Market Brief

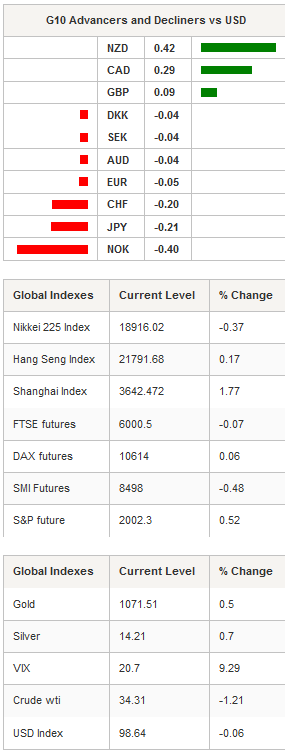

Asian equity markets diverged overnight as we head into Christmas week. The PBoC set USD/CNY lower for the first time since December 3rd to 6.4753, down from 6.4814 on Friday. The Shanghai Composite climbed 1.77%, while the tech-heavy Shenzhen Composite rose 0.96%. In Japan, equity indices were heading south for the third straight day as investors are still trying to determine whether the modification of the BoJ’s QQE last Friday should be considered as a stimulus. The Nikkei was down 0.37%, while the broader TOPIX index fell 0.38%. USD/JPY traded sideways in Tokyo and remained within 121.04 and 121.51. Over the medium-term, the pair is also trading range bound between 118 and 125.90.

In Europe, according to the poll results from Spain, the stability of the union is set to be strongly challenged during 2016. Indeed, the 2015 Spanish general election put an end to the traditional bi-party political system, a system which had been in place since the seventies, and delivered a hung parliament as the two new forces - i.e. left-wing anti-austerity Podemos and liberal Ciudadanos - won nearly a third of the seats. It is therefore likely that political uncertainty in the euro zone will make the headlines in 2016, adding pressure on the EUR. However on the short-term, investors do not seem overly concerned as EUR/USD moved between 1.0849 and 1.0883 during the Asian session; the bias remains positive.

In Brazil, the uncertainty escalated another notch as Finance Minister Joaquim Levy announced its resignation on Friday. The Brazilian real got hammered and fell 2.63% against the US dollar and 3.18% against the euro. 2016 will therefore be a challenging one for the world’s seventh biggest economy with the impeachment process, further potential cuts of its sovereign ratings and a widening fiscal gap. The pressure on the BRL will likely remain elevated as newcomer, Nelson Barbosa, will most likely be less hawkish regarding the much awaited austerity measures. USD/BRL closed at 3.9831 last week.

In Europe, equity futures indicate a lower open with the FTSE 100 down 0.07%, the SMI down 0.48, the CAC 40 down 0.28%. The German DAX was up 0.06%, while the Spanish IBEX 35 dropped 2.95% amid the general election results. EUR/CHF is trading around 1.08 and USD/CHF is on its way back to parity.

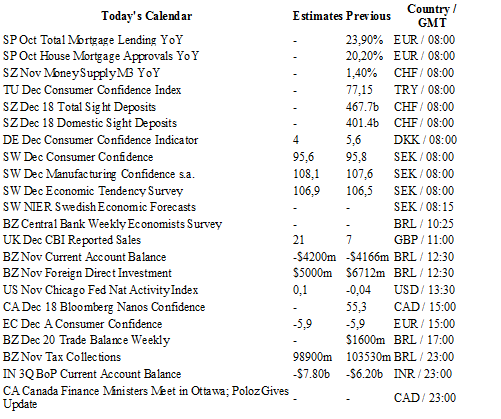

Today traders will be watching consumer confidence from Denmark; current account balance and foreign direct investment from Brazil; consumer confidence from the euro zone.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0862

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5529

R 1: 1.5336

CURRENT: 1.4908

S 1: 1.4857

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 121.41

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 0.9944

S 1: 0.9476

S 2: 0.9259