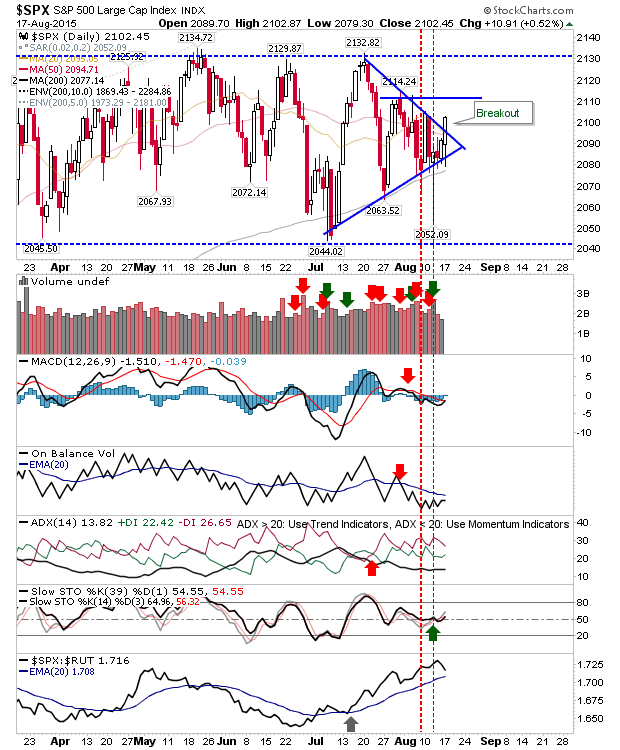

The larger picture still holds to trading ranges, but the coiling action in the S&P suggests an upside breakout is in the making. It qualified on the basis of price, but volume yesterday was disappointing. Bulls will be happy, but today needs volume buying to suggest this breakout is genuine.

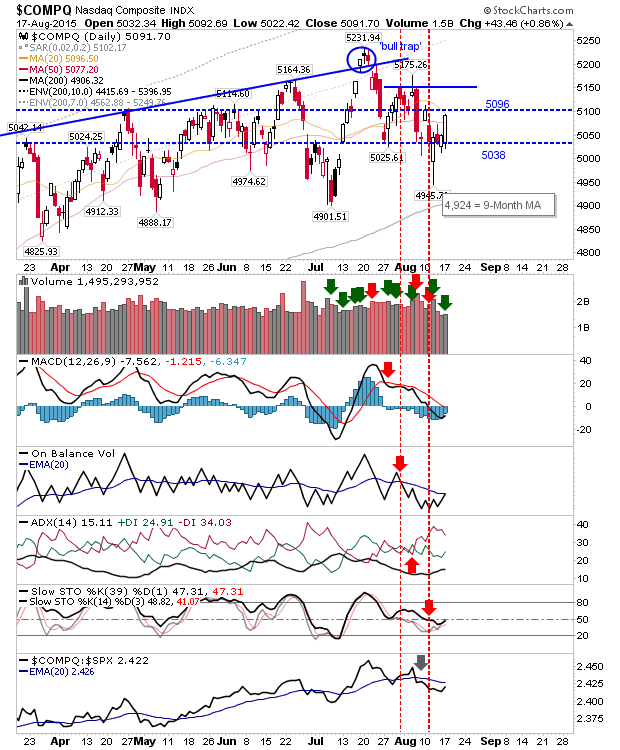

The NASDAQ did a little better. It managed to register an accumulation day, but the uptick was modest. The July swing high is next up, but resistance at 5,096 has to be navigated first.

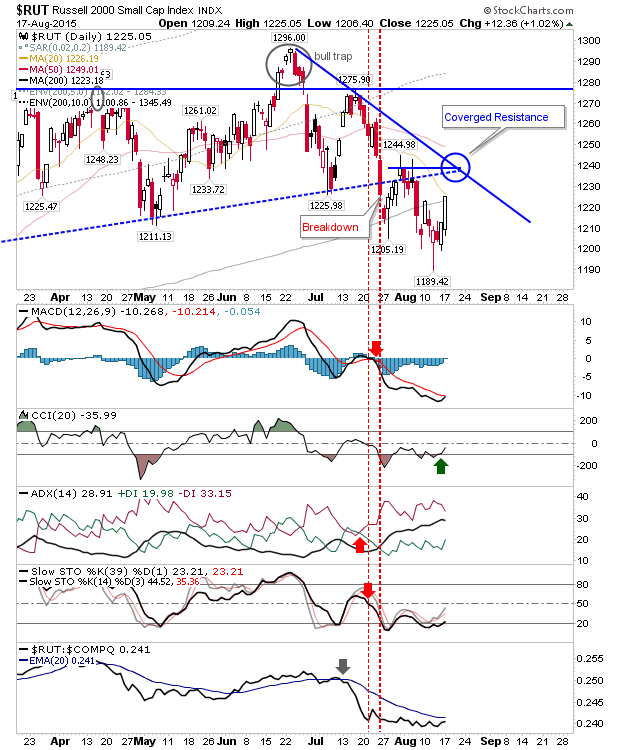

The Russell 2000 returned to its 200-day MA. There is converged resistance at 1,238 which looks like a magnet for a test. It will be interesting to see if a rally can repair the significant technical damage done to this index.

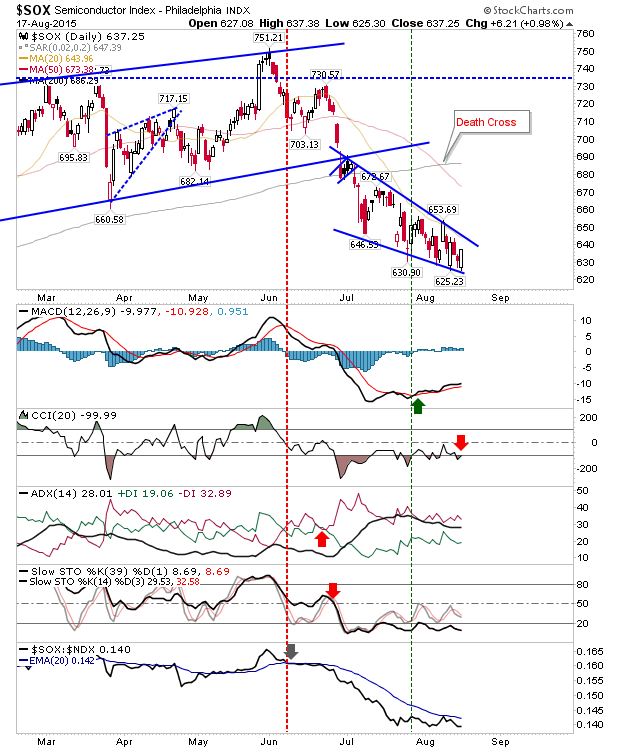

The Semiconductor Index continues to shape its bullish wedge, offering excellent value to those who purchased it at the open yesterday.

Today will be about holding yesterday's gains and adding some volume to the mix. Shorts will feel some pressure, but the real buyers aren't willing to commit yet.