Market Brief G10 Advancers and Decliners vs USD NZD 0.49 CAD 0.26 AUD 0.18 SEK 0.17 GBP 0.15 NOK 0.14 DKK 0.12 EUR 0.11 JPY 0.08 CHF 0.01 Global Indexes Current Level % Change Nikkei 225 Index 18438.67 0 Hang Seng Index 22631.73 0.76 Shanghai Index 3290.93 3.38 FTSE 100 futures 6416.16 0.62 DAX futures 10096.6 1.03 SMI Futures 8680.21 0.06 Dow Jones Industrial Average futures 17804 0 Global Indexes Current Level % Change Gold 1166.58 0.8 Silver 15.98 0.85 VIX 17.08 -1.96 Crude wti 50.1 0.94 USD Index 94.76 -0.05

Risk appetite opened up stronger in the Asian session. Regional equity indices were broadly higher on good Chinese data and expectations for the Fed to delay hikes. The Shanghai Composite rose 3.06% and Shenzhen composite increased 4.10% pulling the Hang Seng up 0.92%. Japanese market were shut for holidays. In the FX markets, the USD was sold-off as emerging market and commodity currencies continued to attract bargain hunters. Fed Reserve Vice Chairman Stanley Fischer sounded hawkish, stating that policymakers are still likely to raise interest rates this year. He added that this view was contingent on the global economy which could push the US economy off course. Markets shrugged off Fischer’s hawkish view. EUR/USD climbed to 1.1378 from 1.1354 as Mario Draghi suggested that ECB’s quantitative-easing program is working well, decreasing the likelihood of additional easing. NZD/USD rose to 0.6707 from 0.6673 as REINZ house sales increased 38.3%y/y down from previous increase of 41.7%. A softer read but still a very solid number as national median house prices set a new record at NZ$484,650. With markets closed (US bond market holiday) US yields curves was unchanged as the 10-Year treasury yields held at 2.08%. Commodity prices remain firm led by recovery in copper, gold and oil prices (helped by Glencore (L:GLEN)'s announcement to sell copper mines in Australia and Chile). Sentiment has clearly shifted in the commodity complex as opinion leader are now talking about having hit the bottom in prices.

Over the weekend, the PBoC announced plans to expand its credit asset pledged lending program. The program would increase from original two providences to ten providences. This program creates a procedure for banks to obtain liquidity from the PBoC. The expanded program should limit worries of a liquidity squeeze on banks and support general risk appetite. This move potentially triggered the PBoC deputy governor to indicate that China's stock markets corrections was “almost over.” The PBoC fixed USD/CNY 87 pips lower at 6.3406, while USD/CNY fell to 6.3218.

As quoted in Bloomberg, ECB president Mario Draghi comment that the ECBs QE programs was working better than anticipated, despite having taken longer to reach the intended inflation goal. The ECB President said in an interview that “it presently appears that it will take somewhat longer than previously anticipated for inflation to come back to, and stabilize around, levels that we consider sufficiently close to 2%,” and this was due primarily to the sizable fall in oil prices. The current trend of ECB speak seems focused on breaking the markets view that more easing is a forgone conclusion. However, subdued European data suggest that an extension of current program is likely.

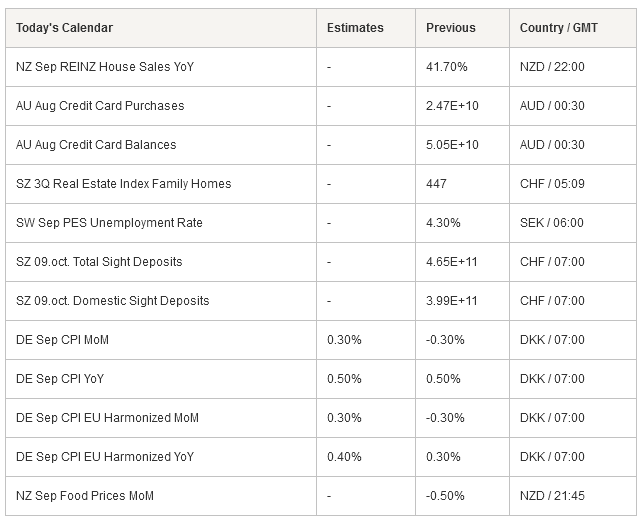

With the US on Columbus Day holiday and a lack of first-tier data trading activity will be subdued. Participates will be focused on unfolding events in the commodity markets. Despite dire warning oil prices continue to find demand as US drillers cut oil rig production for a sixth straight week, suggesting that the bull trend might not be finished. In the US markets, we will hear from a batch of Fed members Atlanta Fed President Lockhart, Chicago Fed President Evans and Fed Governor Brainard. The rate markets is now pricing in a March interest rate hike (61% no hike in Dec). With fear of a near term Fed hike now gone investors demand for high yielding beta currencies should continue.

Currency Tech

EUR/USD

R 2: 1.1561

R 1: 1.1330

CURRENT: 1.1305

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5659

R 1: 1.5383

CURRENT: 1.5366

S 1: 1.5089

S 2: 1.4960

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 120.15

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9644

S 1: 0.9513

S 2: 0.9259