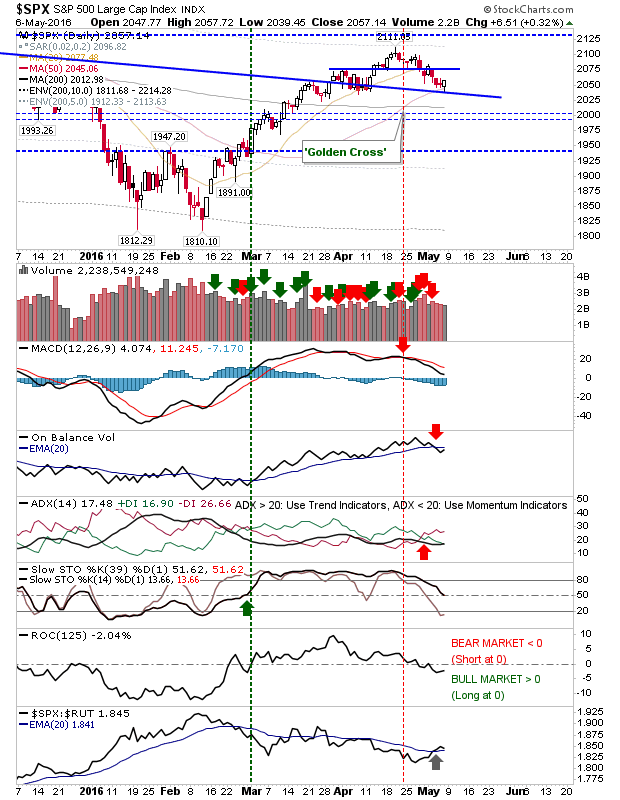

Friday delivered a positive end-of-week close after a sequence of down days. Volume was not impressive and was below mid-week selling.

The S&P dug in at its 50-day MA, but is holding to 'sell' triggers in the MACD, On-Balance-Volume, and -DI/+DI. Relative performance finished the week with Large Cap strength over Small Caps. Rate-of-Chart moved back to the bullish mid-line in what could offer itself as a bullish buyback opportunity.

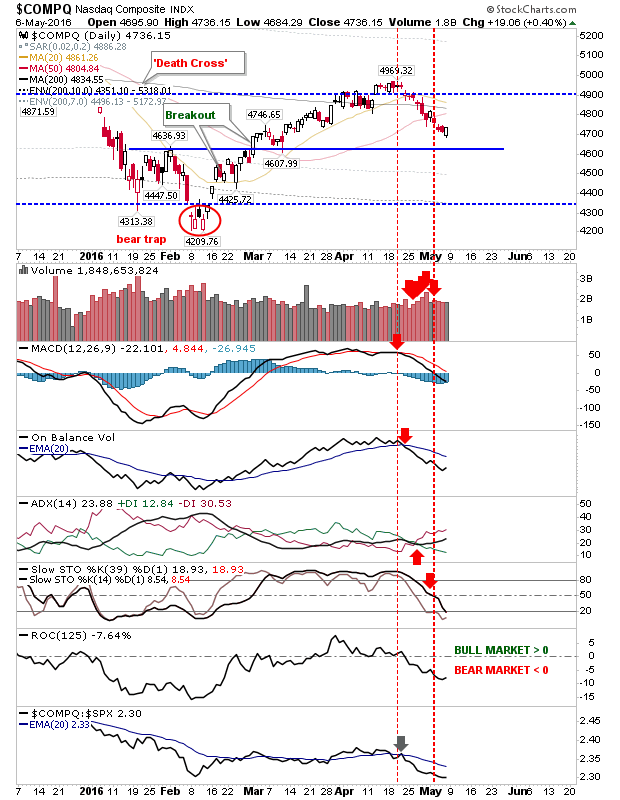

The NASDAQ remains above nearest support on net bearish technicals. The premise for a swing low could be on offer if there is a gap higher today, Monday, but the index looks to be in a bit of a no-man's land with converging resistance of 20-day, 50-day, and 200-day MAs overhead.

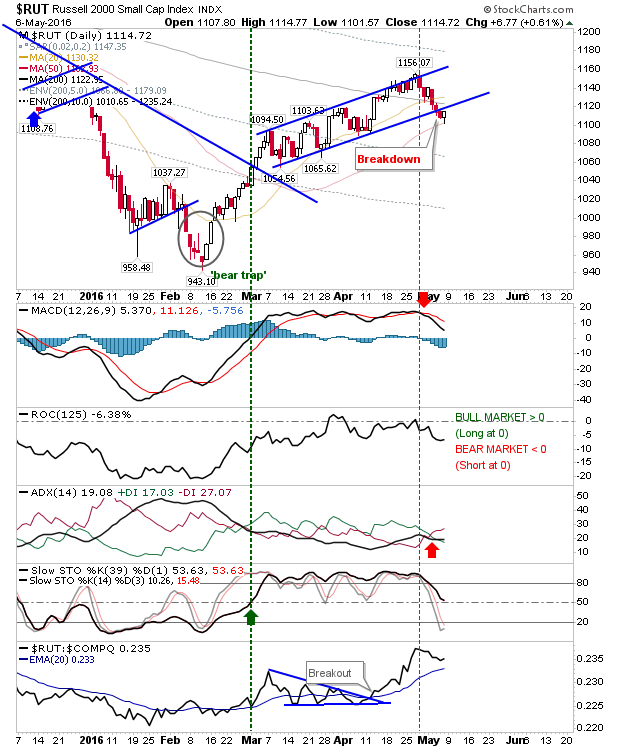

The Russell 2000 finished with a bullish hammer with a low tag off the 50-day MA. Slow Stochastics [39,1] is down at potential mid-line support and is holding to strong out-performance relative to the NASDAQ.

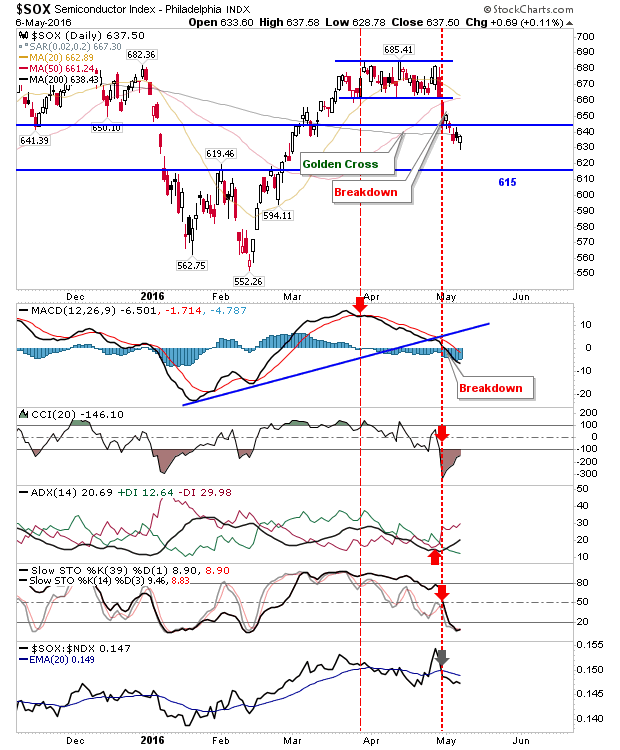

The Semiconductor Index found support at 200-day MA with converged oversold stochastics of [39,1] and [14,3]. Aggressive buyers may look to take advantage of the dip.

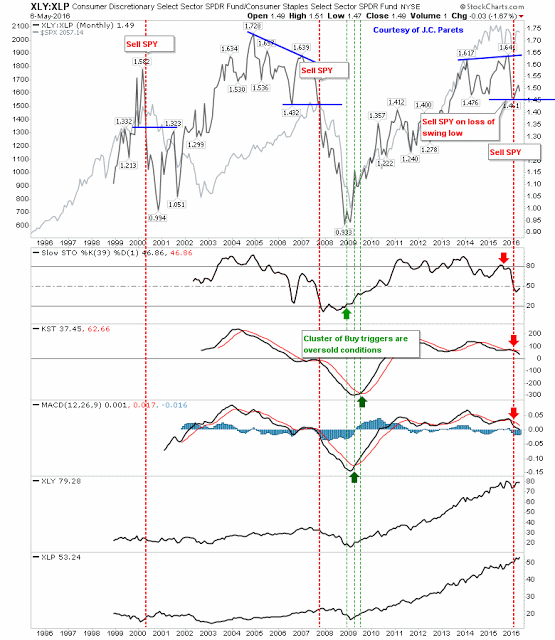

The relative relationship between Staples (via Consumer Staples Select Sector SPDR (NYSE:XLP)) and Discretionary (via Consumer Discretionary Select Sector SPDR (NYSE:XLY)) bounced weakly for April and ticked lower for the first part of May. Technicals in this relationship remain bearish and are some way from oversold levels typical of a solid swing low in the broader market.

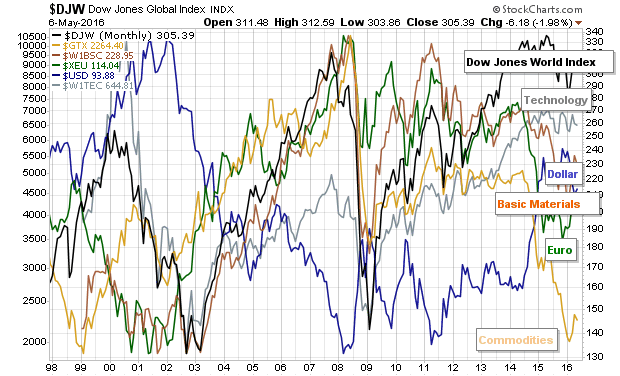

In general terms, Commodities remain in deep discount territory, but Global Stocks look overvalued.

For Monday, bulls should look to the Semiconductor Index and S&P for leads. A positive start will also help Small Caps return above former channel support. If there is a slow start to the week, then the NASDAQ has the potential to drift lower without the need for active selling, but should sellers make an appearance then it could be painful.