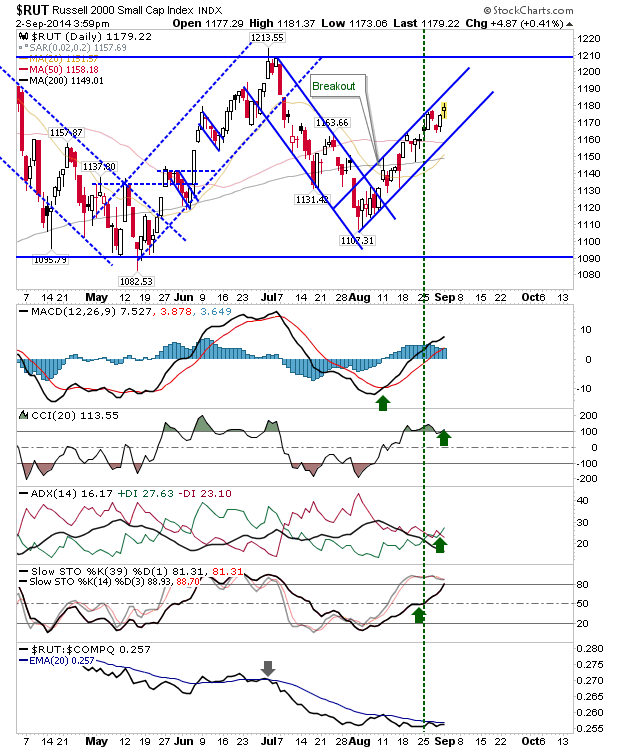

The Russell 2000 posted a small gain to keep itself inside the rising channel. It hasn't tagged resistance or hit support, so it's a 'hold'.

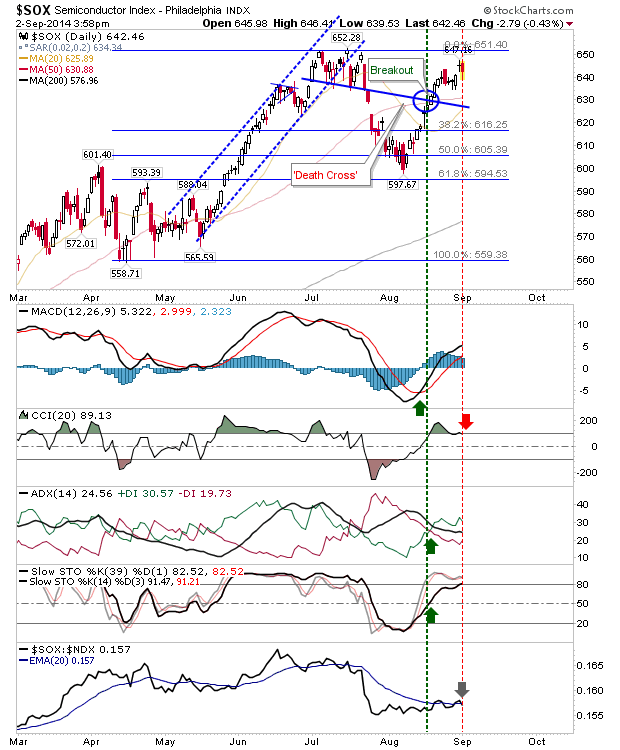

The Semiconductor index finished with a bearish engulfing pattern which may suggest weakness over the near term. Both 50-day and 20-day MAs look like attractive downside targets, but a push back to these levels may also generate an opportunity to flip long.

For today, day traders can probably look for something from the semiconductor index. Longs are probably still holding after yesterday.