- US futures rise, with Russell 2000 continuing to outperform

- Highest foreign inflow to Asian markets since 2013 with risk-on

- Minutes of the most recent Federal Open Market Committee meeting will be released on Wednesday.

- On Wednesday U.S. jobless claims and GDP data is also released.

- In the U.K., Chancellor of the Exchequer, Rishi Sunak is expected to announced the government’s spending plans for next year.

- The US celebrates the Thanksgiving holiday on Thursday and markets there are closed.

- The week ends with Black Friday, the traditional start of the US holiday shopping season.

- Futures on the S&P 500 Index rose 0.7%.

- The Stoxx Europe 600 Index gained 0.5%.

- The MSCI Asia Pacific Index climbed 1%.

- The MSCI Emerging Markets Index was little changed.

- The Dollar Index dipped 0.4% to 92.16.

- The euro gained 0.3% to $1.1877.

- The British pound rose 0.4% to $1.3371.

- The Japanese yen strengthened 0.2% to 104.32 per dollar.

- The yield on 10-year Treasuries climbed one basis point to 0.87%.

- The yield on two-year Treasuries increased less than one basis point to 0.16%.

- Germany’s 10-year yield rose one basis point to -0.57%.

- Britain’s 10-year yield rose one basis point to 0.331%.

- West Texas Intermediate crude gained 1.4% to $42.15 a barrel.

- Gold weakened 0.6% to $1,827.19 an ounce.

Key Events

US contracts on the Dow, S&P, NASDAQ and Russell 2000 as well as global stocks extended their rally on Tuesday following US President Donald Trump's acceptance that the transition to a Joseph Biden administration must begin. On Monday, the US General Services Administration finally released the resources that would allow this to officially move forward.

The Dollar Index neared its lowest level since 2018 while oil moved off its highest levels since March. Bitcoin continues to push back toward its all-time high.

Global Financial News

The relative performance of US futures confirmed the rotation out of tech and into cyclical sectors as well as away from large into small caps. Futures on the Russell 2000, (+1.3%), gained four times that of contracts on the NASDAQ, (+0.3%) as of the time of writing.

With the outlook for more than one effective vaccine now in focus, the view that social restrictions are likely to be eased also extended the rotation out of US and into international stocks. The worst global pandemic in one hundred years has also prompted international investors to repatriate capital out of the US stock market and into global shares as cases of COVID-19 across the US continue to increase. Investors poured $48 billion into 9 regional Asian markets since Oct.1, the most since 2013.

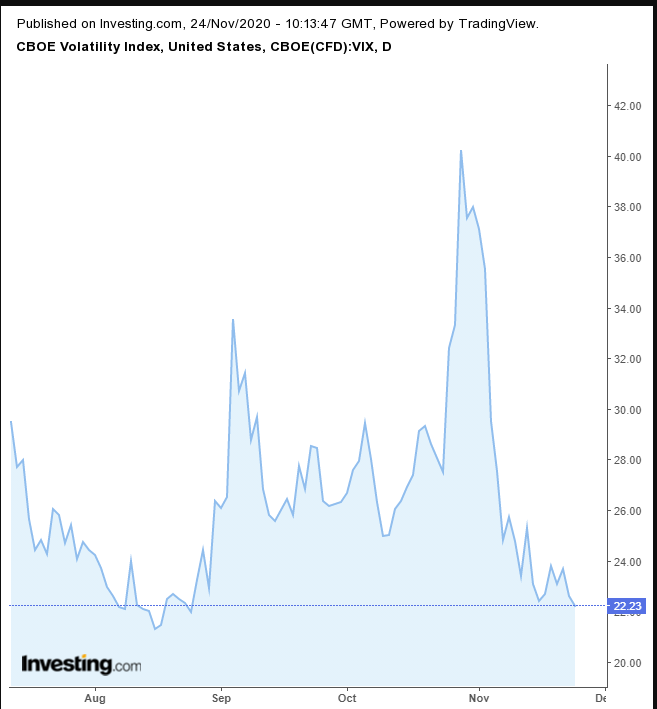

The VIX, also sometimes called called the “fear gauge” fell to its lowest level since August.

The drop also demonstrates that markets now believe there will be a smooth transition of power in the US, as well as additional positive news on three potential vaccines, increasing confidence in an economic recovery.

Helping bear that out, along with other nominees for position his cabinet, President-elect Biden has also nominated former Federal Reserve Chair, Janet Yellen as Treasury Secretary. As a familiar face to stock markets with a proven track record, Yellen should make investors more comfortable about taking on additional risk. She's also considered market friendly and will probably work well with current Fed Chair, Jerome Powell.

In Europe this morning, the Stoxx 600 Index rose by as much as 0.9%, supported by gains in the travel and oil and gas sectors, as these sectors have the most to gain from governments lifting lockdown restrictions along with economic recoveries. On Sunday, France announced it will be easing social restrictions over the coming weeks. The pan-European benchmark reached its highest level since late-February but is still down 5.9% YTD.

Japan’s Nikkei 225 shot up 2.5%, as traders played catch up after Monday’s global rally which they missed because of a market holiday there.

China’s Shanghai Composite was the only major regional benchmark in the red, falling 0.3% from a 5-year high on apparent profit-taking, while showing no reaction to the start of the US presidential transition. Reuters claims that analysts don’t expect a US policy shift on China with a Biden administration, which we find surprising, after both Biden and the Democrats harshly criticized President Trump’s trade war with China.

NPR, Bloomberg, and Washington Post expect that Biden may change the tactics used to deal with China, but not the strategy.

Yesterday on Wall Street, US shares advanced as investors continued to cash out of the sectors that outperformed during the coronavirus, into stocks that are expected to perform better in a normal economy.

Yields, including on the 10-year Treasury note, also climbed for a second day.

Monday’s rebound off the rising channel’s bottom confirmed Friday’s inverted hammer.

The dollar extended the downside breakout of a H&S continuation pattern.

The greenback found support on the very pip of the Nov. 6 low. A fall below the Aug. 31 low of 91.99 would bring it to the lowest level since 2018.

Despite the weakening dollar, gold fell because of its haven status as traders increased their exposure to risk.

The yellow metal fell to its lowest levels since July 6, apparently finding support by the bottom of a range, which—after confusing us with different possible patterns since its early August all-time high—is unclear whether it’s a bullish wedge, as we have been thinking, or a bearish falling channel. Traders will likely turn bearish if the price falls below $1,800, failing the pattern and the 200 DMA.

Bitcoin continues to accelerate, breaking the $19,000 level, its highest since Dec. 18, 2017 which was bested only by its record high of $19,870.6 on Dec. 17, 2017.

While the price is trading at the top of the session, showing strength, it stopped by Saturday’s shooting doji star, demonstrating the remaining supply bulls will have to cut through to take on the record.

Oil climbed for the third day on hopes of a return to normal on vaccine news.

Technically, the price recently broke out of a bottom, but it found resistance by the bullish wedge’s high recorded on Aug. 26. If the price climb past $44, we’d turn bullish.