Tuesday March 26: Five things the markets are talking about

Global equities have rallied overnight after two session of losses as the U.S 10-year Treasury yields backed away from this year’s low yield print, but the outlook remains somewhat uncertain as investors weigh the possibility of the U.S slipping into a recession.

Note: The 10-year note has backed up to +2.442%, having lost -5 bps yesterday and dropped temporary below the three-month bill.

U.K MP’s take control for a day

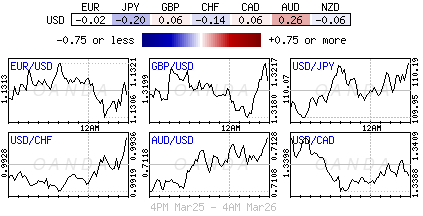

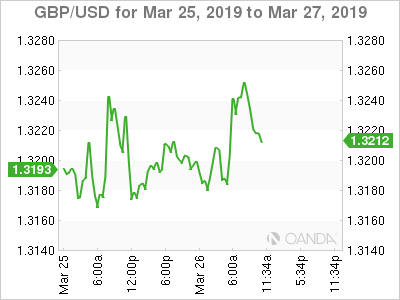

In FX, sterling (£1.3185) has edged lower after PM Theresa May lost control over the Brexit process in a U.K Parliament vote late last night. MP’s may now be able to demand that the PM pursues radical Plan B options, potentially including a second referendum, keeping Britain in the EU union, or even canceling Brexit. Remember, a no-deal Brexit does remain on the table!

MP’s are expected to vote on a range of Brexit options tomorrow (Mar 27), basically looking to agree on a deal with closer ties to Brussels – and then try to drive the government in that direction.

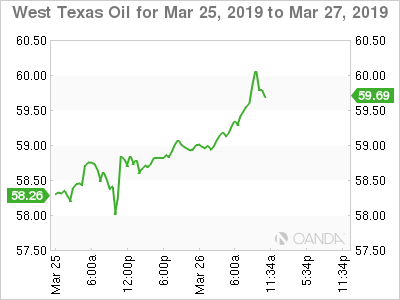

In commodities, oil prices have rallied for the first time in a number of days amid rising tensions in Venezuela that again threaten to further curb supplies.

On tap: U.S consumer confidence & RBNZ monetary policy announcement (Mar 26), CAD trade balance & NZD business confidence (Mar 27), U.S final GDP (Mar 28), GBP current a/c, CAD GDP & U.K Parliament vote (Mar 29).

1. Stocks given the ‘green’ light

In Japan, the Nikkei rallied aggressively from its five-week lows print on Monday to close sharply higher overnight as cyclical stocks rose on short-covering. The market is also being supported by investor purchases of stocks before they go ex-dividend at the end of March. The Nikkei share average ended +2.15% higher, while the broader Topix rallied +2.57%.

Down-under, Aussie shares closed marginally higher overnight, helped by mining shares and an uptick in U.S Treasury yields. The S&P/ASX 200 index firmed nearly +0.1%. The benchmark fell -1.1% on Monday. In S. Korea, the Kospi stock index rose slightly (+0.18%) overnight as foreigners turned net buyers following Monday’s sharp selloff. The index has risen +5.28% so far this year and fallen -1.5% in the previous 30 trading sessions.

In China, shares fell overnight, extending this week’s sharp losses as investors remain concerned over the outlook for global growth and the next round of China-U.S trade talks to take place later this week (Mar 28/29). At the close, the Shanghai Composite index was down -1.51%, while the blue-chip CSI300 index was down -1.13%.

In Hong Kong, equities were steady after Monday’s heavy losses, but investor sentiment remains fragile as concerns over the possibility of a U.S recession happening, and as China and the U.S prepare for this week’s high-level trade talks. At the close of trade, the Hang Seng index was up +0.15%.

In Europe, regional indices trade mostly higher following on from a stronger session in Asia overnight and higher U.S futures this morning.

U.S stocks are set to open in the ‘black’ (+0.25%).

Indices: Stoxx600 +0.29% at 375.42, FTSE +0.41% at 7,207.25, DAX -0.06% at 11,340.28, CAC-40 +0.35% at 5,279.12, IBEX-35 +0.04% at 9,183.12, FTSE MIB +0.15% at 21,090.50, SMI +0.52% at 9,354.10, S&P 500 Futures +0.25%

2. Oil prices rise amid ongoing supply cuts, but recession fears loom, gold lower

Oil prices have rallied overnight, pushed up by supply cuts led by OPEC+ and U.S sanctions against Iran and Venezuela, although investor concerns about a potential recession is keeping a lid on the market for now.

Brent crude oil futures are at +$67.48 per barrel, up +27c, or +0.4%, from yesterday’s close.

U.S West Texas Intermediate (WTI) futures are at +$59.35 per barrel, up +53c, or +0.9%, from Monday’s settlement.

Oil prices have been supported for much of this year by efforts by OPEC+, who have pledged to withhold around +1.2M bpd of supply this year to prop up markets.

Market consensus believes that OPEC is likely to extend its current supply cut deal for the duration of 2019 when they next meet in Vienna in June. Russia has been a reluctant partner in the supply cuts but is expected to opt to preserve the deal and retain a leadership role within the group that accounts for +45 % of total global oil output.

Support for the ‘black stuff’ has also come from U.S sanctions against OPEC-members Iran and Venezuela.

Note: Iranian crude oil shipments have averaged just over +1M bpd this month, down from +1.3M (NYSE:MMM) bpd in February, while in Venezuela, production has plummeted from +3M bpd in 2000 to +1M bpd in 2019.

However, recession risk is at an 11-year high, and it’s this fear that could dent global fuel consumption.

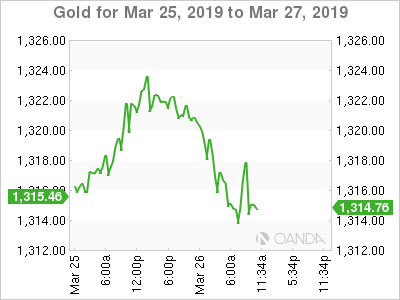

Ahead of the U.S open, gold prices have eased overnight, after hitting a one-month high in Monday’s session, as a recovery in equity prices and U.S Treasury yields help reduce some of the ‘yellow’ metal’s safe-haven appeal. Spot gold is down -0.3% at +$1,317.46 per ounce, after touching its highest since Feb. 28 at +$1,324.33 yesterday. U.S gold futures are down -0.4% at +$1,317.10 an ounce.

3. Sovereign yields back up, but recession fears loom

Ten-year German government Bund yield remains below the psychological zero print as recession fears dominate market sentiment and Brexit troubles drain market liquidity.

U.K MP’s voted Monday to take control of parliament for a day from PM May, meaning they are now expected to vote on various Brexit options tomorrow.

However, a ‘no-deal’ Brexit actually occurring would see a massive swing to owning more German bunds, which could push the 10-year Bund yield much deeper into negative territory and trigger more flattening of the long end of the German yield curve, and a very strong widening of credit indices.

Currently, German Bund yields remain atop of their three-year low at -0.027%, as fears of global economic slowdown continue to dictate investment strategies along with Brexit.

The U.S 10-year Treasury yield (+2.428%) fell to their lowest since December 2017 yesterday, causing the curve between three-month bills and 10-year notes to invert further as investors evaluated last week’s “dovish” pivot by the Fed.

Elsewhere, Aussie 10-year yields hit a fresh record low overnight before rising about +5 bps to +1.83%.

4. Pound unfazed by latest Brexit development

Sterling (£1.3175) trades largely flat after posting a modest rise yesterday after the U.K parliament voted to take control of the Brexit process. Market consensus believes the majority of MP’s would prefer a move toward a permanent custom union option, which would in turn would require an extension of Article 50 by the year-end. The downside is that a long extension to Brexit would bring “prolonged uncertainty.” EUR/GBP is at €0.8576. U.K MP’s will now decide whether to back ‘indicative’ votes on alternatives to U.K PM May’s divorce deal.

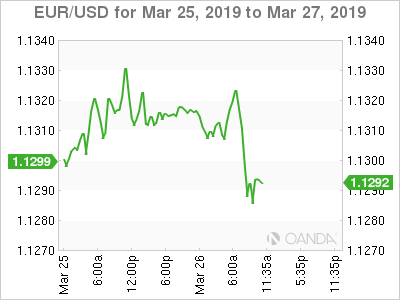

Elsewhere, the yen has slipped -0.2% to ¥110.15, while the offshore yuan is steady at ¥6.7144 and the EUR is little changed at €1.1317.

Note: The focus is on the Hungary Central bank rate decision where the MNB is likely to begin its ‘normalization’ process.

5. German consumer morale slips despite job market

German data this morning shows that German consumers are less optimistic heading into April despite a renewed growth outlook and a vibrant labour market.

Market research firm GfK’s forward-looking monthly barometer stood at 10.4 points for April, down on 10.7 for March.

The gap has “once again narrowed” between rising consumer expectations of changing economic conditions and declining earnings-related conditions, against the backdrop of strong labour market performance, the GfK noted.

“The coming months will show whether this is the beginning of a turnaround,” said GfK in a statement.

The pollsters said consumers “do not expect Germany to slip into a recession this year”.

They do however expect a noticeable slowdown in the economy, like Germany’s ‘wise men’ panel advising the government who last week lowered their GDP growth forecast for this year to just 0.8 percent.

Also weighing on the GfK survey was a drop in both expectations of income and desire to consume, the latter of which has fallen to a level last seen two years ago.

Note: German unemployment remains at historic lows, with just +5.0% of people out of work in Europe’s largest economy.