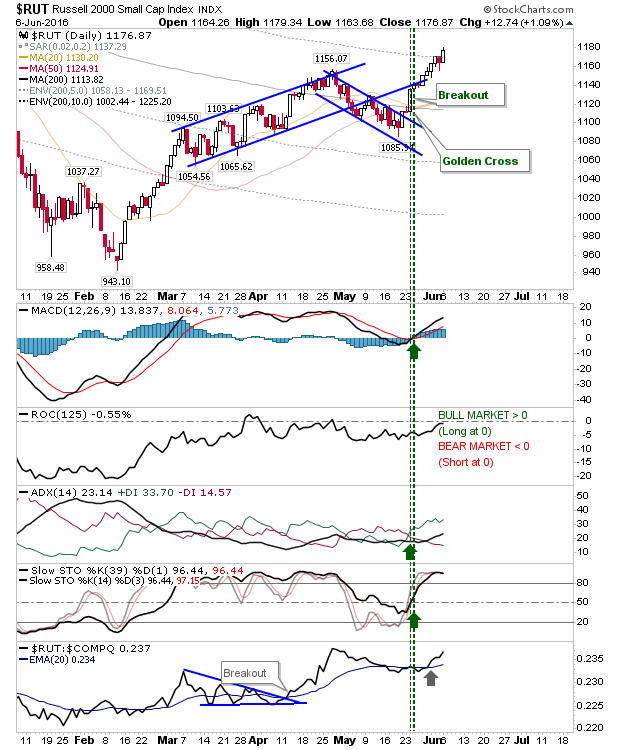

Yesterday the Russell 2000 led the market out with a 1%+ gain as relative performance continued to gain ground; the next phase of the Small Cap rally is well underway. This is good news for bulls looking for gains to continue throughout the summer.

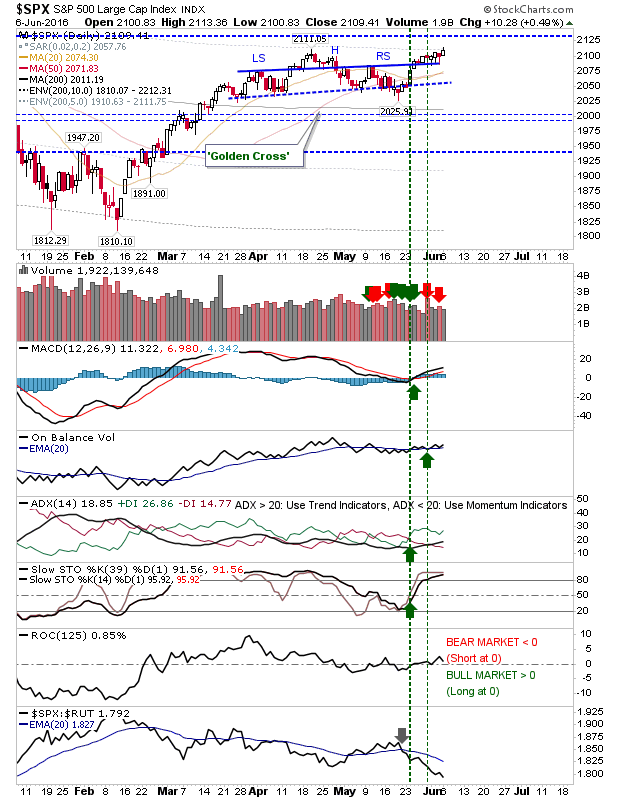

Activity was a little more muted for the S&P. Volume was light and 2016 highs haven't been broken yet, but Friday's loss was reversed. The Head-and-Shoulder pattern looks well and truly cooked.

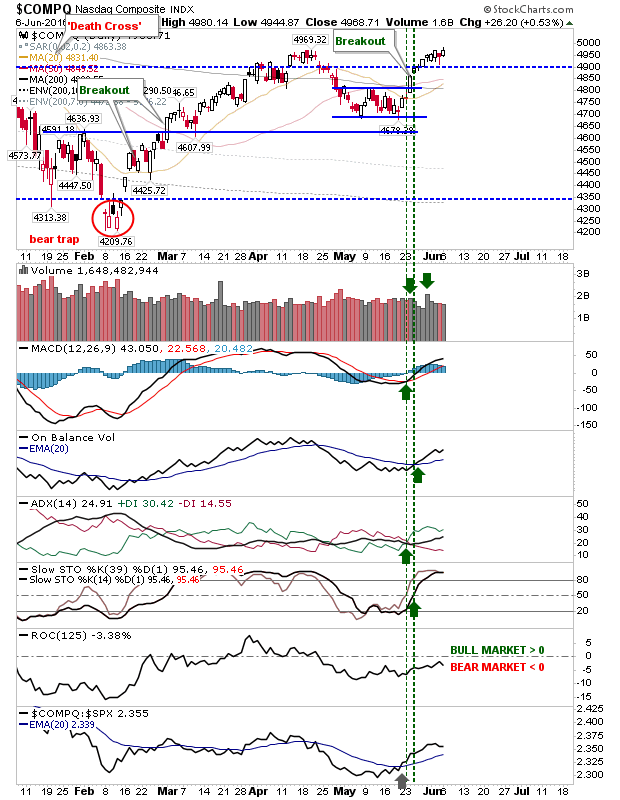

The NASDAQ almost closed above 2016 highs. Shorts may think this is a low risk opportunity, but given the action in the Russell 2000 I suspect this will head higher.

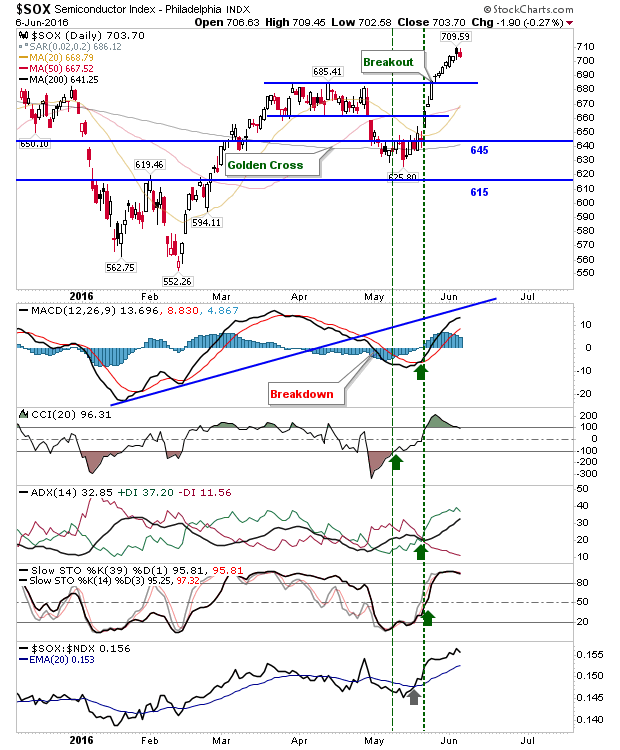

The Semiconductor Index had looked bearish on Friday, and Monday followed through on this. It wasn't a big loss, but there may be more follow-through in the morning session.

For tofsy, look for more of the same—gains in lead indices and Russell 2000 in particular, losses in Semiconductors.