As I’ve mentioned, it’s going to be an unusual time for me, because I am making the long trek (and perhaps insane, considering how many are intending to do the same) up to Oregon to witness the once-in-a-lifetime total eclipse. We’ll see if I regret it or not.

Speaking of regret, we need to see what next week holds. We are at such a crucial crossroads right now. The past two weeks have been a total kick, all thanks to Trump’s antics. The big picture still screams “doomed market”, but the shorter-term picture is more uncertain. Simply stated, if we have a good solid down day on Monday, we are in a complete different ball game. A firm bounce, however, may mean more of the same.

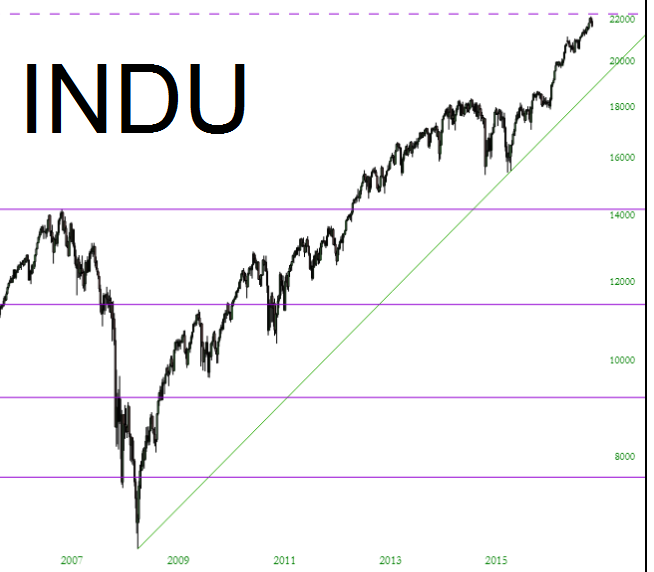

Looking at the Dow Industrials, there is still plenty of room for hope that the bears will get to enjoy things more.

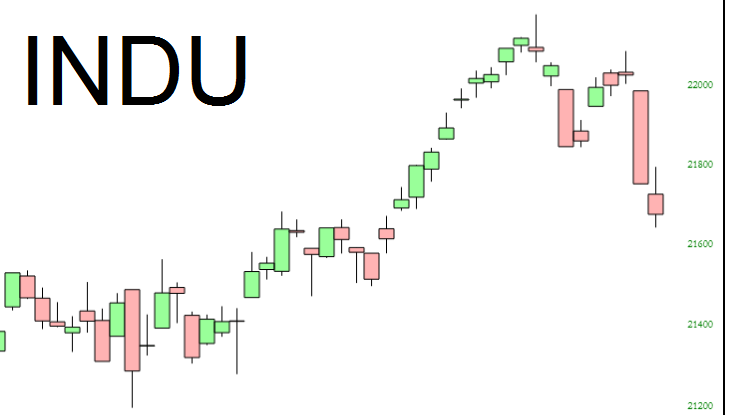

Looking closer, however, we’ve come down very fast, and as was the case during that ridiculous “North Korea” episode, we could be in for another boring bounce. Those are a drag. I’d prefer the market simply collapse into shambles, but last time I checked I had no control over it.

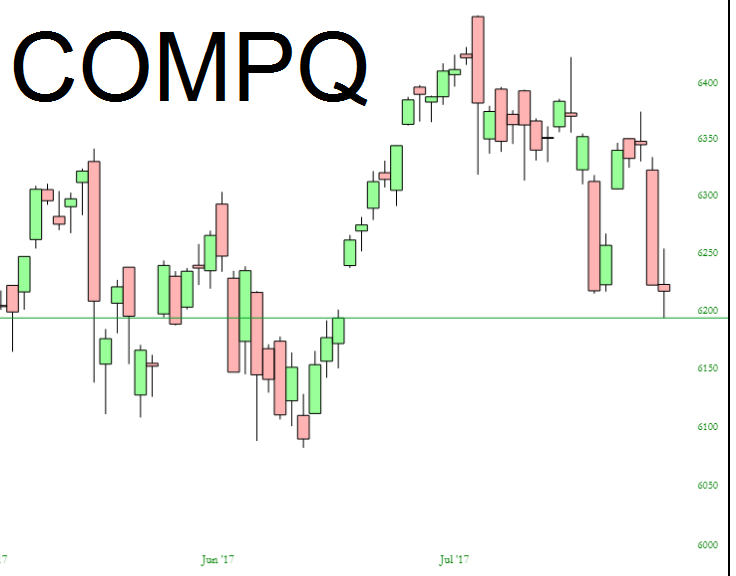

The story is similar on the NASDAQ. For whatever reason, the last two Thursday were the big smack-downs (and almost identical in size).

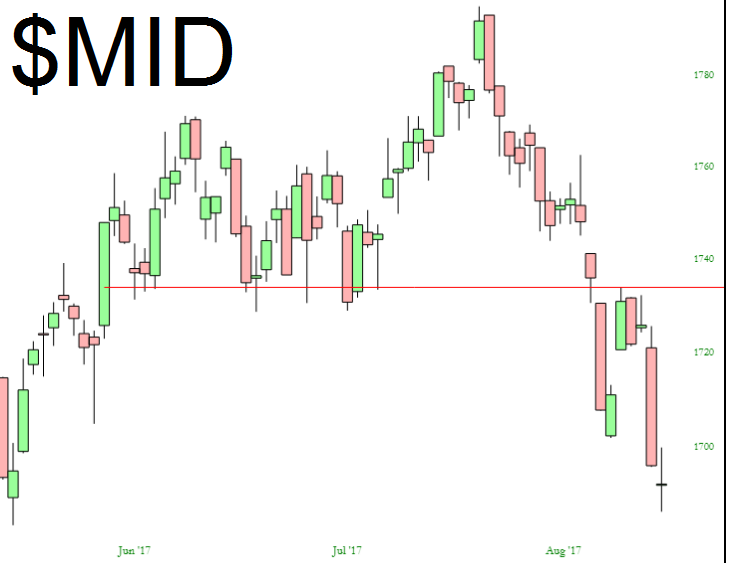

Even if we do get a bounce, the bulls still seem fairly hosed to me. Just take a look at the Mid Caps; see that green line, far away from present prices? That’s primary support. The broken horizontal line defines the top, and we’re cleanly beneath it.

A closer look shows the breakdown more plainly. The small caps and mid caps have been tumbling for a few weeks.

The easiest index for me to “read” these days is the Russell 2000. Long-term, it looks like a slam-dunk for the ursine set.

But, once again, we’re getting to a “bounce or break?” moment. The most meaningful test is the one I’ve highlighted below. If we break that, all hell is going to break loose.

Let’s wrap things up with the S&P 500: as I mentioned Friday morning, I sold my SPY (NYSE:SPY) puts based on the fact it tagged an intermediate-term trendline. The longer-term trendline (green) is miles away, however.

The “break or bounce” is equally important here. Historically, that blue line has been a beast for the bears; perhaps the chaos in the White House will change things for the better.