If you have not been paying attention to what is happening in gold, silver and platinum over the past 3+ days, then read this research article carefully. If you have been paying attention to the move in precious metals, then keep reading to learn why this move is so important.

Precious metals have been on the move higher for much of the past 24+ months. Yet, certain forces have attempted to quell the upside advance as global investors adopt a more fearful stance relating to the global economy. As the COVID-19 virus event hit, a big downside washout move took place in gold and silver. This type of low price rotation is a common pattern as traders are forced to liquidate precious metals positions to cover margin requirements related to open long positions in a deep downside price move. After that washout move completed, we saw precious metals, particularly gold, rally back to previous price levels, while silver meandered near $16~$17 for a while before breaking higher.

Our research team has been warning that silver would become the super-hero of metals in the near future and recently we issued further research posts to support the upside price move we've seen in silver prior to the current big breakout rally. Read some of our earlier posts here.

Sept. 24, 2019: Is Silver About to Become the Super-Hero of Precious Metals?

May 29, 2020: Metals Nearing Critical Momentum for New Parabolic Rally

July 13, 2020: Gold & Silver Measured Moves

The Warning Shot Has Been Fired

If you understand anything about precious metals and how the operate as a hedge against perceived risk in the global markets, then you already understand what I'm about to state. This huge breakout move in silver and gold is a massive warning shot fired across the bow for global investors. The idea that the U.S. stock market can continue to climb to frothy highs while COVID-19 erodes the global economy, credit, debt and trade is moronic. Yes, certain stocks are generating decent revenues and returns, but we are talking about a potential global economic contraction of nearly 20% to 30% or more over the next 16+ months. 40+ million U.S. workers are currently unemployed and many states are already re-issuing “shutdowns” again because of surges in the COVID-19 virus cases.

The first warning shot has not been fired for all to see. It was big, loud and easy enough for anyone with more than two brain cells to see. This is how precious metals tells us that many global investors don't believe the current U.S. and global stock market valuations are legitimate.

It also pushes a very big concern for COMEX and other exchanges relating to the open short positions in gold and silver.

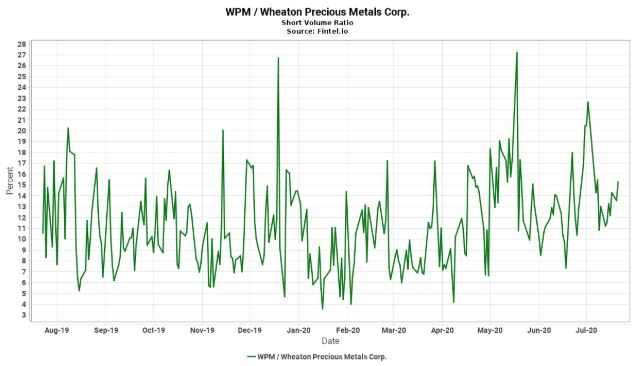

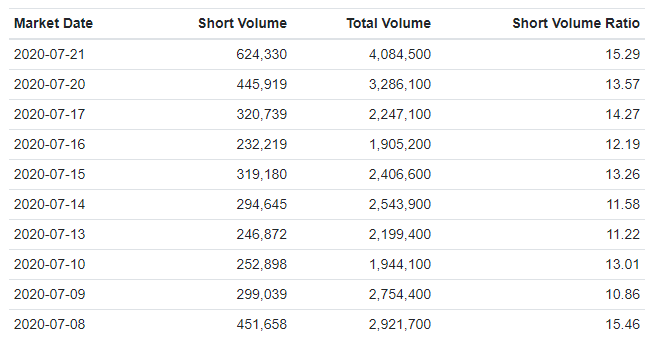

Short volumes in precious metals have recently climbed from 10.86% of total daily volumes to 15.29% over the past 7+ trading days. Historically, these {{|https://fintel.io/ss/us/wpm}} have peaked near 25% to 26% recently. We believe the institutional and private short-sellers are getting squeeze by a 50-ton press right now and that COMEX may have a massive shortage of deliverable material if this rally continues. Many larger firms will simply want to “take delivery” of physical metals if they believe this is the start of a massive upside rally.

Short Volume Ratio Chart

Short Volume Ratio Data

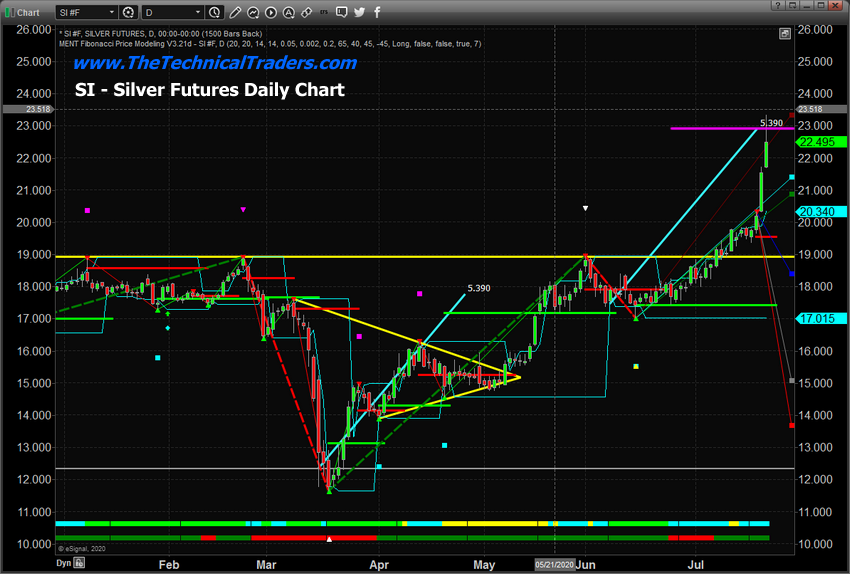

We authored a research article just last week suggesting multiple “measured moves” were about to take place in both gold and silver. As of this morning, silver had reached our predicted measured move target near $22.95 and has started to stall. Gold still has quite a ways to go to reach our target level near $1,935. The fact that silver has already reached the initial measured move target suggests that silver may contract and setup a new momentum base over the next 3+ days before attempting to move higher. Gold, on the other hand, should continue to rally higher attempting to target the $1,935 level while silver sets up a new base (even though the new base may only last a few days).

This daily silver chart highlights the huge breakout move that recently took place and should send a big warning to all traders and investors throughout the globe – something big is taking place. Precious metals don't move like this unless there is massive risk in the markets. The only thing our researchers believe is likely to happen is a surge in new COVID-19 cases pushing many states into shut-downs again and tanking the minor economic recovery process that has just started. We believe the second phase of this process is extended consumer, retail, real estate and massive pension, debt and credit issues for consumers, cities, states and other entities. All of this may only be 2 to 5+ months away from landing on our “deck.”

Silver Daily Chart

The S&P 500, Dow Jones Industrial Average, Transportation Index and SPY (NYSE:SPY) have all stalled recently after rotating near major resistance. The NASDAQ has pushed even higher as traders pile into the technology stocks, which seem to be bucking the trends. The U.S. Federal Reserve will continue to attempt to support the markets throughout the remainder of 2020 and early into 2021, yet the U.S. Presidential Election and the destruction to consumers may hit the markets before we can blink. Delinquencies are starting to skyrocket and the housing market, which by all data measures seems to be rolling along, is starting to fracture.

We believe skilled technical traders must adopt a very cautious portfolio balance right now or risk a massive blowout event – similar to what happened in 2008-09. This move in precious metals is a huge warning to anyone willing to pay attention.

In Part II of this article, we'll go deeper into detail showing you what is likely to happen in the SPY and precious metals markets over the next 6+ months.