By now you are probably aware that the equity markets suffered brutal 4+% slides past week. Still, the real story of last week was in the credit markets, where expectations of “inflation fighting” increased monetary tightening began the week rising quickly only to be abruptly reversed by an unexpected outgrowth of contagion from the smoldering crisis in the crypto markets.

In other words, the Fed’s cure for inflation may have begun what will soon be called “a banking crisis” that ignited last week in crypto-centric financial firms.

The contagious crypto crisis and lower bond prices (higher rates) are now undeniably infecting important regional banks. As a result, the coming week may reveal a catalyst that justifies a Fed pivot much sooner, for very different reasons, and leading to more uncertainty than any market has currently priced in.

The roller coaster of expectations and prices began earlier in the week (Tuesday) with testimony to Congress by the Chairman of the Federal Reserve, Jay Powell. Most analysts, economists, and reporters expected that the Fed would stay on the same path laid out over the past year. That path includes another 2 or 3 small Fed raises of 0.25%, which would put the target for short-term rates close to 5.0%.

Instead, he voiced a much more hawkish concern and, given some of the recent economic numbers, suggested that larger increases (0.50%) may be necessary at their upcoming FOMC meeting in two weeks.

Here is what the Fed Chairman said on March 7th to Congress:

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

In other words, the Fed’s war on inflation and the economy continues. The Fed is insinuating that it could raise interest rates higher and faster than it has already telegraphed. With this, the two-year Treasury rate climbed above 5% and created more than a 100 basis point 2/10 inversion.

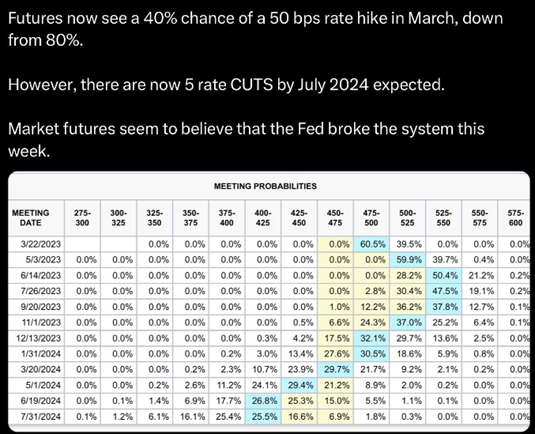

After Chairman Powell spoke to Congress and suggested more rate hikes (not less) may be necessary, the probability that the Fed would raise rates by 0.50% went up dramatically to 80%. As you’ll read shortly, these probabilities have since declined.

However, this inversion implies with a great degree of certainty that we will see a recession in the next few months as this steep inversion has ALWAYS signaled a recession in the future.

Many economists and analysts believe the Fed is being way too aggressive in waging this battle. Most of these folks believe the Fed is trying to destroy demand instead of trying to fix supply, which would bring down inflation faster.

It appears that the Fed has resorted to aggressive interest rate rising actions that worked in the past (1970s) while newer progressive thinking implies that they will destroy the economy (or already have). Here is what a few of these folks had to say:

Art Laffer: “Producing more apples is counter inflationary; producing fewer apples raises their price.”

Economist Jeremy Siegel, Wharton Professor, March 9th, 2023: “It’s not the job of the Fed to offset a supply-side shift [ i.e., Shortages]. They control aggregate demand. I think their focus on how tight the labor market is-suddenly, a monomaniacal type of focus-is the wrong way to go about it [“It” being, reducing hyperinflation].”

Economist Larry Kudlow’s recent comment on March 8th, 2023: “It would seem that the Fed is intent on slaughtering small businesses.”

My comment: The issue with today’s hyperinflation is that it is an aggregate supply shortage problem, not an excess aggregate demand problem.

The way that the Fed is trying to resolve this hyperinflation is as if it’s a DEMAND problem. Raising rates this fast in such an unprecedented steep fashion is really intent to inflict sufficient economic harm on households and small businesses. The Fed is trying to make people cut back on their purchases to reduce aggregate demand for goods and services. At the end of the day, this policy does not help create more goods or more apples, which could effectively increase supply, satiate any excess demand, and pull down inflation.

Now, this is starting to affect the banking industry. (taken from Dr. Bob McHugh of Technical Indicator Index publication):

“Banks face three major risks from the Federal Reserve Bank Open Market Committee’s historic rapid and ascending interest rate actions.

One risk is credit risk, where borrowers with loans tied to prime are seeing their required monthly debt service payments rise, resulting in higher delinquency rates, loan payment defaults, and as a result, an increase in loan loss charge-offs. Add to this credit risk actuality, there is a bogus risk from overzealous Bank Examiners classifying loans that may be satisfactory for the moment, as doubtful or loss, which requires banks to book additional loan loss expenses to fund reserves for projected losses by the Fed Examiners that may or may not actually happen.

Fed Examiner overzealousness was a key causal factor in exacerbating the 1990-1991 Recession, the 2000-2003 Recession, and again in the 2007-2009 Recession. The Fed nails the economy from two directions, front (Powell) and back (Bank Examiners).

The second risk is a deterioration in the current market value of securities with fixed interest rate yields below current market interest rates. Banks can have on average, up to 25% of their assets in securities portfolios. Should they have to sell them, if they are in an available-for-sale category that has to be marked to market, they may have to take losses for the deterioration in market value in this rising interest rate environment. They also might be required to sell their asset portfolios of fixed-rate securities, or even loans that can be securitized for liquidity reasons, at substantial losses for the reason of this next, third risk.

The third risk is a liquidity crunch or deficit, which requires asset sales to pay obligations such as customer deposits. If the value of the assets being sold is inadequate to pay customer withdrawals, i.e. if a run on the bank occurs, it can result in insolvency for the bank, FDIC receivership, and a wipeout of shareholder equity and the value of their stock in the bank.

Now, most of this is Fed-induced destruction, again, as the Fed has embarked on a foolish, ill-conceived path to weaken and even destroy, the financial strength of pretty much everyone and every business. The Fed cannot fix a supply shortage inflation problem by killing the economy unless they are irreparably incompetent or profoundly wicked”

How is This Playing Out? Enter SVB

In just the past two days, SVB Financial Group (SIVB), the holding company for Silicon Valley Bank, lost $2.0 billion from forced asset sales necessary to raise the liquidity to handle a run on the bank from massive spontaneous customer deposit withdrawals.

Just a few days ago, SIVB was trading at $225 a share, a P/E of 10, and analysts thought the stock was worth $250 or more. There has been NO Wall Street analyst covering the bank with a SELL rating. Its market cap had been over $13 billion.

At 11:30 on Friday morning, the FDIC (Federal Deposit Insurance Corporation) took over as the receiver of the bank. The stock, which at one time was selling for more than $700, was effectively worthless, and its bonds were just about worthless as well. See charts of overnight trading Thursday-Friday. See the chart below:

Another chart that clearly shows the quick nosedive of the stock is below:

What Happened?

Thursday morning, the bank announced that it was selling government securities (at a loss) to meet customer deposit withdrawals. Their initial plan was to raise significant capital to shore up their balance sheet. On Friday, that plan fell apart, and now the bank is effectively out of business. The FDIC taking over the bank requires a bailout from the U.S. Government.

This is the second-largest bank failure in the history of the U.S.

Before SVB there was Silvergate (SI). Thursday, Silvergate Bank, also from California, announced a full liquidation of the entire bank, with the discontinuance of operations, due to massive customer deposit withdrawals. This was a bank known for its lending to the Crypto world.

In my view? The Fed raising rates broke these banks, and there may be more. Why?

All banks purchase government securities as part of their overall bank balance sheet. Typically, these holdings are a small percentage of the bank’s total equity. In the past few years, they have become a larger percentage. In SVB’s case, these securities were a significant holding and became over 50% of the bank’s investment portfolio.

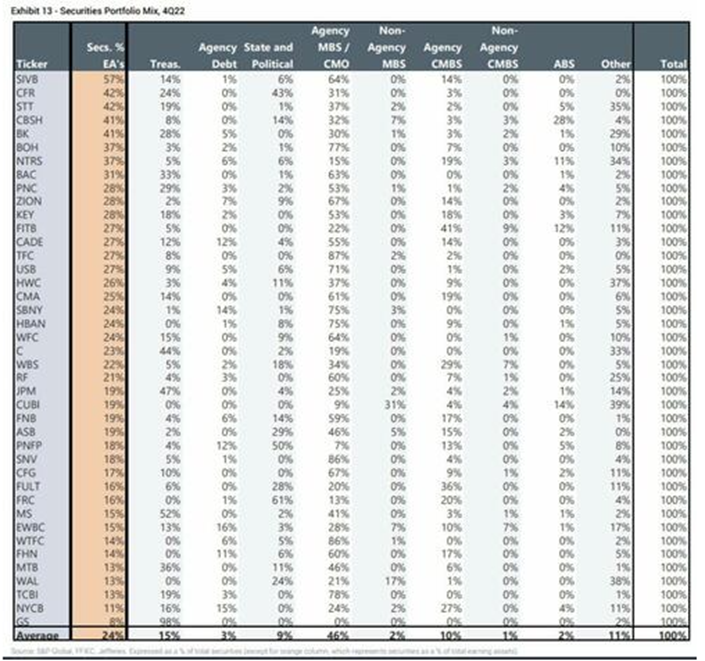

With fast rising interest rates, these securities were sitting with large unrealized losses. When it became known that Silicon Valley Bank may be in trouble, there was an immediate demand for capital (run on the bank). The bank needed to sell these securities and take realized losses, thus ensuring that the bank’s book value would decrease substantially. See the chart below:

All banks have a percentage of their investment portfolio in government securities, and typically these are made up of Treasuries and mortgage-backed securities.

However, when these securities make up a larger percentage of the allowable investable securities and the bank size is smaller, any need for this capital can have a detrimental and, in the case of SVB, horrific consequence.

Here is a chart showing the breakdown of many U.S. banks and their percentage of the portfolio in these types of securities:

The largest bank on the list with a high percentage of government-related investable securities is Banc of America. See some other banks and their potential unrealized losses as a percentage of total bank equity:

Looking at the Modern Family and Regional Banking

One of the most often used members of the Modern Family by our own Mish Schneider is the SPDR® S&P Regional Banking ETF (NYSE:KRE). A key component of the Modern Family, this sector gives a view of the health of small businesses in smaller cities and towns throughout the U.S. that are not dedicated to the large Money Center Banks (JPM, BAC, WFC, etc.). Take a look at the “crash” like the appearance of the KRE (Regional Banks) in just the past two days:

The major market indices were all down for the week, with the S&P 500 down -4.5% and the DIA and QQQ similarly down.

However, given the effect that higher interest rates (Powell comments) and regional banking can have on small businesses, the IWM (Russell 2000 index made up of the 2,000 smallest publicly traded businesses in the U.S.) was down 8% for the week and went into negative territory on a year-to-date basis. The Dow Jones Industrial Average also is down on the year now.

The S&P 500 is barely positive year-to-date, and the tech-heavy Invesco QQQ Trust (NASDAQ:QQQ) is still in better shape. Given this recent downdraft, the S&P 500 ended below its 200-day moving average (see yellow arrow below), which turns the technical picture of the S&P 500 index negative. Notice that the S&P 500 had been staying above a wedge and has now firmly broken below the rising trendline that began in late 2022. See the graph below:

Will this be a Contagious Event for Banks?

I am fairly confident that the Treasury Department, the current Administration as well as the all-important banking regulators are experiencing a troubling weekend. Most likely, they are meeting with the Federal Reserve. I don’t know how much damage this causes, but remember that in 2008 bank Tier 1 Capital was $90 billion. Today that number has grown to $900 billion. Could this be another Lehman or Bear Stearns event?

Of course. But in my view, right now, the Federal Reserve must pivot.

My guess is that they will come out and announce that they are moving their inflation targets from 2% to more like 3-4% and will not be raising rates any further. They will do this potentially in order to resolve the potential banking crisis upon us (unrealized losses).

Additionally, the Fed may very well have to consider lowering Fed overnight rates in the very near future. The market also believed this on Friday as we saw TLT (20-year bonds) rally over 5% in one day. See the chart below:

The 2-year Treasuries, which spiked higher earlier in the week when Powell spoke, retraced most if not all of its recent higher prices. See the chart below:

Probabilities that the Fed would raise 50 basis points at their upcoming Fed meeting diminished greatly by Friday afternoon. The probability chart that came out late Friday afternoon clearly showed this:

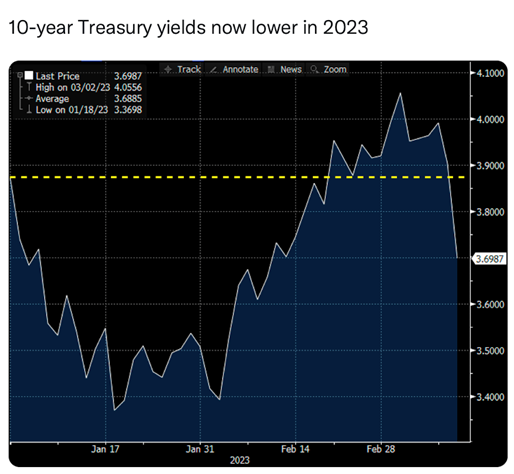

By the end of the day, interest rates on the 10-year Treasuries were lower than at the start of 2023. See below:

Risk-Off

- All 4 key US indices have given up their 50-day and 200-day moving averages and the even more significant 50-week moving averages across the board. IWM has even given up its 200-week moving average already. (-)

- Year-to-Date, the Dow Jones is down 3.5% while IWM was down over 8% this week alone, nasty indications for the market. (-)

- Volume Patterns have collapsed across the major indices, with far more distribution days than accumulation days over the past 2 weeks. All 4 major indices end the week with a distribution day on Friday. (-)

- The selloff this week occurred across every sector, but the least impacted sectors were Consumer Staples (XLP) and Utilities (XLU) which tells us that we are clearly back in a Risk-Off environment. (-)

- Energy got hit across the board including Clean Energy (PBW), Oil Services (OIH), and Natural Gas (UNG) all down 10% or more on the week, a clear recessionary indication. (-).

- The steep selloff to end the week absolutely floored market internals for both the S&P500 as well as the Nasdaq Composite, however, the McClellan Oscillator has reached oversold levels already for both indices. Unfortunately, this isn’t to say that things still couldn’t get worse. (-)

- The New High / New Low ratio for both the S&P500 and Nasdaq Composite has hit its lowest levels for 2023 across every time frame. (-)

- Risk Gauges have backed off all the way to Bearish levels across the board. (-)

- The 1-month vs. 3-month Volatility ratio has moved back into Bearish territory. (-)

- Cash Volatility has broken out back into an Accumulation phase after a sustained Bear phase dating back to late October. (-)

- The number of stocks within the SPY and IWM indices that are above their respective moving averages disintegrated this week. (-)

- As the market is searching for a flight to safety, Bonds (BND) have rallied quickly back into a recovery phase, which is helped by the island bottom pattern that we pointed out last week. (-)

- The 20-year treasury bond (TLT) saw a major improvement on Friday and has regained its 50–day moving average for the first time since February. (-)

- Although Semiconductors (SMH) remain in a Bull phase after this week, all 5 of the remaining members of Mish’s Modern Family underwent their own negative phase changes this week. The worst performers were Regional Banks (KRE), Biotech (IBB), and Retail (XRT) which all closed in Bearish phases. (-)

- Gold (GLD (NYSE:GLD)) was extremely strong this week as equities dropped, closing back above its 50-day moving average and recovering its bull phase. (-)

Neutral

- Both Value stocks (VTV) and Growth stocks (VUG) got wrecked this week, but on a relative basis Growth stocks are actually outperforming Value as well as leading the S&P500 on both a short and long-term basis. (=)

- Although both developed and emerging markets lost key market phases this week, large-cap foreign equities continued to outperform US equities this week. (=)

- Soft Commodities (DBA) outperformed equities this week because even though DBA sold off it managed to reclaim its 50-day moving average before the close on Friday to end the week in a weak recovery phase. (=)