Last week I discussed the growing divergence within the S&P 500 as the largest components of the index were outperforming the smaller SPX stocks. To continue on that topic, below we’re going to look at the S&P Midcap 400 Index (MID).

MID recently made a run back to its prior 2017 high but was unable to break out, creating a lower high in momentum, based on the Relative Strength Index. This creates the third major lower high since December as momentum continues to weaken for this mid cap index.

While the 100-Day Moving Average was able to provide some support during the low earlier in the year, price has been unable to gain transaction along with large cap U.S. equities. The bottom panel of the chart below shows the relative performance of the S&P 400 vs. the S&P 500. With relative performance having peaked in December, the ratio line has been putting in a series of lower highs as mid caps struggle to keep up. While price is still well off prior lows, relative performance is beginning to creep closer to the 2017 low, a bad sign for mid cap stocks.

Looking at volume on this daily chart, we can see a recent increase in large selling days. In early April we saw three consecutive, above-average days of selling as a short-term low was put in for MID. However, more recently two additiional days of above-average, down volume have taken place – a sign many traders attribute to institutional selling.

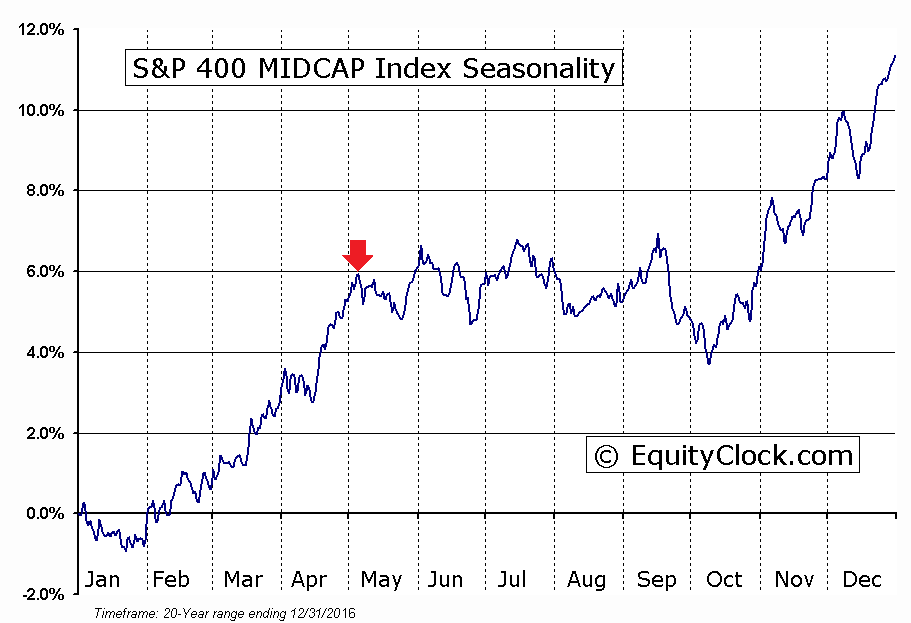

Turning our focus to seasonality, this recent weakness in the mid cap index begins to make a little more seense. Based on the below chart from EquityClock, over the past 20 years, the S&P 400 has put in a short-term high in early May before picking back up later in the month

Going forward I’ll be watching to see how MID acts if price gets back to the prior 2017 low and if the relative performance ratio does in fact set a new low. This period of weakness aligns with long-term seasonality. If the seasonal pattern continues to play out, we could see mid caps weaken further until later this month.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer.